UK Energy Price Cap Falls But Millions Set For Higher Bills

(Bloomberg) -- UK energy bills are set to fall from October though millions of households could still face higher costs in the coming months, following the phase-out of government support.

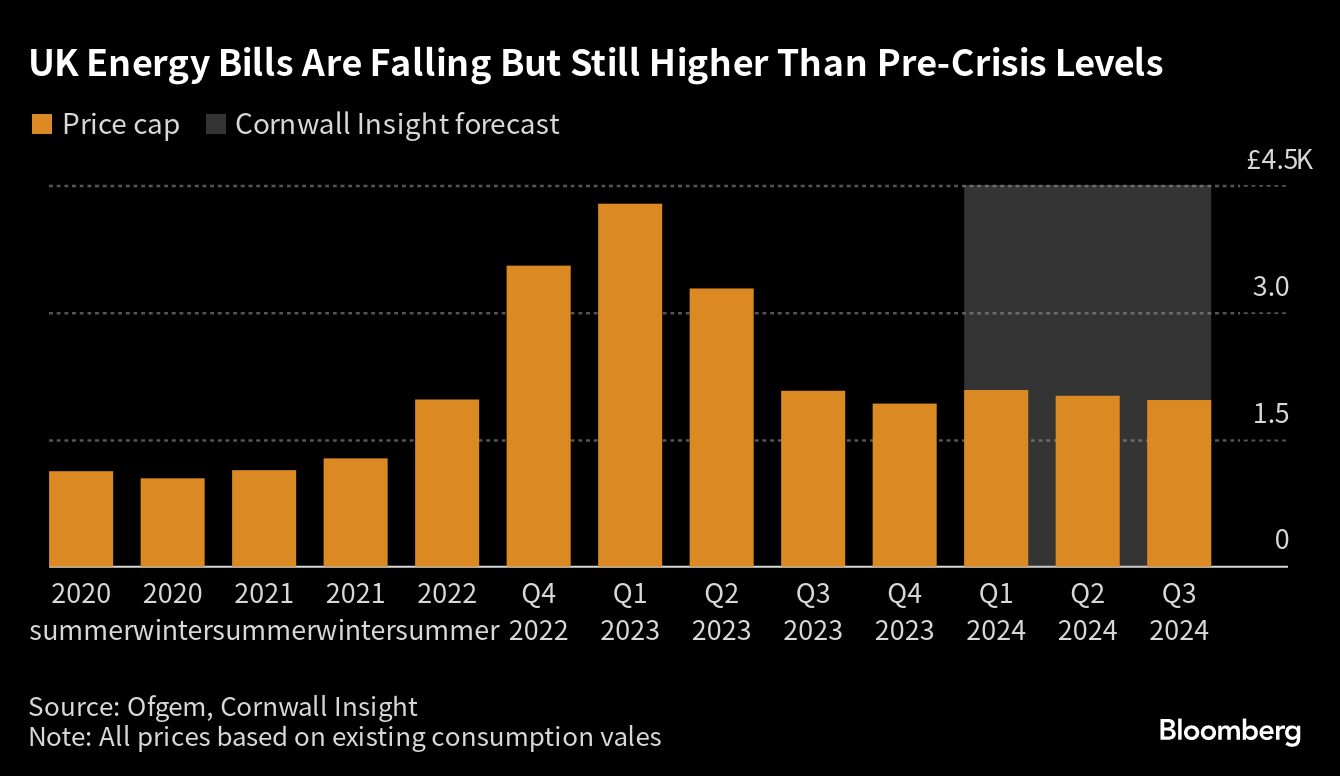

The national price cap will drop 7.3% to £1,923 for the last three months of the year, from £2,074 previously, regulator Ofgem said Friday. The pricing mechanism, set on a quarterly basis, limits how much suppliers can charge per unit of energy. This is the first time the usual energy bill will fall below £2,000 a year since April 2022.

Still, as many as 7.2 million households in England could face higher energy bills this winter, with some paying £100 more, the Resolution Foundation said in a study this week. Ofgem is also increasing standing charges for pre-payment meters, to cover the cost of supply connections. The meters are often installed in lower income or vulnerable households. The regulator is changing the way the earnings allowance for suppliers is calculated and that will add about £10 to each household bill, Ofgem said.

Britain remains in the midst of an historic cost-of-living crisis, with consumers having to pay more for everything from food to fuel housing costs. While inflation has eased from the highest level in decades, it’s still stubbornly elevated. The Bank of England’s chief economist recently warned that rising energy costs could derail efforts to keep overall prices in check.

Ofgem’s cap is meant to shield consumers from market volatility, but it effectively became the UK’s universal energy rate last year, after Russia’s invasion of Ukraine and curtailment of gas supplies triggered a supply crunch.

Bills are “way higher” than pre-crisis levels, Ofgem chief executive officer Jonathan Brearley said on BBC radio. “Many families are struggling, there are alternative options that may adapt better to these volatile prices,” he said commenting on a possible scrapping of the cap in future.

Last winter, the typical annual residential energy bill was around £2,100, as the government’s Energy Price Guarantee and £400 rebates benefited consumers, according to the Resolution Foundation. Now that the supply crisis has receded, government aid has been significantly scaled back.

Consumer charity Citizen’s Advice is calling on the government to do more to help people from falling into fuel poverty, such as expanding the support that lower-income households are eligible for, like the Warm Home Discount. The group says record numbers of people are seeking help from energy debt, which is now more than £1,700 — a third higher than it was in 2019. Campaigners are also pushing the government to consider subsidizing some households through a social tariff.

“The price cap is no longer fit for propose,” Simon Oscroft, Co-Founder of supplier So Energy Trading Ltd said. “In its place we need short term targeted support this winter, but also a more permanent replacement in the form of ongoing targeted support for those customers most in need.”

For now, lower wholesale energy costs are enabling providers to offer more fixed tariffs for their power bills, allowing some consumers to lock in rates. But prices typically rise during the winter, and gas futures for February are now more than 50% more than the level for October, the start of the heating season. Ofgem’s price cap is also expected to rise again at the start of the year.

“While a small decrease in October’s bills is to be welcomed, we once again see energy price forecasts far above pre-crisis levels, underscoring the limitations of the price cap as a tool for supporting households with their energy bills,” said Craig Lowrey, principal consultant at Cornwall Insight.

(Adds details from third paragraph.)

©2023 Bloomberg L.P.