LG Energy Pins Hopes on America Growth as EV Battery Sales Climb

(Bloomberg) -- LG Energy Solution Ltd. raised its 2022 sales outlook by 14% to 25 trillion won ($17.5 billion) after third-quarter operating profit beat analyst estimates, and stressed the importance of North America in its growth plans.

The world’s second-biggest maker of electric-vehicle batteries said operating profit for the three months through September was 522 billion won, in line with preliminary results released earlier this month and well ahead of the average analyst forecast for 372 billion won. Sales jumped 90% from a year earlier to 7.65 trillion won.

The South Korean company reiterated its target of tripling revenue in North America in five years, with the EV market there forecast to see compound annual growth rate of 33% by 2030, ahead of Europe and China at 26% and 17%, respectively.

“Demand for EV batteries will remain strong, especially in North America,” Chief Finance Officer Chang-Sil Lee said in a post-earnings call. LG Energy still plans to increase production capacity in Europe too, he said.

Europe is likely to follow the US in enacting clean-energy rules along the lines of the Inflation Reduction Act, Lee said, describing the policy as “a great opportunity.” The company said it plans to expand its production capacity, customer base and product lineup in North America in response to the changes, as well as strengthen its local supply chain by partnering with major suppliers.

LG Energy said it will “also increase direct sourcing of metals through equity investments and long-term supply agreements.”

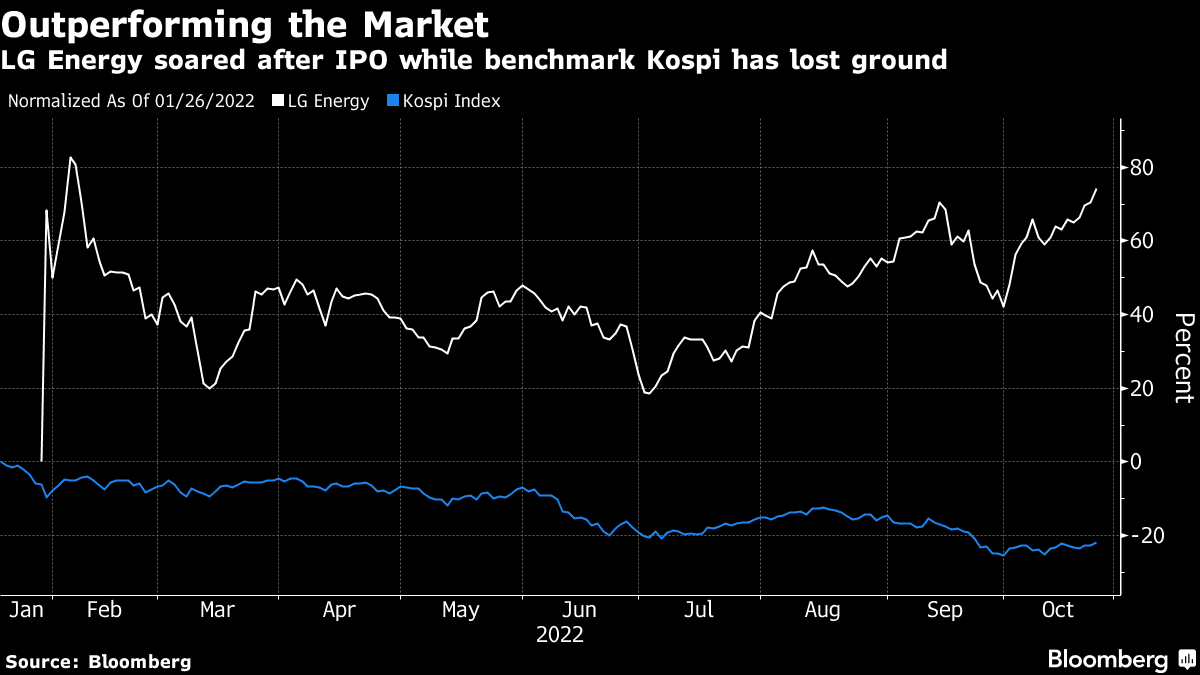

LG Energy shares were up 2.2% as of 11:25 a.m. in Seoul. The shares have advanced 74% since listing in January in South Korea’s biggest-ever initial public offering.

LG Energy’s outstanding orders stood at about 370 trillion won at the end of September, almost double a year earlier. About 70% were for North America, with the rest mostly for Europe. The company said its customers includes General Motors Co., Ford Motor Co., Honda Motor Co., Volvo AB and Stellantis NV.

“We have increased the shipment of EV batteries thanks to improved demand in EU and North America,” Lee said in Wednesday’s statement. “Increased sales of energy storage systems for power grids in the North American market, and batteries for newly launched IT devices also contributed to the strong quarterly performance.”

Net income for the quarter came in at 186 billion won, compared with a 233 billion won loss in the same period last year. The net income figure missed analyst estimates of 258 billion won. LG Energy said that stemmed from foreign exchange-related losses due to the weaker won.

LG Energy said it would stick to a plan to spend 7 trillion won this year.

The promising outlook is set against a backdrop of strains appearing in the EV industry. Tesla Inc. this week cut prices of its cars in China to counter intensifying competition with local rivals, while Hyundai Motor Co. lowered sales targets for 2022, citing challenges including supply-chain disruptions and currency fluctuations. European carmakers have warned of a contraction in sales amid fears of recession and an energy crisis.

LG Energy said a slowdown in Tesla sales was likely temporary as it was related to Covid lockdowns in Shanghai that disrupted production. It is also still considering a plan to build a plant in Arizona and is checking construction costs and how they may be affected by inflation pressures.

(Uncertainty is rising in Europe battery market, CFO says)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

European Stocks Head for Correction After China Tariffs Response

EU Steps Back on 2040 Climate Goal in Order to Win Over Doubters

Austria Plans Funding Help to Encourage More Geothermal Drilling

UK, EU to Work Toward Linking Carbon Markets at May 19 Summit

Europe’s Solar Season Is Getting More Intense and Disruptive

China’s Efforts to Curb Solar Glut Show Limited Impact, CEA Says

China’s Megacity Shanghai Invests in Nation’s Fusion Energy Push

Germany’s Power Market Bailed Out by Gas Plants as Wind Plunges

IEA Chief Calls for Japan to Restart Dormant Nuclear Plants