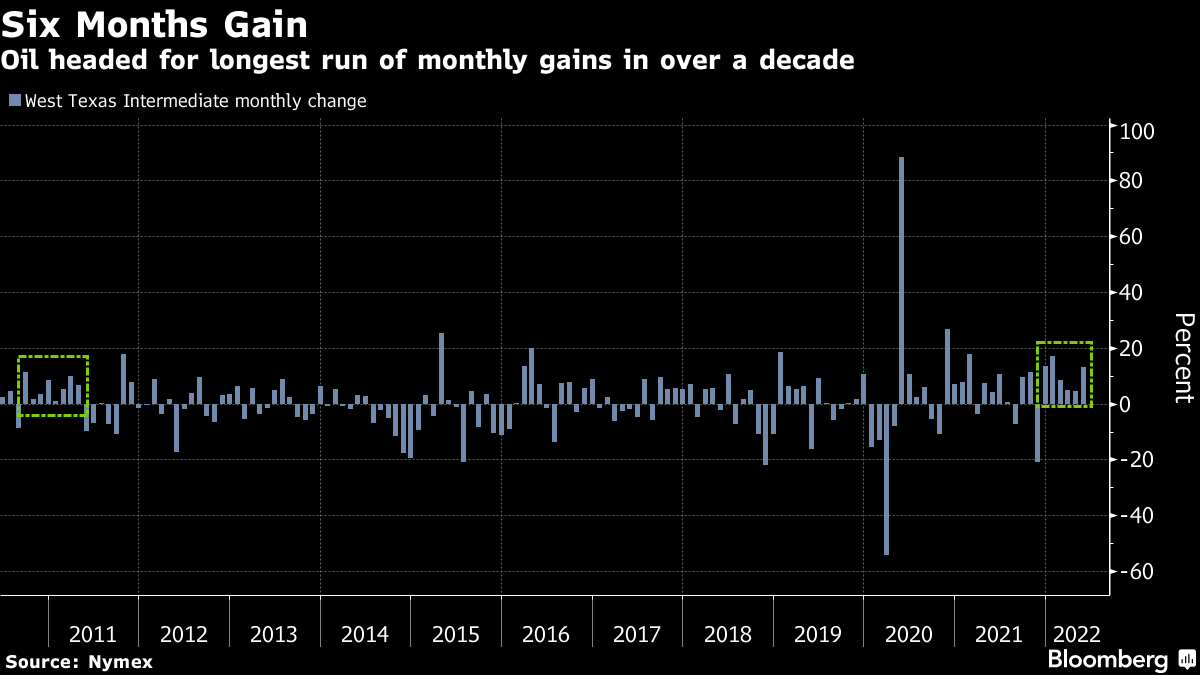

Oil Roars to Sixth Monthly Advance on EU Ban, China’s Reopening

(Bloomberg) -- Oil headed for its longest run of monthly gains in more than a decade as European Union leaders agreed to pursue a partial ban on imports from Russia and China further eased anti-virus curbs, aiding demand.

West Texas Intermediate crude topped $119 a barrel, hitting the highest level since early March. The latest round of EU sanctions would forbid buying oil from Russia delivered by sea but includes a temporary exemption for pipelines. The package, designed to punish Moscow for the invasion of Ukraine, also proposes a ban on insurance related to shipping oil to third countries.

“The real bullish part is that it shows that Europe is moving away from long-term dependence on Russian energy,” said Dennis Kissler, senior vice president of trading at BOK Financial. Most traders believe prices over $120 should lead to some demand destruction, but that may not occur until after driving season, he added.

Crude has soared this year as the conflict in Europe tightened global supplies at a time of rising demand, depleting stockpiles and boosting product prices to all-time highs. Oil prices have also been lifted as drivers kick off the nation’s busy summer driving season just as authorities in China loosen anti-virus curbs that had hurt energy consumption.

The EU’s ban gives an exemption for Hungary, which would continue to receive Russian pipeline oil. The move follows bans by the US and UK on Russian exports, although buyers in Asia -- particularly China and India -- have stepped in to take more of the shunned cargoes.

Adding to further supply constraints, the OPEC+ coalition will likely hold firm to its oil production plans later this week, delegates said. Global oil supply and demand levels remain stable, with no severe disruption yet to Russian exports, and thus require little action from the 23-nation alliance, according to the officials.

In China, there are further signs of lockdowns easing, stoking mobility. Shanghai will let people in areas deemed low risk for Covid-19 leave housing compounds, as the key hub moves to dismantle the last remaining curbs that confined most of its 25 million residents to their homes for two months.

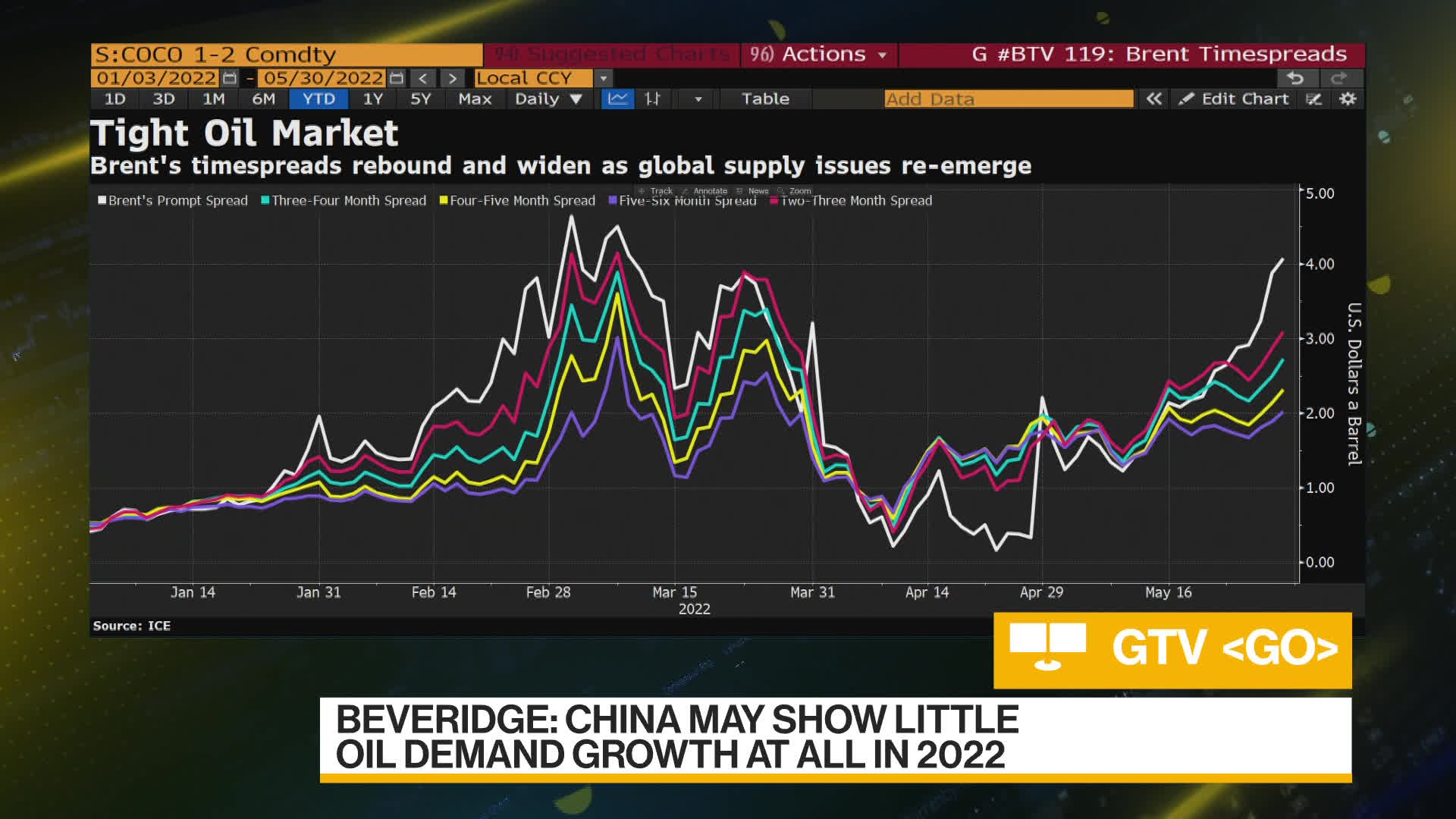

The oil market is steeply backwardated, a bullish pattern marked by near-term prices trading at a substantial premium to longer-dated ones. Brent’s prompt spread -- the difference between its two nearest contracts -- was $4.21 a barrel in backwardation, up from $2.20 at the end of April. Another widely watched metric, the December-December differential, neared $16 a barrel.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens