European Gas Falls Below €50 as Historic Energy Crisis Recedes

(Bloomberg) -- European natural gas futures settled below €50 a megawatt-hour for the first time in over 17 months as the region’s worst energy crisis in decades recedes — though there are signs further price declines are unlikely.

Futures have plunged by more than 80% from their August peak when Russia’s gas cuts hit Europe with about $1 trillion in energy costs, hammering the region’s economy and pushing inflation to the highest in decades. Now, the continent is seeing a sharp turnaround as relatively mild weather, efforts to reduce fuel consumption and strong inflows of liquefied natural gas from the US to Qatar take the edge off.

For now, seasonally high storage levels are a sign of optimism that the region can make it through this winter and next. With most of the usual gas volumes from Russia now absent, European nations appear to have adjusted with ample replacement options.

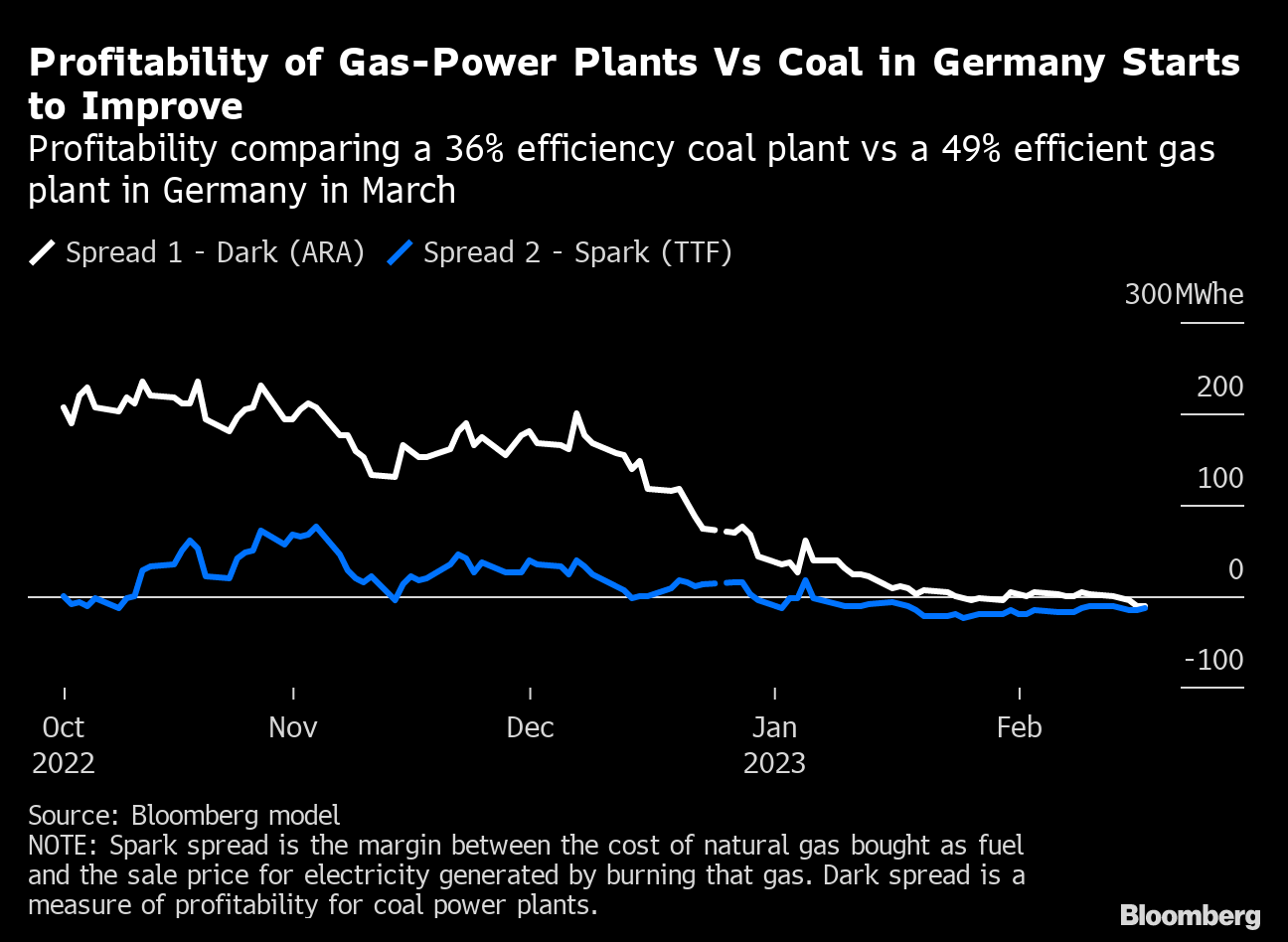

However, some analysts question whether the decline in prices will persist. With the end of winter approaching and heating demand receding, lower prices could make gas more economical for power generation in Europe than alternatives such as coal.

“Gas prices have fallen into the fuel-switching range suggesting that it is now more profitable to run the highest efficiency gas plants in comparison to the lowest efficiency coal plants,” said Stefan Ulrich, an analyst at BloombergNEF.

Demand is also picking up from India to China. Prices could rise if there’s extended cold weather before the end of winter or if there are supply disruptions. Carbon prices have rallied as well, while the slump in gas prices have brought the fuel within touching distance of the oil price.

“We’re getting to a level where the downside is probably more limited whereas still there’s clearly upside, particularly if you get the strong economic growth in China,” Steve Hill, executive vice president for energy marketing at Shell Plc, said in a presentation on Thursday. “We are clearly approaching that range.”

Dutch front-month futures, Europe’s benchmark, closed 5.7% lower at €49.05 a megawatt-hour on Friday, the lowest settlement price since late August 2021. The contract has lost more than 35% so far this year, but is still higher than historic averages.

New Normal

The “new normal” for gas prices in Europe beyond this year could be in the range of €30 to €60, depending on global economic activity and supplies, Deutsche Bank AG economists Marion Muehlberger and Eric Heymann said in a note. They see “no more supply crunch worries, even for winter 23-24” for Europe’s biggest consumer, Germany.

German utility Uniper SE — which was rescued by the government last year after the energy crisis put it on the brink of collapse — said Friday that it will overcome the problems caused by Russian gas cuts by 2024 at the latest, with high costs for replacing the lost volumes remaining an issue.

Recent price declines have helped the company to significantly reduce its losses, though it still recorded negative adjusted earnings before interest and taxes of €10.9 billion for 2022.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Vista Buys Petronas’ Argentina Oil Stake in $1.5 Billion Deal

Emerson launches Global LNG Solutions Centre in Qatar

Woodside hires Mexico Pacific CEO Sarah Bairstow as Louisiana LNG head

US Junk Bond Market Defrosts After Long Period Without Deals

China’s US Decoupling Collapses Trade in Key Petroleum Product

bp announces oil discovery in the Gulf of America

FTC Bans on Executives Joining Exxon, Chevron Boards Tested

EPA to Scale Back Emissions Reporting Plan, ProPublica Says

Trade War to Slash China’s Demand for Plastic Feedstock From US