Pemex Posts Steepest Loss in Four Years Ahead of CEO Pick

(Bloomberg) -- Petroleos Mexicanos’ posted its worst loss since the global pandemic emerged more than four years ago, a negative signal for whoever President-elect Claudia Sheinbaum chooses to revive oil production and slash the company’s almost-$100 billion debt burden.

Pemex posted a second-quarter loss 255.9 billion pesos ($14 billion), compared with a 25.4 billion-peso profit a year earlier, the company reported Friday. It was the steepest loss since the first quarter of 2020, when lockdowns and economic contraction around the world gutted energy demand and prices collapsed. Meanwhile, Pemex’s crude and condensate output slid to 1.784 million barrels a day during the quarter from 1.88 million a year earlier.

The loss was mostly due to Mexico’s peso weakening in recent months, Pemex’s acting-Chief Financial Officer Carlos Cortez said during a conference call with investors and analysts.

Sheinbaum has yet to announce who will run Pemex when her term begins Oct. 1. Possible candidates include Jorge Islas, an academic at Mexico’s UNAM University who has worked as an advisor to the president-elect on energy issues, and Deputy Finance Minister Gabriel Yorio.

Whoever Sheinbaum picks will inherit a company saddled by financial and operational woes. Pemex’s debt is the highest of any major oil explorer at roughly $99 billion, and output has been declining for the better part of two decades.

Pemex is not currently considering a return to capital markets to help cover debt payments, and hasn’t received any instructions from Sheinbaum over a leadership transition, Cortez said.

Outgoing President Andres Manuel Lopez Obrador prioritized investment in fuel making over crude exploration, but the company’s refineries have been losing money due to a lack of technology and upkeep at aging facilities. Mexico continues to be a net fuel importer, though shipments are seen falling next year as Pemex’s flagship facility in Dos Bocas, Tabasco, ramps up production.

The company has also been hampered by a spate of deadly accidents, oil spills and methane leaks in recent years, leading investors to pressure Pemex into releasing a sustainability plan to drastically cut greenhouse gas emissions.

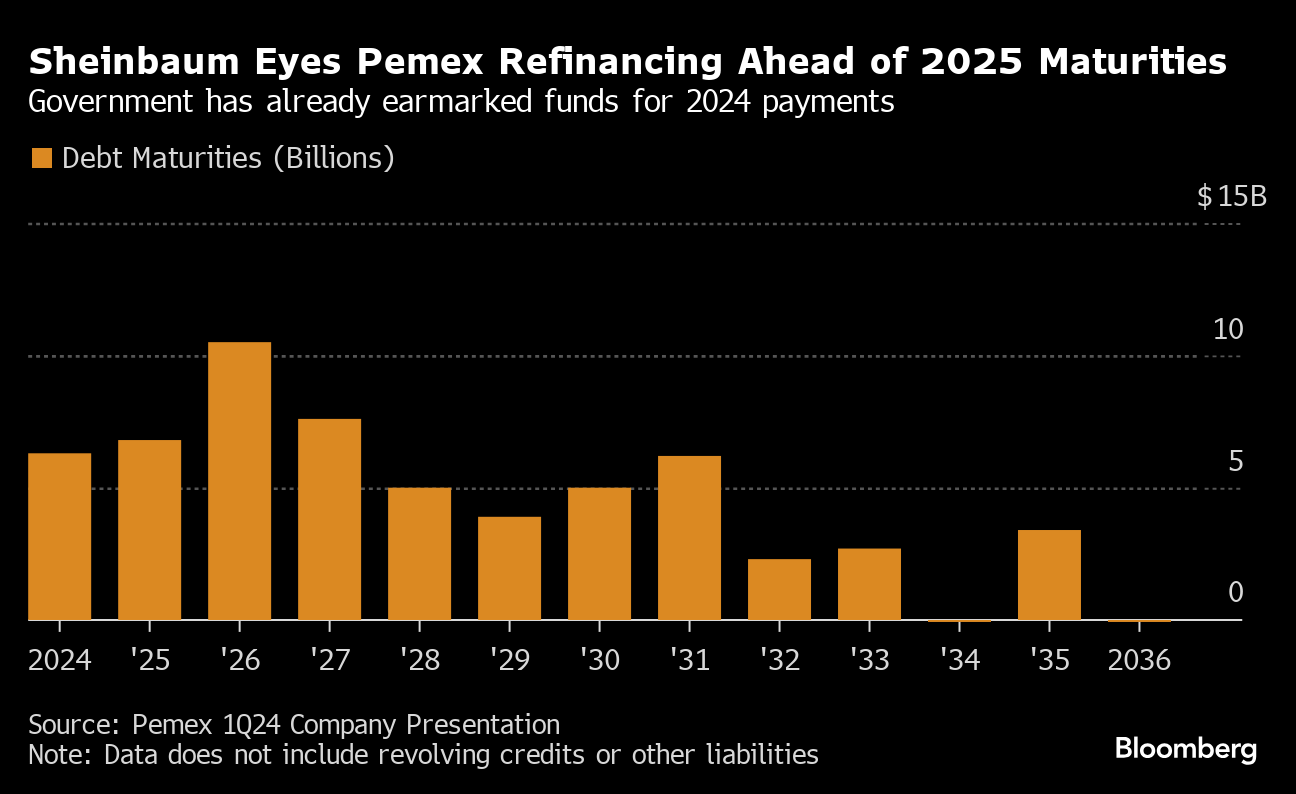

Sheinbaum, who focused on cleaning up Pemex’s image during her campaign, is also under pressure to solve the company’s financial woes. In April, she said she expects the company to refinance bonds ahead of upcoming maturities in 2025.

Sheinbaum has also promised to keep oil production at around 1.8 million barrels per day in coming years, using renewable energy sources to meet Mexico’s growing electricity demand. She aims to make Mexico’s refineries more efficient, reduce fuel imports and grow Pemex’s mandate to include new ventures like lithium extraction and electric-vehicle infrastructure.

She also has echoed the current president’s pledge to continue state support for the oil producer. AMLO, as he is known, showered Pemex with around 1.37 trillion pesos in cash injections and tax breaks since taking office.

Pemex’s bonds due 2033 climbed 1.1 cent to nearly 102 cents on the dollar as of 2:23 p.m. in New York.

(Updates with finance chief’s comments on capital markets in sixth paragraph, bond price in final paragraph. A previous version corrected the currency conversion in second paragraph.)

©2024 Bloomberg L.P.