S&P 500 Rises for a Second Week; Yields Drop: Markets Wrap

(Bloomberg) -- US stocks ended a shortened trading session higher while Treasury yields declined. Speculation that President-elect Donald Trump will temper his most extreme trade policies drove the dollar to its biggest weekly loss in three months.

The S&P 500 climbed more than 1% for a second straight week. On Friday, it rose 0.6%, notching fresh record highs. The 10-year Treasury yield fell to 4.19%. The Bloomberg Dollar Spot Index extended a weekly decline to more than 1%, snapping eight weeks of gains.

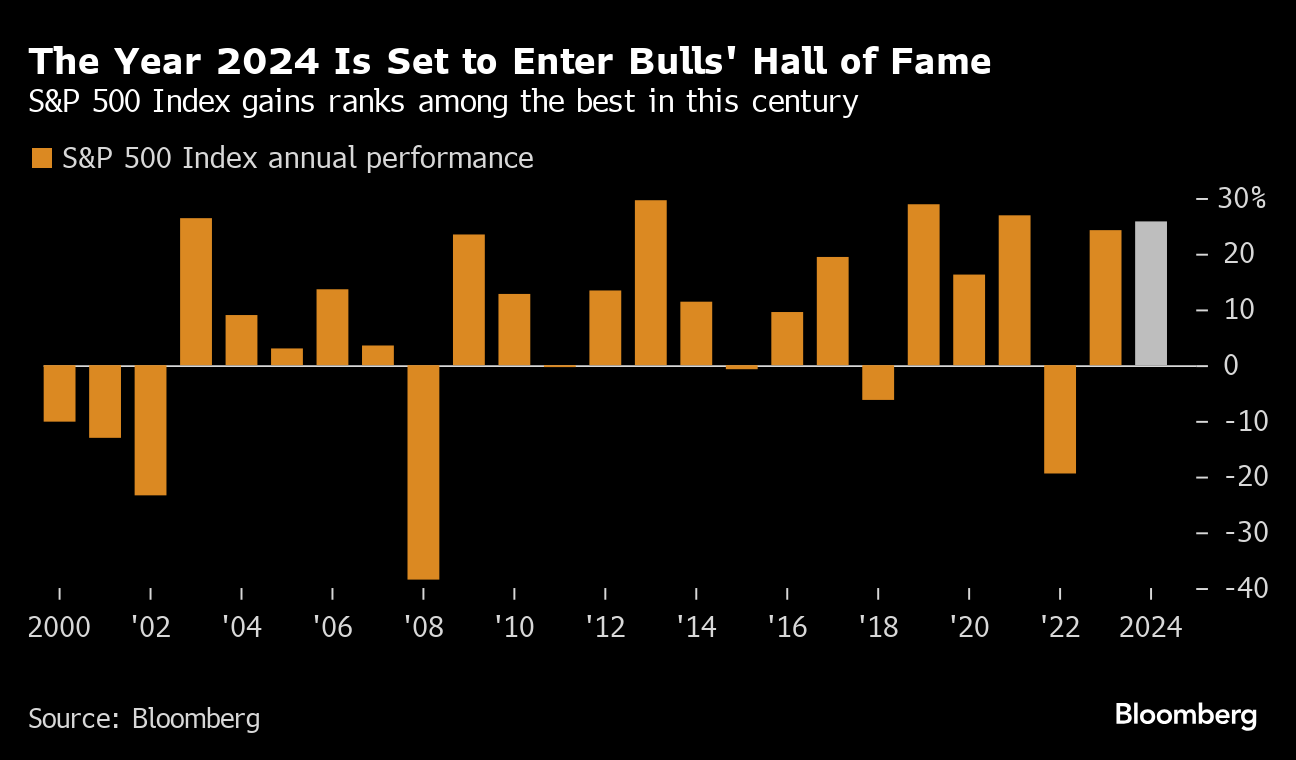

Trump’s pick for his Treasury secretary has fueled optimism that tariffs will be measured, boosting US stocks and bonds, and sapping dollar strength. The S&P 500 rose 5.7% in November, its best month this year, as investors plowed $141 billion into US equities, the heaviest inflows for a four-week period on record, according to EPFR Global data. A handful of tech titans have led 26% year-to-date gains in US stocks on the prospect of Federal Reserve rate cuts while the American economy continues to grow.

“We were talking day in and day out about trade tensions in 2019. What happened? The Nasdaq was on a tear. What mattered was the Fed was making a U-turn, real rates went down, and that drove equities,” Max Kettner, multi-asset chief strategist at HSBC Holdings Plc, said in an interview with Bloomberg TV. “That’s very similar to now — this is still a cutting cycle. It’s a fantastic set-up.”

In Canada, the economy posted a modest gain last month after a weaker-than-expected third quarter, keeping the central bank on track to keeping cutting rates.

There is now an “extreme disconnect” between investor bullishness on US assets and bearishness on the rest of the world, according to Bank of America Corp. strategists, who made a contrarian bet on European stocks as the continent’s main equity index heads for its worst year of underperformance relative to the US since 1976.

Scope for fiscal spending appears to be improving in Europe, while any potential ceasefire in Ukraine could ease pressure from high energy prices, according to the strategists.

The euro fluctuated after euro-area inflation climbed above the European Central Bank’s 2% target, but by a margin that was seen as too small to derail the path of policymakers to lower rates. Traders on Friday raised their ECB rate-cut bets, seeing a 20% chance of a half-percentage point reduction. Consumer prices rose 2.3% from a year ago in November, up from 2% in October and matching the median estimate in a Bloomberg survey of analysts.

The yen briefly fell below 150 against the dollar after Bank of Japan’s Governor Kazuo Ueda said further weakness in the currency is a big risk. Earlier, the yen had pushed past that threshold as Tokyo inflation data showed prices rose more than expected on a headline basis, reinforcing bets that the BOJ will raise interest rates when it meets next month.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.6% as of 1:07 p.m. New York time

- The Nasdaq 100 rose 0.9%

- The Dow Jones Industrial Average rose 0.4%

- The MSCI World Index rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro rose 0.2% to $1.0574

- The British pound rose 0.4% to $1.2732

- The Japanese yen rose 1.4% to 149.50 per dollar

Cryptocurrencies

- Bitcoin rose 2.1% to $97,083.2

- Ether rose 0.6% to $3,594.77

Bonds

- The yield on 10-year Treasuries declined eight basis points to 4.19%

- Germany’s 10-year yield declined four basis points to 2.09%

- Britain’s 10-year yield declined three basis points to 4.24%

Commodities

- West Texas Intermediate crude fell 0.1% to $68.62 a barrel

- Spot gold rose 0.8% to $2,659.18 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Lower as Trade War Concerns Vie With Pressure on Iran

Oil Falls After Trump Delays Canada, Mexico Tariffs by a Month

Wright Confirmed to Lead Energy Agency Key to Trump’s Plans

Oil Rises as Trump Slaps Tariffs on Biggest Crude Supplier to US

UAE’s Adnoc Aims to Buy Nova Chemicals, Roll Into Deal With OMV

Ukrainian Drone Surge Highlights Russian Oil Refining Risk

South Korea Exports Resilient as Trump’s Tariff Threat Looms

Crude Oil Steadies With Traders in Limbo Over US Trade Policies

Oil Steadies as Traders Look to Tariff Fallout and Stockpiles