Woodside and Santos in Early Deal Talks to Create LNG Giant

(Bloomberg) -- Woodside Energy Group Ltd. is in preliminary talks with Santos Ltd. on a potential merger, opening the door for the creation of an Australian gas export powerhouse amid a global wave of multi-billion dollar energy deals.

Discussions are at an early stage, according to Santos, which said it is also exploring a range of “alternative structural options.” Talks “remain confidential and incomplete, and there is no certainty that the discussions will lead to a transaction,” Woodside said in a statement.

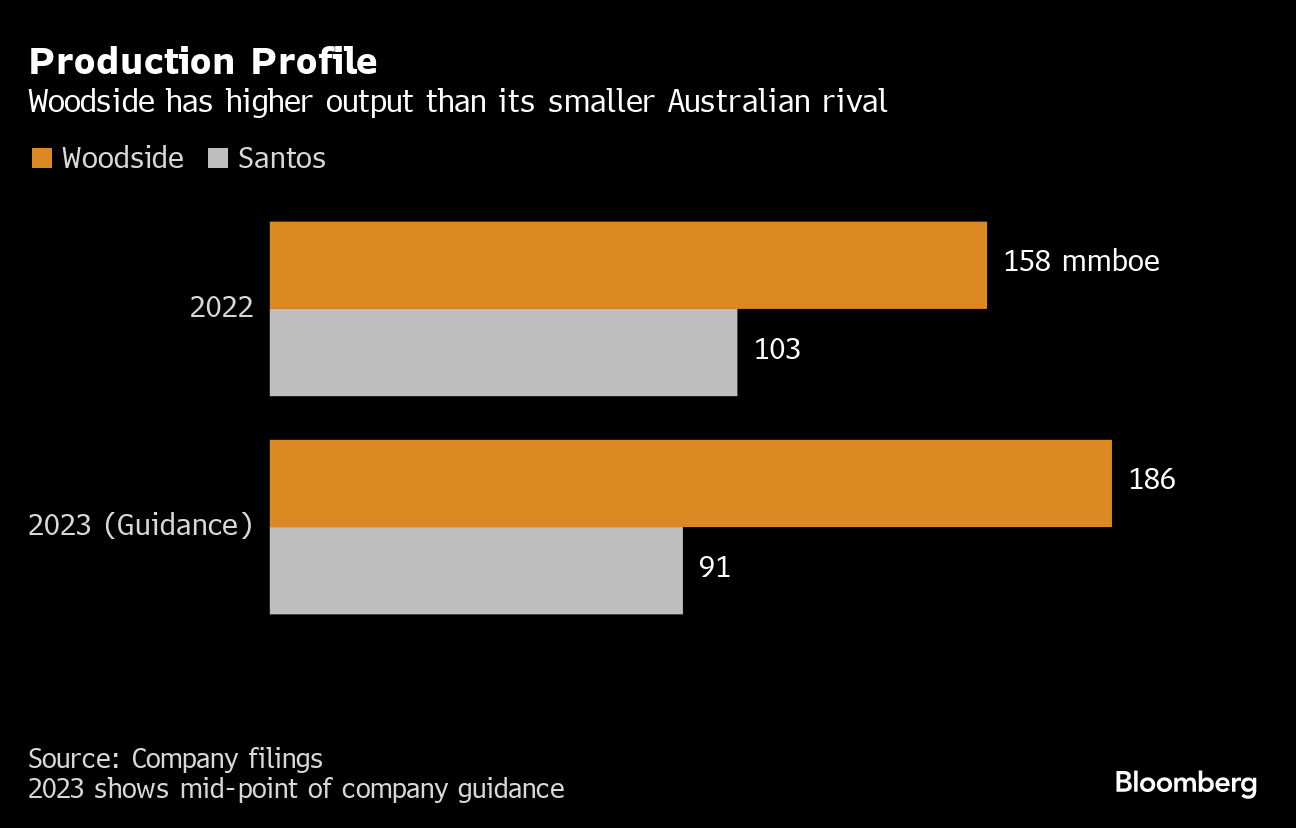

Woodside, with a market capitalization of about A$57 billion ($37 billion), is seeking to add growth options to meet oil and gas demand that it forecasts to remain resilient for decades. Smaller rival Santos, valued at A$22 billion, said last month it was working with advisers on options to boost its value.

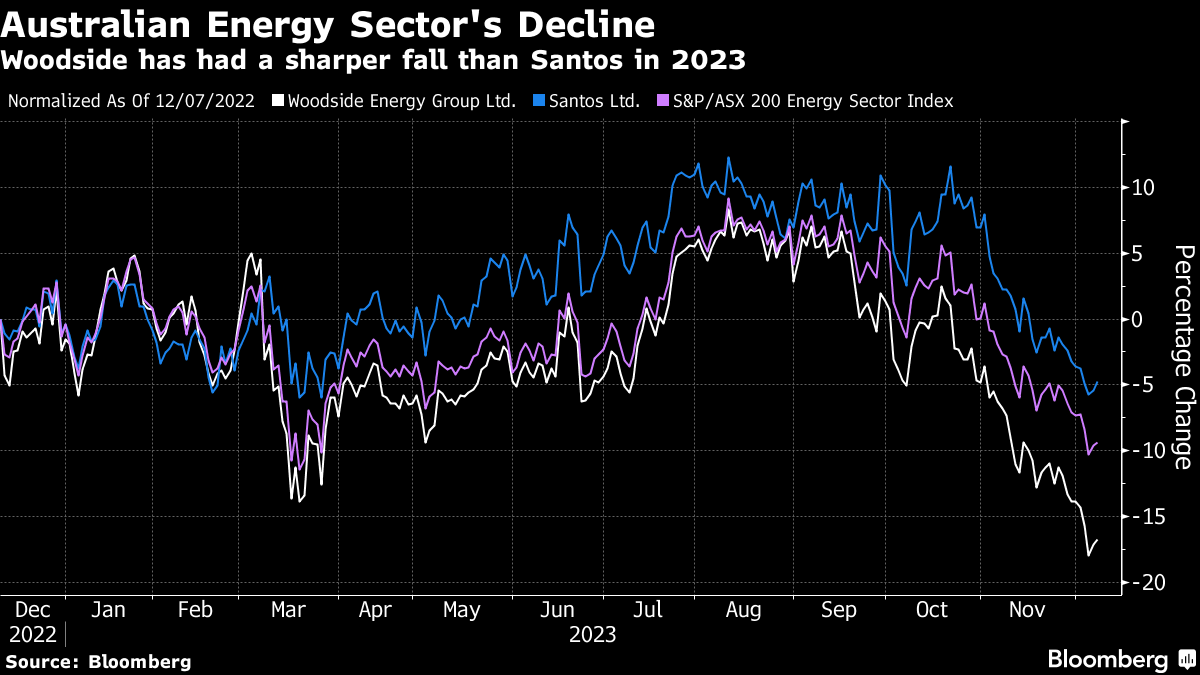

Both producers have seen their shares decline in recent months, falling at least 15% since the start of August as earnings have retreated following the sector’s bumper 2022 fueled by a spike in energy prices.

Representatives for the companies weren’t immediately available to comment further. The Australian Financial Review earlier reported the producers were exploring a deal.

A possible combination of Woodside and Santos comes amid a wave of merger activity as oil and gas producers figure out how best to deploy last year’s profit windfalls. The talks follow Exxon Mobil Corp.’s roughly $60 billion bid for Pioneer Natural Resources Co. and Chevron Corp.’s $53 billion takeover of Hess Corp.

The Santos-Woodside discussions also illustrate the growing importance of liquefied natural gas, with producers insisting the fuel will be vital to complement renewables as part of the energy transition.

Oil and gas will be supported as “populations and economies grow, with our target markets in Asia driving primary energy demand,” Woodside’s Chief Executive Officer Meg O’Neill told investors last month. “Growth in demand for LNG in particular is expected to continue.”

Woodside is already the top LNG exporter in Australia, which vies with the US and Qatar as the fuel’s largest shipper, and a combination would create one of the world’s biggest producers.

The Perth-based company last year completed a deal worth about $20 billion to add BHP Group Ltd.’s oil and gas division, while Santos acquired Oil Search Ltd. in a $15 billion deal agreed in 2021.

Woodside has operations in locations including Australia, the U.S. and Trinidad, and is currently advancing a slate of projects worth about $24 billion, including the Scarborough LNG development.

Santos has assets including a stake in an LNG export project in Papua New Guinea and facilities in Australia. The producer is developing the Barossa gas field off the coast of the Northern Territory, and a project in Alaska.

Investor L1 Capital in October called for a strategic review, arguing Santos has lagged peers in part because investors seeking exposure to LNG have chosen alternative stocks. Splitting out its oil and other gas assets in Australia to become a pure-play LNG company would boost shares by about 40%, L1 said.

(Updates with comment in second paragraph, background, charts.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens