Global Natural Gas Crunch Amplifies U.S. Refining Boom, for Now

(Bloomberg) -- A global shortage of natural gas is giving U.S. fuelmakers an edge over European rivals.

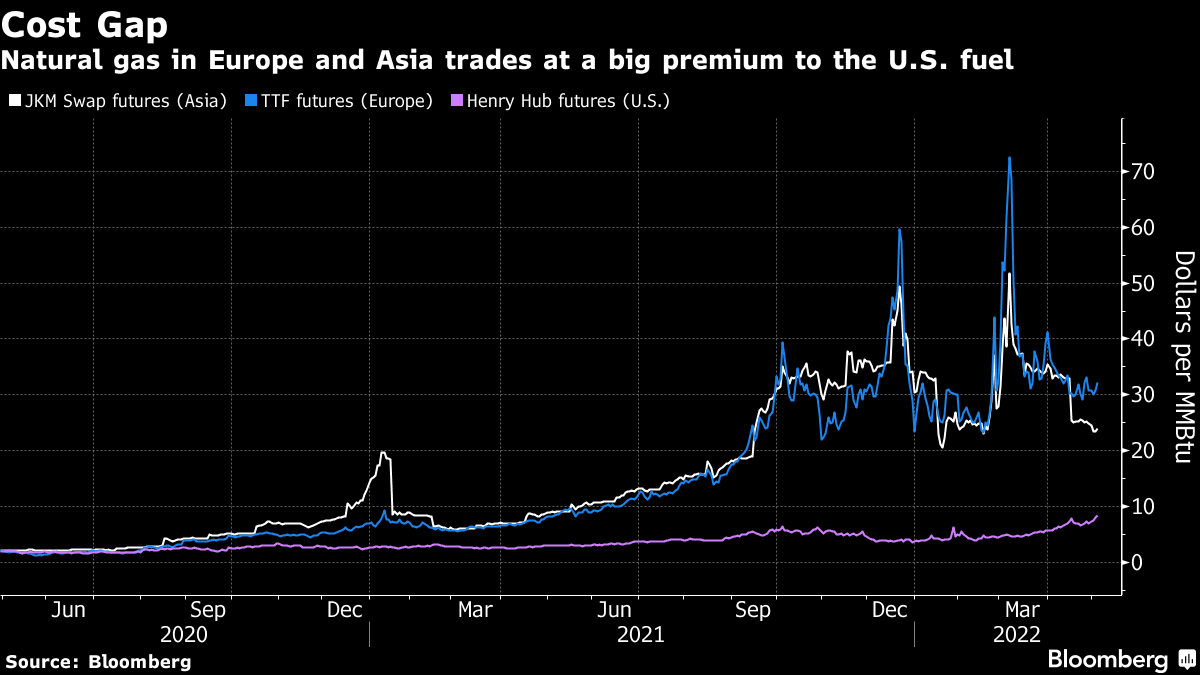

Refiners rely on natural gas as a crucial source of heat to distill crude oil into products such as diesel and gasoline. In the U.S., gas prices have more than doubled over the past year to top $8 per million British thermal units. But that still pales in comparison to the $32 European users have to pay.

Because the world is short of fuel, global prices for gasoline and diesel need to be set at levels that allow European refiners to keep running even as they outspend. That means the higher the gap is between natural gas prices in Europe and the U.S., the more profits American refiners such as Valero Energy Corp. will reap by supplying their products, everything else remaining the same.

“Natural gas price disparity between the U.S. and Europe should provide a structural margin advantage for U.S. refiners, especially for assets located in the Gulf Coast,” Valero Chief Executive Officer Joe Gorder said in a conference call with analysts last week.

Prices for diesel and gasoline are skyrocketing, leading to a windfall for refiners. The so-called 3-2-1 crack spread, a rough calculation for U.S. refiners’ gain on making gasoline and diesel, has more than doubled over the past year to an all-time-high. Marathon Petroleum Corp. and Valero, the two largest independent crude refiners in the U.S., are poised to collect record earnings in 2022, according to analyst estimates compiled by Bloomberg.

“We are in an area that I haven’t seen in my career,” David Lamp, the CEO of CVR Energy Inc., said during a conference call with analysts when commenting on spreads. “We’re short refining capacity worldwide.”

Cheaper natural gas has translated into a cost benefit of as much as $9 per barrel of oil for U.S. refiners relative to their European rivals, according to Phillips 66.

But costly natural gas is ultimately a negative for all refiners as it erodes profits. The U.S. advantage may disappear if domestic prices become more tied to the overseas market as exports grow, or if European supply disruptions ease. For Marathon Petroleum, where gas accounts for 15% of operating costs, a one-dollar move in prices for the heating fuel has an impact of $330 million on earnings before taxes and other items, Chief Financial Officer Maryann T. Mannen said Tuesday in a conference call with analysts.

“We would expect natural gas to be a headwind as the year progresses,” Mannen said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens