Refining Woes Hit Big Oil as Pressure Rises on Investor Returns

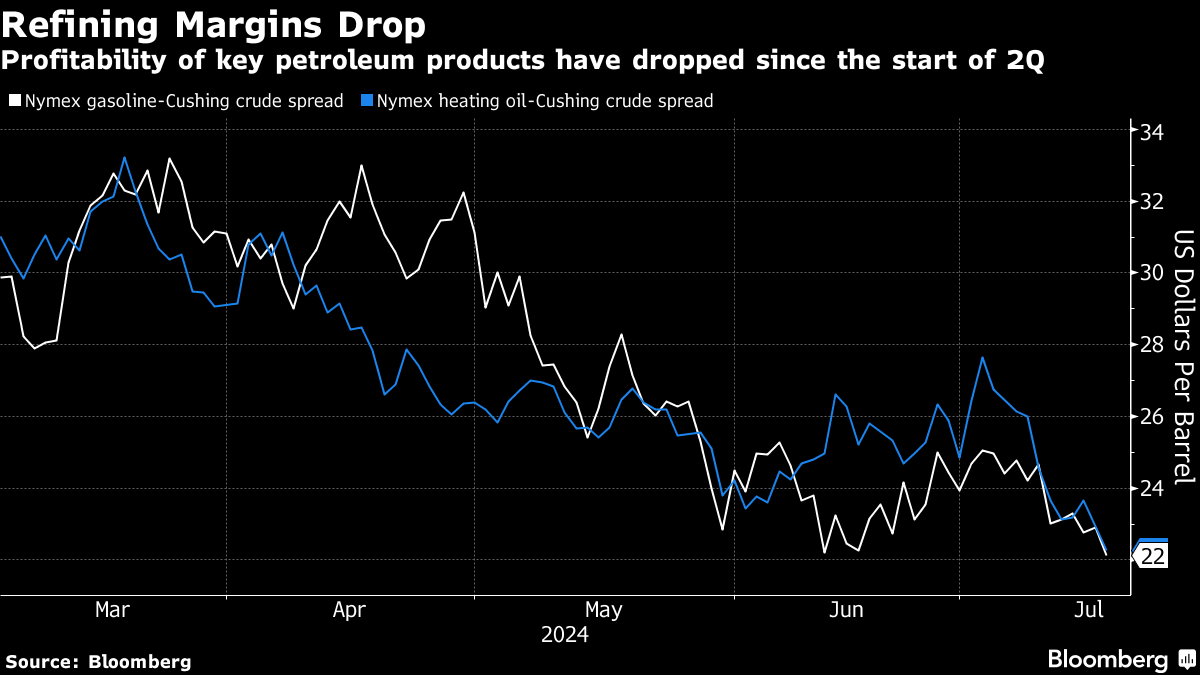

(Bloomberg) -- Refining margins are expected to prove a drag on oil-industry earnings, adding pressure to a sector struggling to balance shareholder returns and growth.

Lackluster diesel demand, rising competition from biofuels, and new refineries in the Middle East squeezed fuel-making margins during the second quarter. For Exxon Mobil Corp., which has the biggest refining footprint among the supermajors, the drop is forecast to be severe enough to wipe out gains from higher crude prices.

“The message is clear – refining is going to be challenging for the quarter,” said Paul Cheng, a Scotiabank analyst.

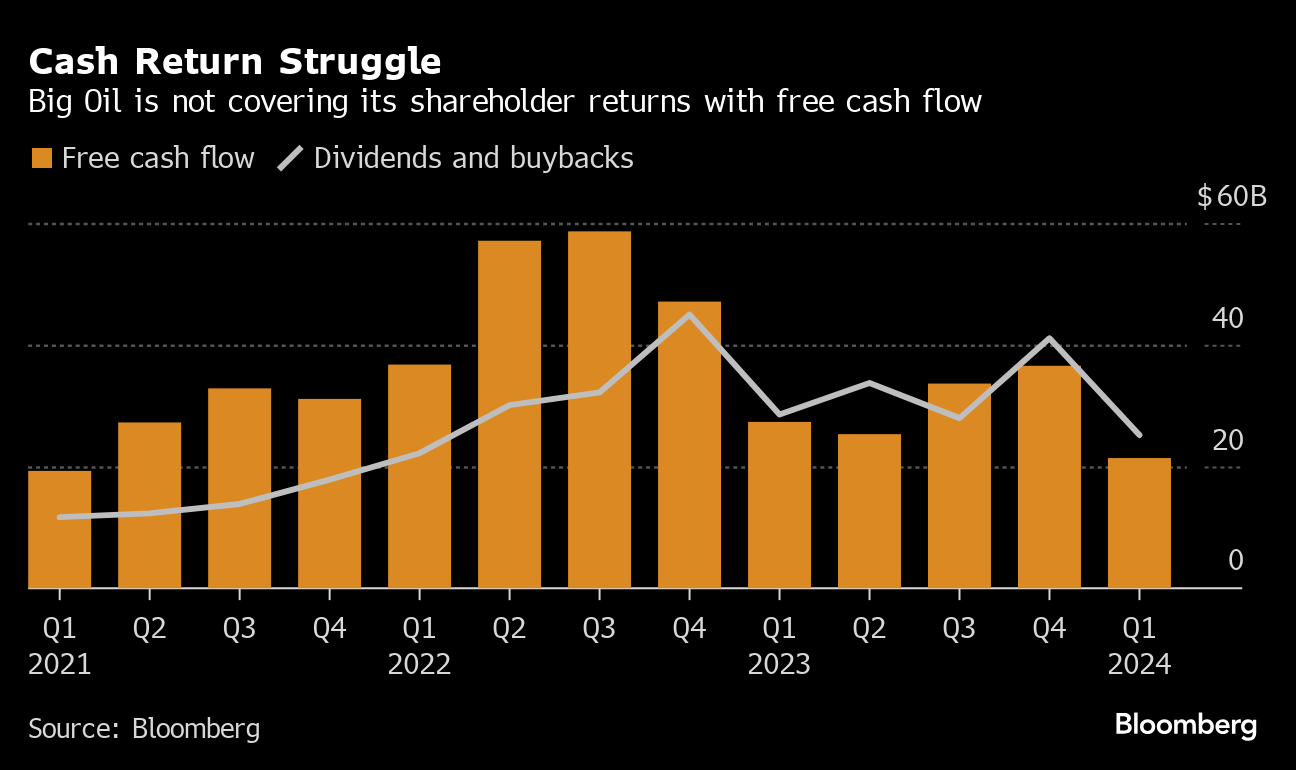

The hit to refining, which often acts as a hedge against volatile crude and natural gas prices, comes at a time when Big Oil is finding it more difficult to keep up with shareholder demands for higher crude output and cash returns. Executives have resorted to delaying low-carbon projects and piling on more debt to fund buybacks, dividends and future fossil-fuel production.

Combined second-quarter adjusted net income Exxon, Chevron Corp., Shell Plc, TotalEnergies SE and BP Plc fell by 3.9% to $28.1 billion on a sequential basis, according to estimates compiled by Bloomberg. That’s despite the 4% advance in international benchmark crude prices and slight gains in gas markets.

The current market is a far cry from the record refining margins seen in the aftermath of Russia’s 2022 invasion of Ukraine. This year, diesel demand dipped to the lowest seasonal level in 26 years in March.

Exxon, which benefited from robust refining returns in 2022 and 2023, has warned that shrinking margins reduced overall quarterly earnings by as much as $1.5 billion, more than double the gain from crude’s ascent. BP guided to “significantly lower” refining margins and said it may write down its Gelsenkirchen plant in Germany by as much as $2 billion. Shell’s refining margin shrank by one-third to $8 a barrel.

“Our expectation is refining margins continue to weaken moving forward,” Jason Gabelman, a New York-based analyst at TD Cowen said in an interview.

Big Oil’s playbook for the post-pandemic rebound in oil and natural gas prices has been to increase buybacks and dividends rather than spend the windfall on new projects. The strategy had the twin benefits of repaying investors after a decade of poor returns and not oversupplying markets, good for both prices and the environment.

But with refining in trouble and OPEC willing to bring more supply back to the market over the next 12 months, Big Oil’s ability to keep increasing payouts is imperiled. Analysts at Citigroup Inc. said they are increasingly funded by debt. S&P Global Inc. analysts last month said their decision to remove the positive outlook on BP’s debt should be seen as “a warning shot to the industry.”

The fix is to divert cash toward growing the core fossil-fuel business, according to Citigroup analyst Alastair Syme. The urgency is greater for European companies that got sidetracked by low-carbon initiatives, he said.

“There has to be a change in the narrative,” he said. “If you ultimately want to grow returns to the shareholder you either have to grow business or expand the current rate of return.”

TotalEnergies will kick off supermajor earnings season when it discloses results on Wednesday, followed by BP and Shell on July 30 and Aug. 1, respectively. Exxon and Chevron will report on Aug. 2.

Exxon may be the most exposed to weak refining, but its growth prospects far exceed rivals, according to Gabelman. Its $63 billion purchase of Pioneer Natural Resources Co. will be included in results for the first time. Additional project start-ups in 2025 should add $5.5 billion to earnings annually, Gabelman said.

Investors will be watching out for an updated timeline on Exxon’s Golden Pass liquefied natural gas export terminal in Texas, where the main contractor recently went bankrupt.

For Chevron, shareholders and analysts will be keen for any update on the arbitration case with Exxon that has thrown a wrench into the $53 billion acquisition of Hess Corp.

©2024 Bloomberg L.P.