Oil Heads for Weekly Surge as Iraqi Supply Disruption Continues

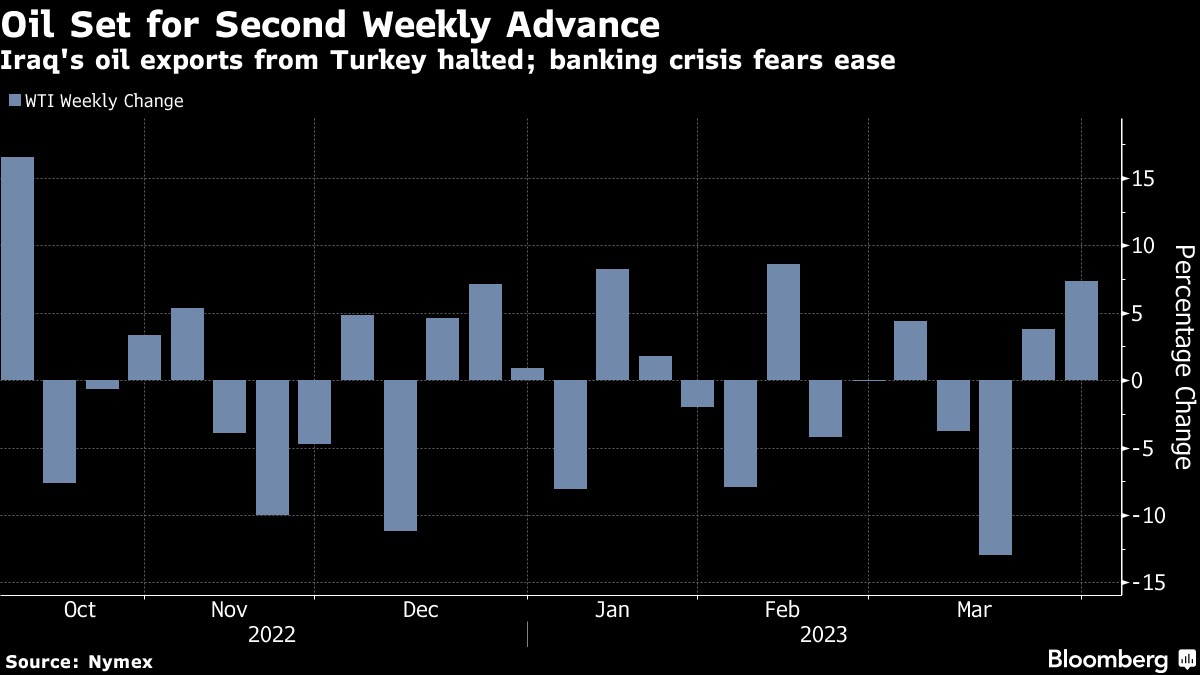

(Bloomberg) -- Oil headed for a weekly surge of more than 7% as an ongoing disruption to Iraqi exports tightened the market ahead of US inflation data.

West Texas Intermediate futures were steady above $74 a barrel on Friday after closing almost 2% higher in the previous session. Iraq’s oil exports from Turkey are unlikely to resume this week, as a dispute between Baghdad and Kurdistan that’s halted around 400,000 barrels a day continues.

China’s recovery showed more signs of strength in March, with manufacturing continuing to expand and construction picking up. Most market watchers are betting the nation’s rebound will help to underpin higher prices this year.

Oil still remains on track for a fifth monthly loss, primarily due to a banking crisis that rippled through markets earlier in the month, though the worst of the turmoil now appears over. Resilient Russian supply and strikes in France that have curbed crude demand also added to the bearishness.

Investors will be watching a read on US inflation later Friday for clues on the path forward for monetary tightening, as Federal Reserve officials continued to stress the need to lower prices. OPEC+ also meets next week, though changes to production quotas aren’t expected.

“Receding banking risks certainly provide buoyancy, as could the narrative of cooling inflation,” said Vishnu Varathan, the Asia head of economics and strategy at Mizuho Bank Ltd. “Add to that supply disruption risks, and we have oil that is less nervy and more likely to challenge barriers to ascend.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz