Dubai’s Utility Invites Pitches for Multi-Billion Dollar IPO

(Bloomberg) -- Dubai Electricity & Water Authority has invited banks to pitch for a role on an initial public offering that could value the utility at around $25 billion, people familiar with the matter said.

DEWA has named Moelis as an adviser on what will likely be the city’s biggest listing, the people said. The company, owned by the Dubai government, will probably choose a mix of international and local banks, they said.

While Dubai firms are required to sell at least 25% of their shares in an IPO, the utility may try to list a smaller amount at first, the people said. DEWA didn’t immediately respond to requests for comment.

Moelis declined to comment.

The deal could be the first of 10 IPOs of state companies planned by Dubai as it seeks to revive trading on its bourse and catch up with Abu Dhabi and Riyadh, which have both seen multiple listings in recent months.

DEWA caters to Dubai’s 3.4 million residents and had 12.3 gigawatts of power capacity last year, according to its website. It reported net income of $1.3 billion for 2019.

The move also comes as Dubai and the wider Persian Gulf economies recover from last year’s coronavirus pandemic and oil-price crash.

That rebound has buoyed regional stock markets. Investors placed more than $34 billion of orders for Abu Dhabi-based Adnoc Drilling Co.’s $1.1 billion IPO in September. ACWA Power International, a Saudi Arabian utility, attracted $300 billion for its $1.2 billion listing around the same time.

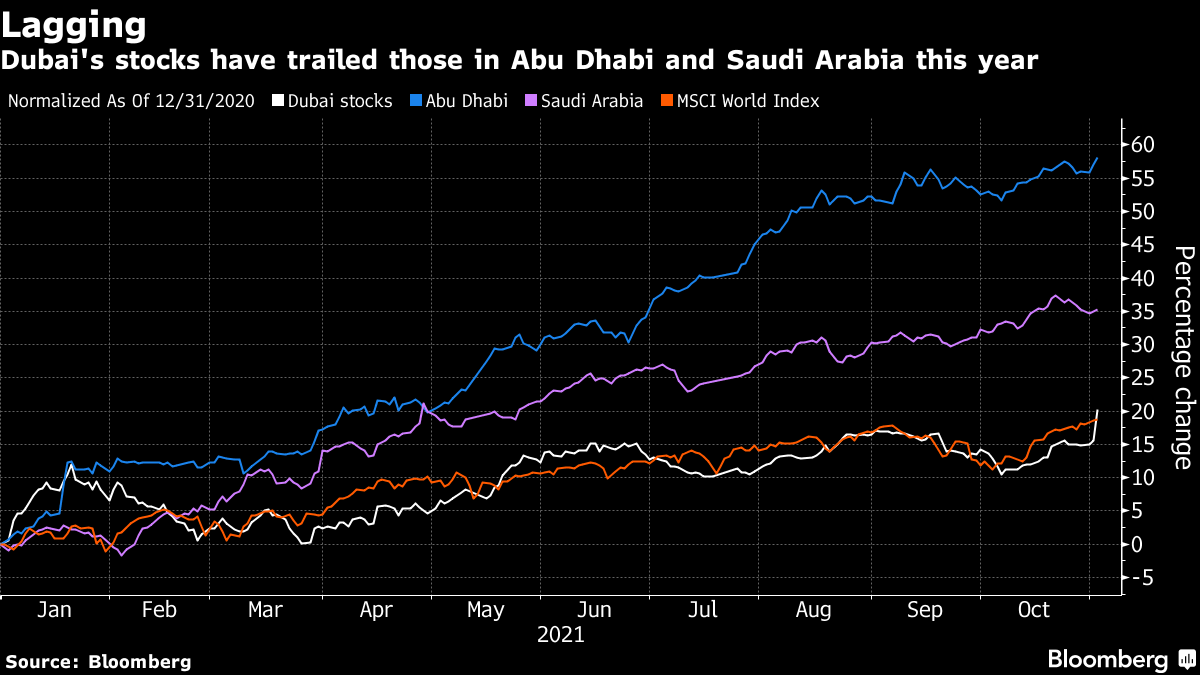

Dubai’s equity market has climbed 20% this year, while Abu Dhabi’s is up almost 60% and Saudi Arabia’s added 35%.

Since 2017, there’s been just one IPO in Dubai and a string of delistings that have dented investor confidence. Equity trading has fallen in three of the past four years.

Dubai announced its plan to IPO companies this month. It’s said that DEWA and Salik, which collects road tolls, will be among the 10 firms, but hasn’t revealed the names of the rest.

(Adds Moelis no comment in fourth paragraph)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Steadies as Traders Look to Tariff Fallout and Stockpiles

Oil Steadies as Traders Try to Make Sense of Trump’s Tariff Talk

Glencore-Indonesia JV Eyes $1 Billion Sustainability-Linked Loan

Oil Fluctuates as Trump’s Rapid-Fire Trade Moves Rattle Market

China’s Surging Power Demand Creates a Climate Conundrum

Oil Set for First Weekly Drop This Year as Trump Rattles Market

Oil Extends Drop With Focus on Rising Stockpiles, Trump Actions

ADNOC achieves industry-leading carbon intensity at Shah Oil Field enabled by AI

Oil Holds Drop as Trump’s Tariff Threats Raise Trade War Fears