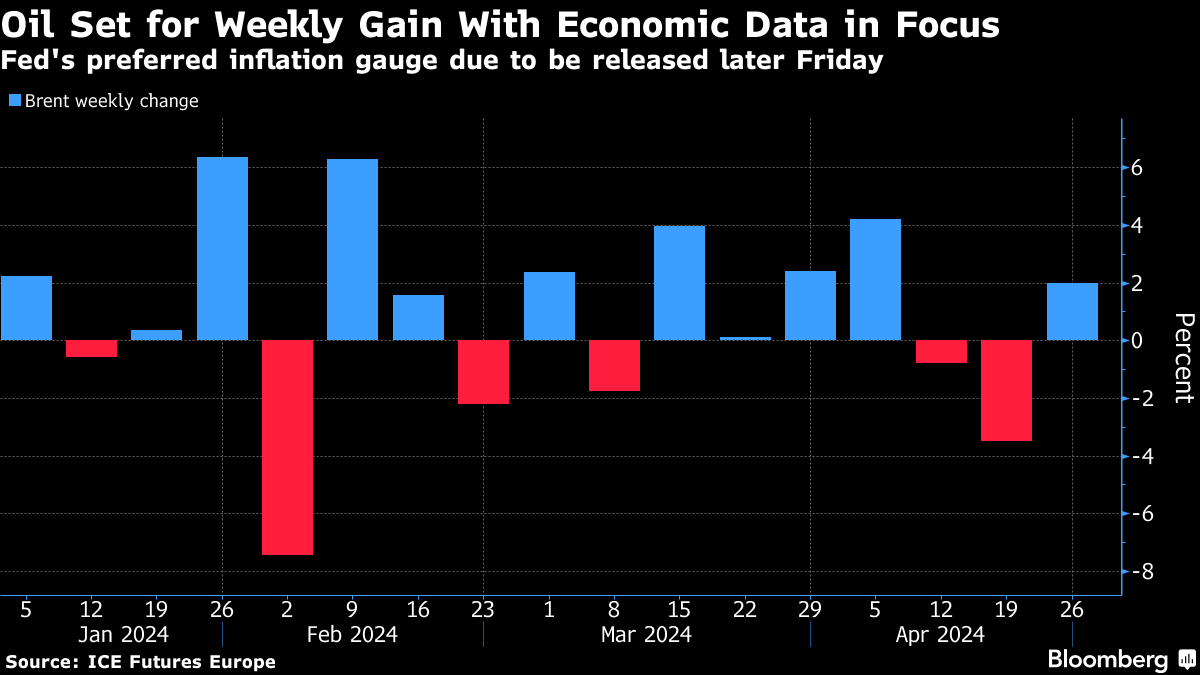

Oil Heads for Weekly Advance Ahead of Critical US Inflation Data

(Bloomberg) -- Oil headed for a weekly gain ahead of US inflation data that may give further clues on the path forward for monetary policy, shaping appetite for risk assets including commodities such as crude.

Brent rose above $89 a barrel and is up more than 2% for the week, while West Texas Intermediate was near $84. The Federal Reserve’s preferred inflation figure is due later Friday, coming hard on the heels of data showing weaker US economic growth. Other gauges of price rises in the US remained hotter-than-expected, suggesting the timing of rate cuts may be pushed back.

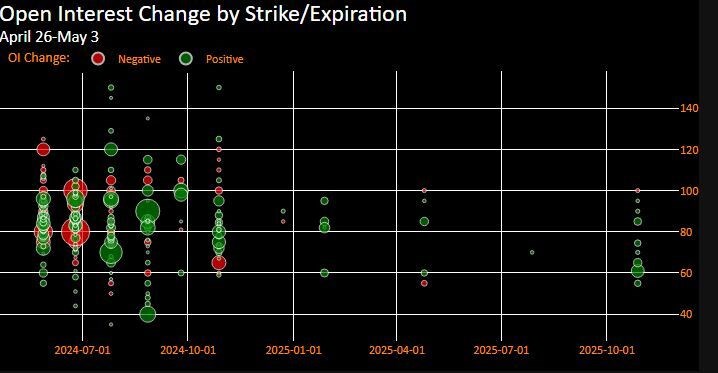

Crude has advanced this year on supply cuts implemented by OPEC+ and political risks in the Middle East, including heightened tensions between Israel and Iran that lifted Brent above $90 a barrel earlier this month. This week’s advance was also supported by a drawdown in US nationwide inventories.

The “focus is likely to stay on macro,” said Charu Chanana, an analyst at Saxo Capital Markets Pte, adding that a further acceleration in prices could cloud demand prospects. There were also headwinds from the weak US GDP data, which prompted stagflation concerns, she said.

