Shale Driller Crescent Point Works to Shed ‘Deal Junkie’ Image

(Bloomberg) -- Crescent Point Energy Corp. Chief Executive Officer Craig Bryksa spent five years revamping the Canadian oil driller and investors are finally starting to see it pay off.

After taking over a company with about C$4 billion in long-term debt and a grab bag of assets from Saskatchewan to Utah, Bryksa sold fields, whittled down debt and executed a $2.5 billion buying spree that focused Crescent on Canada’s Duvernay and Montney shale formations.

Concentrating on just a couple of regions enabled the company to shrink costs and amass technical expertise at the same time that debt reduction freed up cash for dividends and buybacks.

“We needed to move into assets that I would describe as ‘bigger-company assets,’ with more scalability, better returns and that could generate an extreme amount of free cash flow,” Bryksa said during an interview in Toronto.

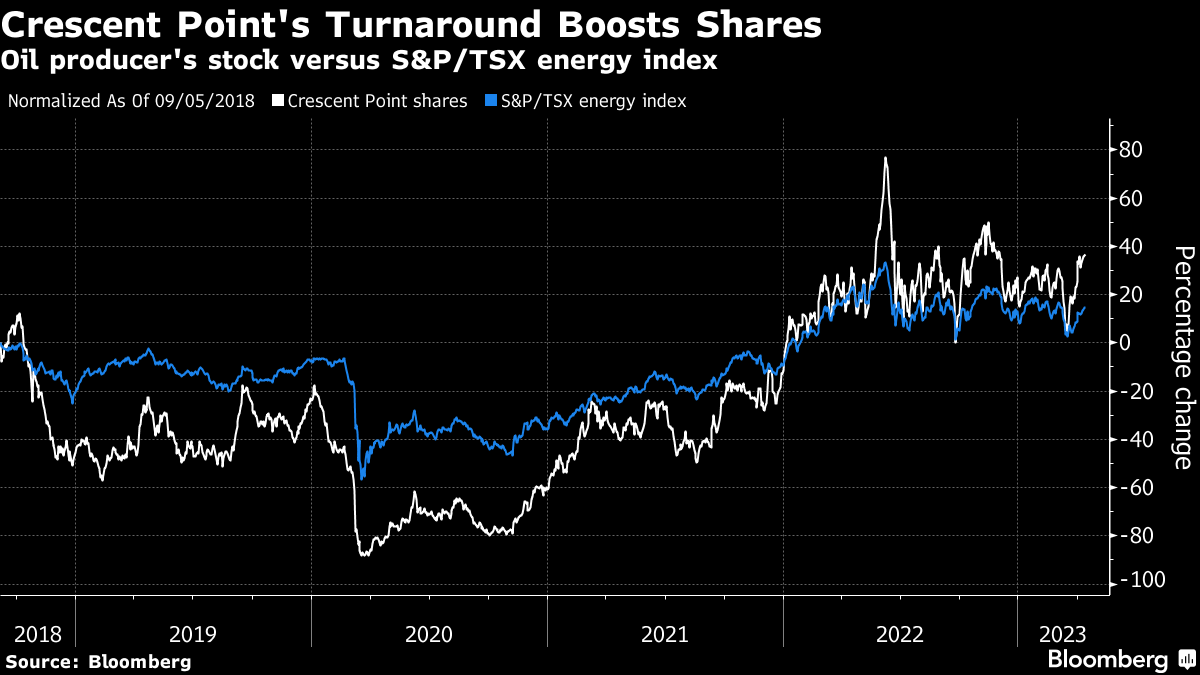

Analysts and investors have so far applauded the overhaul. After trailing peers for most of the first three years of Bryksa’s tenure, Crescent Point’s shares pulled even with Canada’s broader energy index last year and are currently outperforming it. Of the analysts that cover Crescent Point, 92% recommend buying the shares, up from 62% five years ago.

Still, the revamp has left Crescent Point “highly dependent” on continued drilling success for growth, Michael Harvey, an analyst at Royal Bank of Canada, said in a note to clients. The company’s production base, which is about 85% weighted to crude, also leaves it vulnerable to fluctuations in oil prices, he said.

Even so, Harvey rates the shares “outperform,” the equivalent of a buy, because of its “attractive drilling opportunities.

Another overhang on the stock is the company’s reputation as “deal junkies,” in Bryksa’s words. Crescent Point was one of North America’s most acquisitive oil producers, making 30 deals worth a total of $10.1 billion in the decade before Bryksa took over.

While much of Bryksa’s strategy has centered on acquiring better assets, he has been working to convince investors that Crescent Point won’t keep fussing with the portfolio and that its focus is on the holdings it has.

Crescent Point’s current five-year plan includes increasing production to the equivalent of 195,000 barrels of oil a day by 2027 from about 160,000 this year. The company also has committed to returning half of discretionary excess cash flow to shareholders, in addition to the base dividend.

“We have a very disciplined approach around what fits and what doesn’t fit,” Bryksa said of the portfolio. “It centers around returns, scalability, market access and free cash flow generation.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens