Oil Rises as Biden Quits US Race, Blazes Threaten Canadian Wells

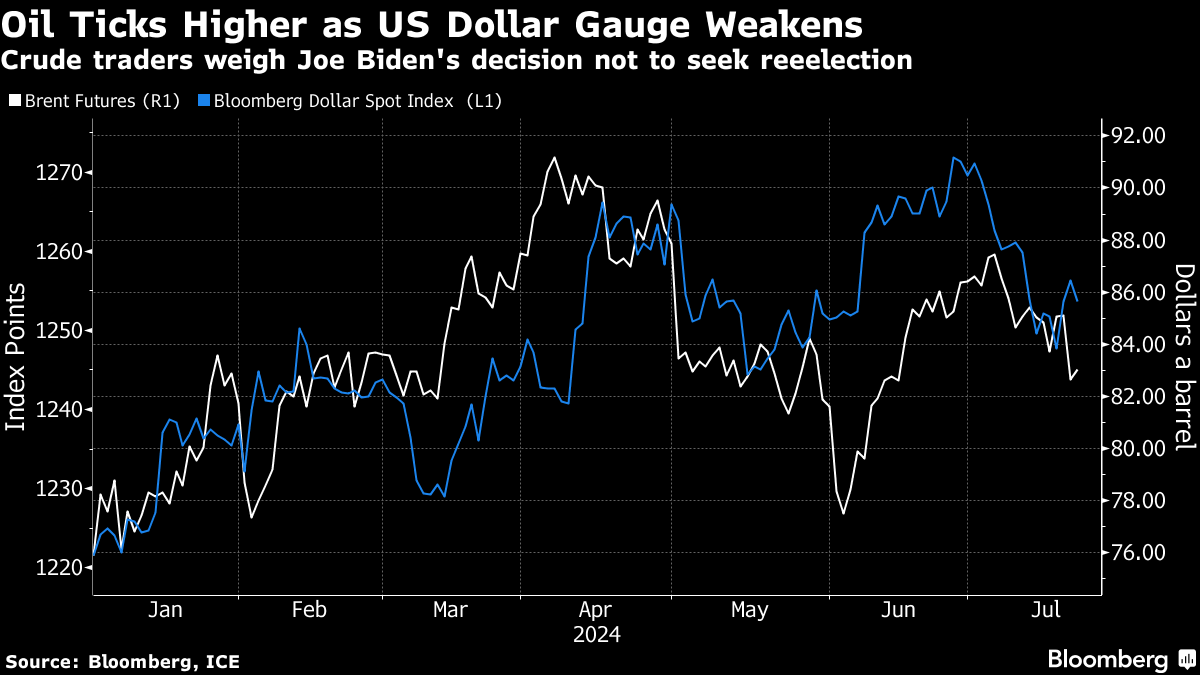

(Bloomberg) -- Oil edged higher — after slumping almost 3% on Friday — as investors weighed the fallout from President Joe Biden’s decision not to seek reelection, while wildfires menaced some production in Canada.

Global benchmark Brent rose above $83 a barrel after posting its biggest one-day drop since early June, while West Texas Intermediate was near $81. Biden abandoned his bid for a second term as concern mounted he couldn’t beat Donald Trump, and endorsed Vice President Kamala Harris. The US dollar eased in Asian trading, benefiting commodities priced in the currency.

In Canada, a blast of heat across the Alberta oil patch has triggered a wave of wildfires. An estimated 348,000 barrels a day of production are at risk, according to Alberta Wildfire and Alberta Energy Regulator data.

Oil has pushed higher this year as OPEC+ reined in output, setting the scene for a drawdown in global stockpiles over the northern hemisphere summer. Geopolitical tensions have also been to the fore, with Israel’s war against Hamas and clashes with Iran-backed groups including the Yemen-based Houthis sparking concerns of regional instability that could threaten supply.

At the weekend, Israel struck targets around the Houthi-held Red Sea port of Hodeidah in retaliation for a drone attack on Tel Aviv. The airstrikes were aimed at facilities including fuel-storage sites, with a Houthi-run television channel showing flames and smoke raging at the installations it said were hit.

Market metrics point to tight near-term conditions. Brent’s prompt spread — the difference between its two nearest contracts — was more than $1 a barrel in backwardation, a bullish pattern. Two weeks ago, the gap was 76 cents.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Steadies as China Demand Concerns Offset Libyan Disruptions

Wintershall Dea E&P assets transferred to Harbour Energy as sale process completes

Kyle Bass Says Blackballing Oil Has Proved a Bad Bet for ESG

Oil Extends Drop on Signs of OPEC+ Output Boost and China Woes

Oil Holds Gain on Positive US Economic Data, Libya Disruptions

Oil Holds Losses as Slipping Equities Vie With Stockpiles, Libya

Oil Steadies After Technical Drop as US Stockpiles Seen Falling

Wall Street Sours On Oil as Goldman Flags Risks From OPEC+ Boost

Oil Steadies After Three-Day Rally as Libya Adds to Supply Woes

Woodside reports $1.94 billion half-year profit amid major project milestones

Why data centres and AI could shake up the global LNG market

Why energy executives expect the world to hit net zero by 2060

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Partner content

Integrally geared compressors cut the carbon and boost carbon capture

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled

Ebara Elliott Energy offers a range of products for a sustainable energy economy