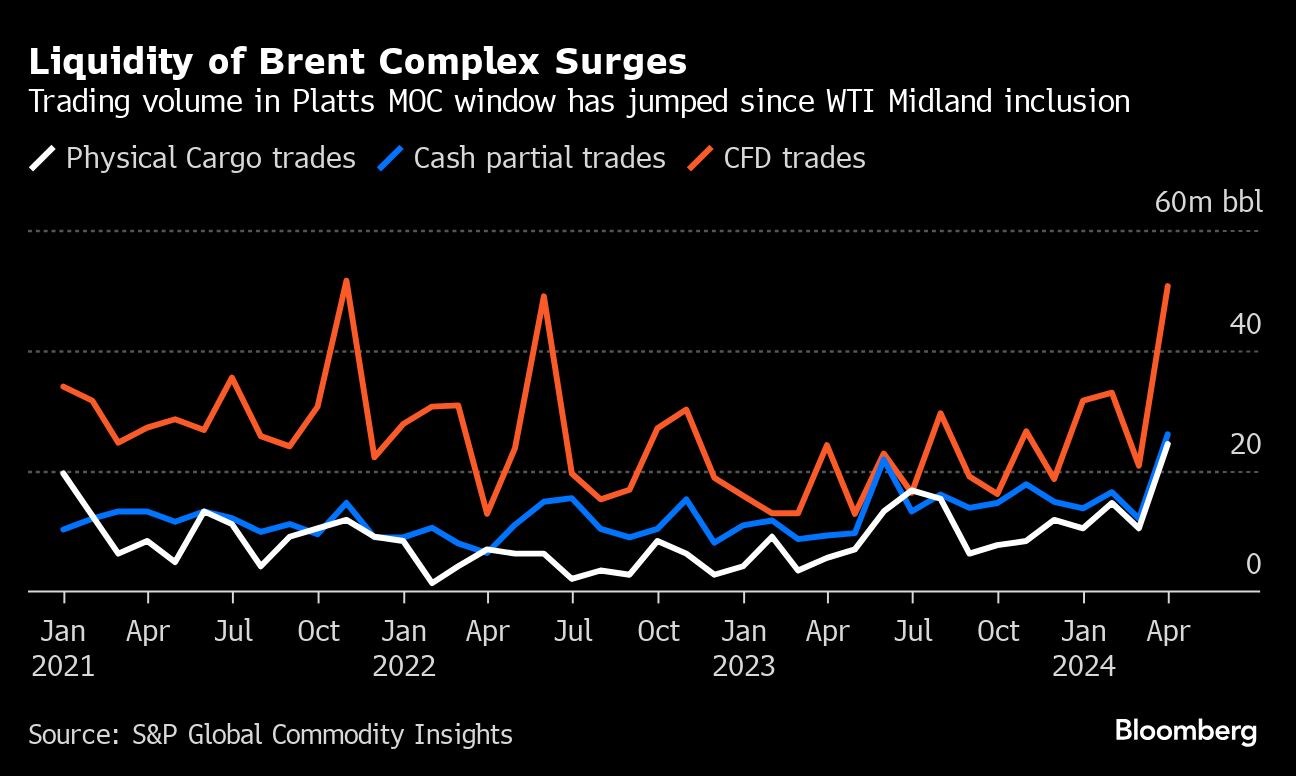

Still, timespreads point to a tighter market, with the gap between Brent’s two nearest contracts at $1.31 a barrel in backwardation, a bullish pattern where the nearer contract trades at a premium to next in line. That’s more than twice the difference seen a month ago.

Also in focus on Friday will be earnings and market commentary from some of the world’s biggest oil majors, including Chevron Corp. and Exxon Mobil Corp.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Shell beats forecasts with $7.7b Q1 profit in 2024

May 02, 2024

Oil Extends Drop on Mideast Cease-Fire Prospects, US Inflation

May 01, 2024

Oil Holds Drop as Mideast Cease-Fire Talks Erode Risk Premium

Apr 30, 2024

Oil Drops as Progress on Cease-Fire in Gaza Shrinks Risk Premium

Apr 29, 2024

Red Sea Diversions Spew Carbon Emissions Equal to 9 Million Cars

Apr 29, 2024

Qatar Energy Minister: demand for oil and gas will continue for a long time and industry must act responsibly

Apr 29, 2024

Exxon and Chevron Output Booms in World’s Hottest Oil Patches

Apr 27, 2024

Pemex Ekes Out Tiny Profit as Oil Production Decline Resumes

Apr 26, 2024

Oil Holds Modest Loss as Risk-Off Tone Counters Lower Stockpiles

Apr 25, 2024

Oil Holds Gain With Stockpile Data and Iran Sanctions in Focus

Apr 24, 2024

Why the energy industry is on the cusp of disruptive reinvention

Mar 12, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum