Nicholas Threatens to Lash Gulf Coast With Rain for Days

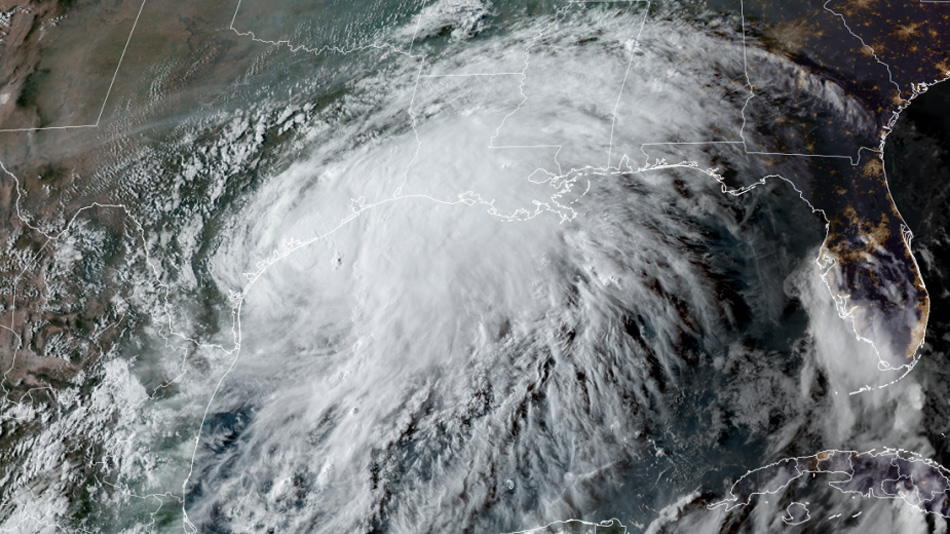

(Bloomberg) -- Storm Nicholas is lashing the U.S. Gulf Coast with torrential rain that could last for days, knocking out power, unleashing floods and dealing another blow to the energy industry just two weeks after Hurricane Ida.

The storm made landfall in Texas early Tuesday morning southwest of Houston with winds of 70 miles (110 kilometers) per hour, the eighth tropical cyclone to hit the U.S. this year. “Life-threatening” flash floods are expected across the South over the next couple of days, the National Hurricane Center said. Power outages shut two critical fuel pipelines to the Northeast and a natural gas export terminal.

“It could be several days of heavy rain across the Gulf coast,” Josh Weiss, a forecaster at the U.S. Weather Prediction Center, said.

By Tuesday evening, the storm had weakened to a tropical depression, with winds dropping to 35 mph as it moves into Louisiana, bringing five to 10 inches (13 to 25 centimeters) of additional rainfall across the region. There could be isolated totals of 20 inches in southern and central Louisiana and the western Florida Panhandle, the Hurricane Center said.

Nicholas is soaking Texas as climate change increases the intensity of disasters from storms and hurricanes to wildfires. At least 80 people were killed after Hurricane Ida hit coastal Louisiana and headed Northeast earlier this month and wildfires have burned large swaths of the U.S. West this year.

More than 140,000 homes and businesses were without power Tuesday night in Texas -- mostly in Houston and nearby counties -- down from a high of 520,000, according to PowerOutage.US, which tracks utility outages.

The blackouts forced Colonial Pipeline Co. early Tuesday to temporarily shut two pipelines, both of which are critical fuel conduits from the U.S. Gulf Coast to the Northeast. Freeport LNG said all three production units at its liquefied natural gas export terminal near Houston were down, likely due to an electricity disruption.

While Nicholas mostly bypassed the Gulf of Mexico’s oil and natural gas platforms, torrential rains pose a threat to coastal refineries and petrochemical facilities. The region’s energy sector is still recovering from the impact of Hurricane Ida more than two weeks ago, with about 40% of the Gulf’s offshore crude capacity offline. Oil futures traded higher Tuesday on speculation Nicholas could add to the disruption to supply.

The heaviest rain will likely fall from Monday to Wednesday, according to the Weather Prediction Center. The storm’s slow forward advance adds to the flooding risk as it passes over the region.

Nicholas is the Atlantic’s 14th storm in 2021. Half of the storms so far have hit the U.S., and Ida was the season’s worst, crashing into the Louisiana coastline before devastating New York with rain and floods. On Monday, AIR Worldwide updated its projected losses from Ida, saying the storm probably caused $20 billion to $30 billion in insured losses. Earlier estimates were around $18 billion.

The latest storm is expected to hit areas of Louisiana still recovering from last year’s Hurricane Laura and is likely to bring heavy rain to areas slammed by Ida, Edwards said. That could also disrupt efforts to restore power.

Nicholas may also hamper restoration efforts of Gulf of Mexico oil platforms and pipelines that have remained offline since Ida. U.S. Gulf Coast physical crude prices could surge if supplies aren’t returned promptly.

An average Atlantic season produces 14 storms by the time it ends in November, so 2021 is ahead of pace.

(An earlier version corrected the day of the week for the storm’s landfall.)

(Updates with storm weakening in fourth paragraph, number of outages in sixth paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Russia, Turkey Discuss Gas Swap to Pay for Nuclear Plant

India LNG Buyers Negotiate US Deals Before Modi-Trump Summit

Moldova Seeks Deal to Keep the Lights on After Russia Cut Gas Supply

Zelenskiy Says Working With Trump’s Team, Seeking Deal With US

Norway Gets First Ship to Carry Waste Carbon to Undersea Storage

ADNOC Gas delivers record $5 billion net income for 2024

Quebec Says It’s Open to LNG, Oil Projects After Trump Threats

Big Oil’s Wave of Buyouts Sets Up Next Leg of Energy IPO Rebound

Ecopetrol Shares Drop As Petro Proposes Shale Operation Sale