European Gas Set for Another Weekly Gain on Tight Russian Supply

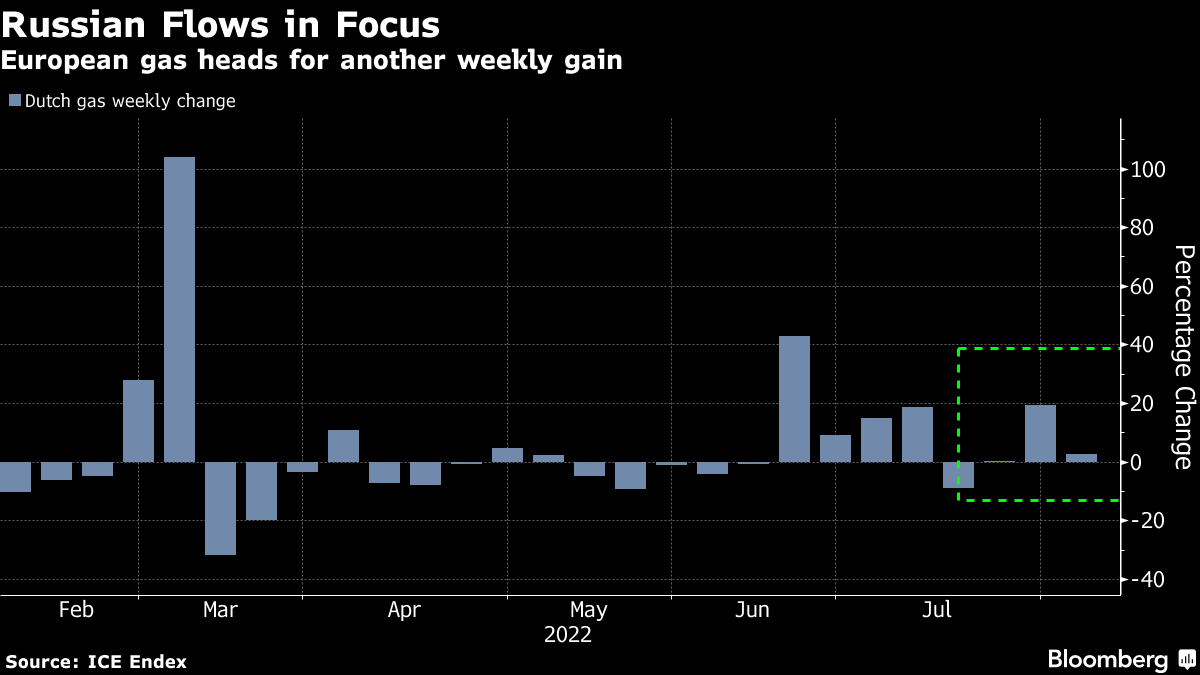

(Bloomberg) -- European natural gas headed for a third weekly gain as persistent concerns over Russian supply heighten the risk of shortages.

Benchmark futures slipped on Friday, but were about 3% higher this week. Prices surged after Moscow last week slashed supplies through the key Nord Stream pipeline to just 20% of its capacity, citing issues with equipment. But Kremlin insiders have privately said that the cuts are to pressure the European Union over sanctions on Russia, while Berlin has repeatedly said it sees no technical reasons for the reduced flows.

The cuts are reverberating through Europe, lowering industrial output, driving up inflation to the highest in decades and threatening to push major economies into recession. The EU has been racing to stockpile gas for the winter, cutting fuel consumption and boosting imports of liquefied natural gas. The bloc has filled about 71% of its storage sites, in line with the five-year average, which has helped keep prices from rising even further.

“The market appears to have consolidated a bit following the massive increases caused by the reduced flows on Nord Stream,” analysts at trading firm Energi Danmark said in a note. “Further price jumps are, however, very likely if gas supply from Russia to the EU cedes completely.”

The reduction in Russian flows to Europe has helped push up LNG prices everywhere, increasing costs for the EU and other major buyers, analysts at Morgan Stanley said in a note. “With no easy path to meeting Europe’s rising call on LNG, we expect global prices to remain elevated and volatile,” they said.

Dutch front-month gas, the European benchmark, was 1.3% lower at 196.58 euros per megawatt-hour by 1:16 p.m. in Amsterdam. The UK equivalent contract slipped 0.9%, but is also poised for a third weekly advance.

Turbines

One of Nord Stream’s turbines -- critical to boosting flows through the link -- is still in Germany following repairs in Canada, amid a stand-off over its return to Gazprom PJSC. The Kremlin said Thursday that it would like to get the unit back, but the company needs documents to show that it isn’t subject to international sanctions. Three more turbines, that are still in Russia and need maintenance, could be subject to the same sanctions risks, according to Gazprom.

“Anything that the Russians are saying on this is basically an excuse not to provide gas to the European Union,” said Eric Mamer, spokesman for the European Commission. “Of course, there is blackmail on the side of Russia when it comes to the supply of energy.”

Traders also remain on edge as several gas facilities that are crucial for Norwegian supplies to the UK and continental Europe, are scheduled to start seasonal maintenance next week. The works would add to the market’s tightness.

Still, there’s some better supply news from elsewhere. A major LNG export terminal in the US, shut this year after a blast, signaled this week that it could restart in early October at almost full capacity. That should bring a relief to Europe just before winter demand starts to kick in.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens