Oil Slumps, Yen Drops on Japanese Vote Result: Markets Wrap

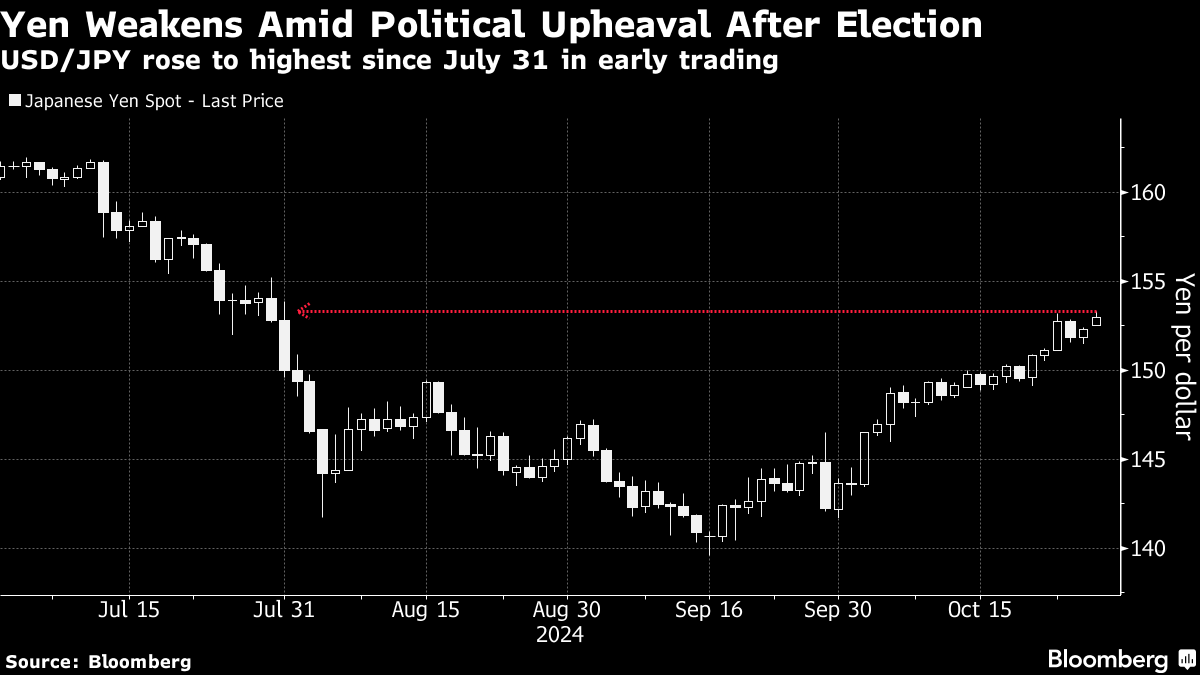

(Bloomberg) -- Crude declined after Israeli strikes on Iran avoided oil facilities. The yen fell after Japan’s ruling coalition failed to win a majority in parliament, stoking speculation the political uncertainty would make the central bank less hawkish.

Oil tumbled more than 5% at one point and gold also edged lower after Iran said its oil industry was operating normally following Israel’s attacks on military targets across the country in retaliation for a missile barrage earlier this month.

“The measured and targeted response from Israel has increased hopes of de-escalation,” Warren Patterson, head of commodities strategy at ING in Singapore, wrote in note. “If we do see some de-escalation it would allow fundamentals once again to dictate price direction.”

In currency markets, the yen was in the spotlight with a drop to its weakest level in about three months against the dollar, after a gamble by Prime Minister Shigeru Ishiba to call a snap election backfired. The weaker yen, which benefits the nation’s export-oriented economy, helped push the Topix index up by as much as 1.8%. European and US equity futures rose.

Chinese shares edged lower after profits at industrial firms plunged in September, a challenge to the economy as deflationary pressures sap the strength of corporate finances. Meanwhile, China’s central bank unveiled a new tool to help it better manage liquidity.

In India, shares of the country’s largest solar-panel maker Waaree Energies Ltd. jumped nearly 75% early on debut after a $514 million initial public offering.

Crucial Stretch

Markets are readying for a barrage of data this week including Chinese economic activity readings, Eurozone and US growth prints as well as a payrolls report to help position portfolios into year-end.

“As the elections approach and Trump trades increasingly are implemented, the US dollar may remain on the front foot while US rates remain elevated, creating a somewhat painful backdrop for emerging market assets,” Barclays Plc strategists led by Themistoklis Fiotakis wrote in a note to clients. While it may worsen in a Trump win, “there has already been some degree of election premium built into currency markets over recent weeks.”

For the US bond market, already stung by the worst selloff in six months, the coming days will be particularly crucial, as they feature the Treasury Department’s announcement on Wednesday on the scale of its coming debt sales.

The rally in stocks faded Friday, with the S&P 500 notching its first weekly loss in seven weeks as a gain in tech stocks failed to offset a drop in bank shares. Five of the so-called Magnificent Seven report earnings this week and are expected to post their slowest collective quarterly earnings expansion in six quarters, according to data compiled by Bloomberg Intelligence.

Elsewhere in Asia this week, major Chinese banks will release earnings reports while the Bank of Japan will give a policy decision. Australia’s inflation data and the official and private Chinese PMI readings will also be closely parsed to help gauge the outlook on the risk-sensitive Aussie and NZ currencies.

Some of the key events this week:

- Bank of Canada Governor Tiff Macklem speaks, Monday

- Japan unemployment, Tuesday

- US job openings, Conference Board consumer confidence, goods trade, Tuesday

- Alphabet, HSBC, Santander earnings, Tuesday

- Australia CPI, Wednesday

- Eurozone consumer confidence, GDP, Wednesday

- Germany GDP, CPI, unemployment, Wednesday

- UK Chancellor of the Exchequer Rachel Reeves presents budget to Parliament, Wednesday

- US GDP, ADP employment, Wednesday

- Meta, Microsoft, UBS, Volkswagen earnings, Wednesday

- US Treasury Department holds quarterly refunding announcement of bond-auction plans, Wednesday

- Australia retail sales, Thursday

- China Manufacturing and non-manufacturing PMI, Thursday

- Eurozone CPI, Thursday

- Bank of Japan policy decision, Thursday

- US PCE data, Thursday

- Canada GDP, Thursday

- Amazon, Apple, Samsung earnings, Thursday

- China Caixin manufacturing PMI, Friday

- UK S&P Global Manufacturing PMI, Friday

- US nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.5% as of 5:40 a.m. London time

- Nasdaq 100 futures rose 0.6%

- Futures on the Dow Jones Industrial Average rose 0.4%

- The MSCI Asia Pacific Index rose 0.2%

- The MSCI Emerging Markets Index rose 0.2%

- S&P 500 futures rose 0.5%

- Nikkei 225 futures (OSE) rose 1.8%

- Japan’s Topix rose 1.5%

- Hong Kong’s Hang Seng rose 0.3%

- The Shanghai Composite rose 0.3%

- Euro Stoxx 50 futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.1% to $1.0785

- The Japanese yen fell 0.9% to 153.61 per dollar

- The offshore yuan fell 0.1% to 7.1438 per dollar

- The British pound fell 0.1% to $1.2945

Cryptocurrencies

- Bitcoin was little changed at $67,673.37

- Ether fell 0.3% to $2,481.07

Bonds

- The yield on 10-year Treasuries advanced four basis points to 4.28%

- Germany’s 10-year yield advanced three basis points to 2.29%

- Britain’s 10-year yield was little changed at 4.23%

- Australia’s 10-year yield advanced seven basis points to 4.48%

Commodities

- Spot gold fell 0.4% to $2,735.44 an ounce

- West Texas Intermediate crude fell 4.7% to $68.43 a barrel

- Spot gold fell 0.4% to $2,735.44 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Ticks Higher With China Stimulus and US Stockpiles in Focus

Stocks Buoyed as ‘Santa Claus Rally’ Period Begins: Markets Wrap

Japan Aims for 60% Emissions Cut by 2035 in Target Seen as Lax

Oil Drifts Lower in Pre-Holiday Trading as Dollar Strengthens

Stocks, Bonds Decline for the Week After Fed Pivot: Markets Wrap

Hedge Funds Boost Bullish WTI Bets Most in a Year on Sanctions

Buffett Boosts Occidental Oil Bet Despite $2 Billion Paper Loss

Oil Heads for Weekly Drop as Dollar Strengthens on Fed Outlook

Oil Falls as Dollar Surges on Fed Outlook for Fewer Rate Cuts