Oil Declines After Surge as Traders Keep Focus on Middle East

(Bloomberg) -- Oil eased — after advancing by almost 2% on Monday — as broader financial markets carried a risk-off tone, while traders also continued to track tensions in the Middle East between Israel and Iran.

Brent edged lower toward $74 a barrel, while West Texas Intermediate was near $70. Investors are still waiting to see how Israel will retaliate against Iran for a recent missile barrage, as well as subsequent attacks by Tehran-backed proxies. In wider markets, Asian stocks fell after US losses.

Crude has been buffeted this month — with global benchmark Brent swinging in a more-than-$11 range — as conflict in the Middle East has raised the potential for disruptions to supplies. At the same time, China has moved to support growth with stimulus, supporting prices, but investors remain wary that the global oil market may swing to a surplus in the coming quarters.

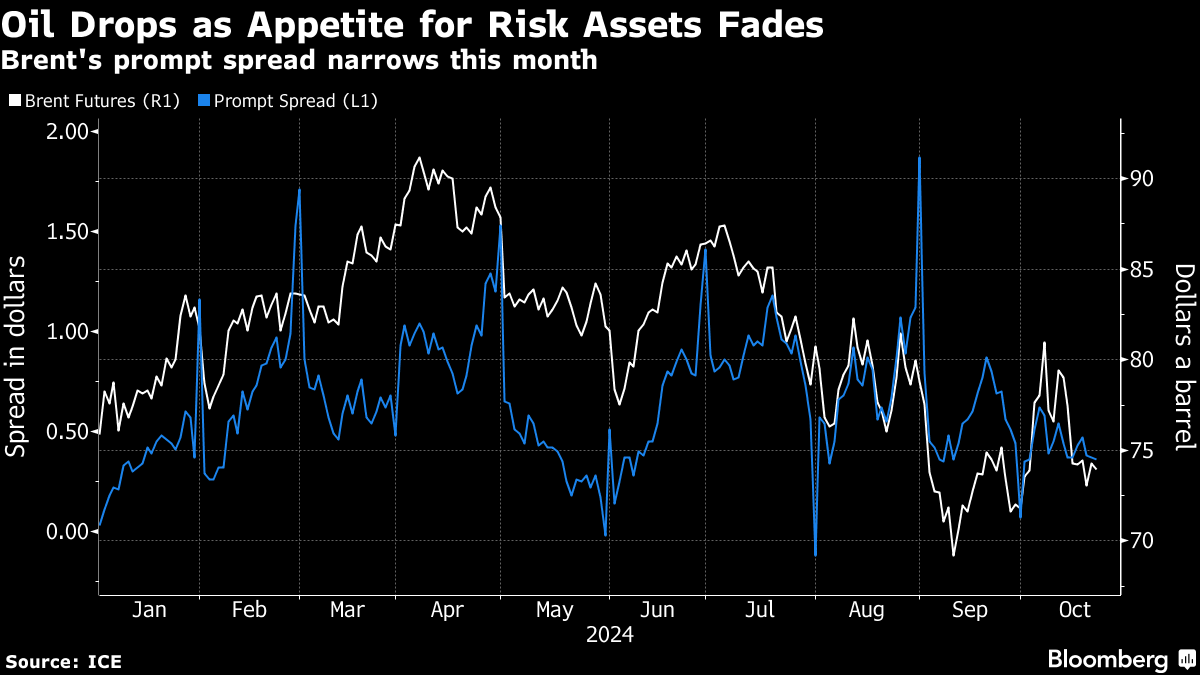

Brent’s prompt spread — the difference between its two nearest contracts — has narrowed in recent weeks, suggesting physical conditions are becoming less tight. The differential was 35 cents a barrel in backwardation, compared with 69 cents about a month ago.

Stockpiles have also been in focus. The volume of crude held at the closely watched US hub at Cushing, Oklahoma, has expanded for the past four weeks, the longest run of inflows since early March. An industry estimate on the most recent shift is due later on Tuesday, with official data due the next day.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Watching Dark Fleet Ship-to-Ship Oil Transfers in Asia Waters

Aramco CEO Says He’s Bullish on China After Stimulus Roll-Out

Oil Rebounds as Israel Plans Next Iran Move After Weekend Attack

Oil Prices Show How Numb Traders Have Become to US Sanctions

US Pins Hope for Cease-Fire and More on Sinwar’s Killing

Diesel Exports From China Decline to Lowest Level Since Mid-2023

Oil Steadies as Traders Weigh Middle East Risks, China Outlook

World Set for Cheaper Energy on Shift From Oil and Gas, IEA Says

Oil Extends Losses on Report Israel Won’t Target Iranian Crude