Five Key Charts to Watch in Global Commodity Markets in 2024

(Bloomberg) -- Welcome to 2024! Extreme weather, economic uncertainty and mounting geopolitical risks from Ukraine and Russia to Israel and the broader Middle East were dominant themes last year, and are poised to remain part of the storylines in the weeks and months ahead. Rising tensions in the Red Sea have disrupted container shipments through the key trading route, raising prospects for more expensive commodities as vessels are forced to embark on longer travel routes. While oil traders largely looked past the conflict in the waning days of 2023, volatility is crawling back in the first trading sessions of January.

Here are five notable charts to consider in global commodity markets this year.

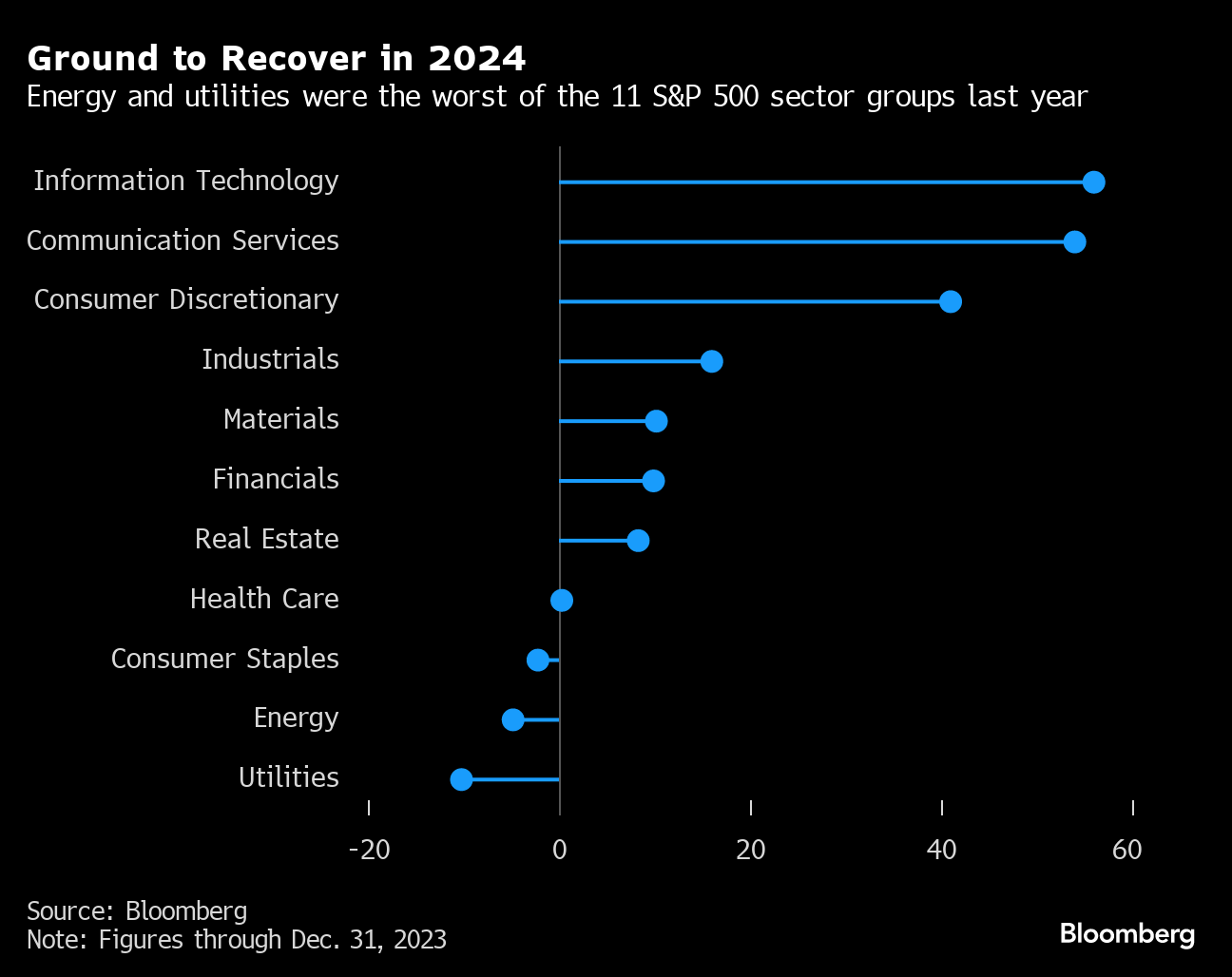

Sector Overview

US energy stocks endured a shaky 2023 amid an uncertain supply picture that sent oil prices surging through September before unwinding into year-end as global inventories ballooned. The S&P 500 Energy Index fell 4.8% to rank second-worst among the 11 S&P 500 industry groups. That’s a stark reversal of fortune after a blowout performance in the prior year thanks to soaring energy prices and record profits. Going forward, Bloomberg Intelligence sees the potential for a continued selloff for the sector. Utilities — which includes Constellation Energy Corp., Duke Energy Corp., Dominion Energy Inc. and NextEra Energy Inc. — was the worst performer, falling 10%.

Crude Oil

Oil is fresh off its first annual decline since 2020. And while there’s no crystal ball to determine what’s in store for 2024, one thing is clear: Supply will remain a driving factor. Record production in the US and rising output from non-OPEC+ nations has contributed to a global glut, despite pledges by the Organization of the Petroleum Exporting Countries to curb supplies. Investors are taking note, with Brent’s prompt spread once again flirting with contango, a bearish market structure that signals oversupply where barrels for immediate delivery are cheaper than future contracts. UBS Group AG cut its forecasts for the global oil benchmark as the cartel’s spare production capacity swells, with Brent expected to hold in a $80-a-barrel to $90-a-barrel trading range this year. Morgan Stanley also slashed its price forecasts.

Energy Dealmaking

Blockbuster takeovers by Exxon Mobil Corp., Chevron Corp. and Occidental Petroleum Corp. made 2023 a year to remember in the global energy industry. Those deals pushed the total value of announced mergers and acquisitions to $346.2 billion, according to data compiled by Bloomberg. That’s 80% more than the prior year, and was only outdone by the value of transactions announced in 2014 and 2018. Last year’s dealmaking was driven by oil-and-gas takeovers, with $229.9 billion in announced transactions representing the biggest annual tally for the energy subsector in at least a quarter century. US shale bosses are bracing for more megadeals this year, a quarterly survey by the Federal Reserve Bank of Dallas shows. On Thursday, APA Corp. agreed to buy shale explorer Callon Petroleum Co. for $2.6 billion.

Shipping

Iranian-backed Houthi rebels have disrupted shipping in the Red Sea for the last two months in a bid to end Israel’s military assault on Gaza. Some of the world’s biggest shipping firms are avoiding the vital trade corridor, complicating flows between Europe and Asia and forcing some vessels to take the more costly route around the Cape of Good Hope. Through Tuesday, ships traveling through the Bab el-Mandeb Strait — which provides a strategic link between the Mediterranean and Indian Ocean via the Red Sea and the Suez Canal — have dropped precipitously, according to IMF PortWatch data.

Metals

The future of spot gold rests heavily in the hands of the US Federal Reserve. Expectations that the central bank was poised to cut interest rates sooner than expected helped propel the precious metal to a record last month. But that euphoria has since tempered with swaps markets now seeing more than a 60% chance of a cut by March — lower than the 85% odds seen in late December. Investors of bullion-backed exchange-traded funds are on edge, with December marking the seventh straight month of outflows. The trend may not reverse until the market is convinced that the Fed is firmly on a path of looser monetary policy, which tends to help the non-interest bearing metal.

(Updates with latest Brent forecasts in fourth paragraph, energy M&A in fifth and swaps pricing in seventh.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions

Shipping Giants Ask Watchdog to Avoid Biofuels in Green Push