Oil Dips After Technicals Signal Rally May Have Run Too Hot

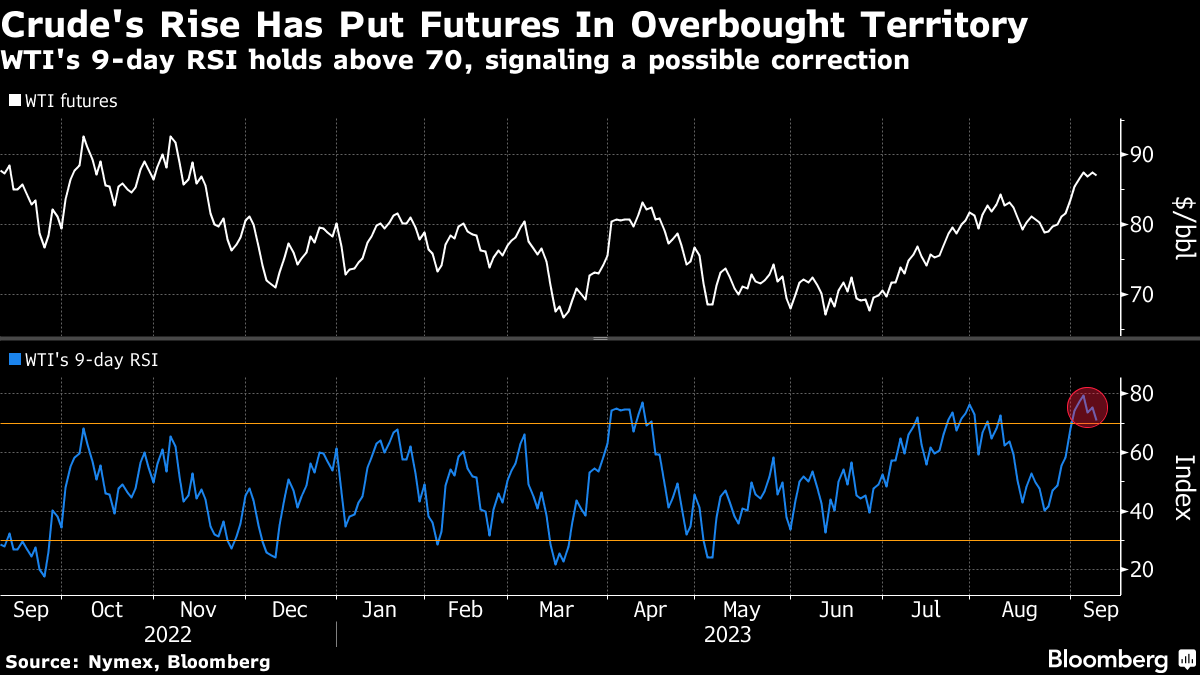

(Bloomberg) -- Oil declined after rallying almost 10% over the past two weeks, with technical indicators suggesting recent gains may have been overdone.

West Texas Intermediate fell to around $87 a barrel after a 2.3% advance last week. Technical gauges including the relative strength index suggest futures remain overbought. Oil has surged by almost $20 a barrel since mid-June on production cuts from Saudi Arabia and Russia, which have now been extended through the end of the year.

“Indicators are signaling overbought conditions,” said Han Zhong Liang, investment strategist at Standard Chartered Plc in Singapore, pointing to the RSI, stochastic oscillators and Bollinger bands. “Put together, we believe a consolidation is likely.”

Still, there were some further bullish signals over the weekend. China’s deflationary pressures eased slightly in August as consumer prices rose, a positive sign for the world’s biggest oil importer. Financial markets are also pricing in lowered odds of a recession in the US.

OPEC+ leaders Saudi Arabia and Russia last week extended their supply curtailments. The 1 million barrel-a-day reductions the Saudis initially pledged for July will now be in place until year-end, alongside a smaller export cut from Russia.

Widely watched timespreads continue to signal tightness. Despite having eased slightly over recent sessions, the gap between global benchmark Brent’s two nearest contracts remains firmly in a bullish backwardation structure — when later-dated contracts trade at a discount to nearer ones.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets