Exxon’s $59 Billion Profit Clouded by Buybacks Disappointment

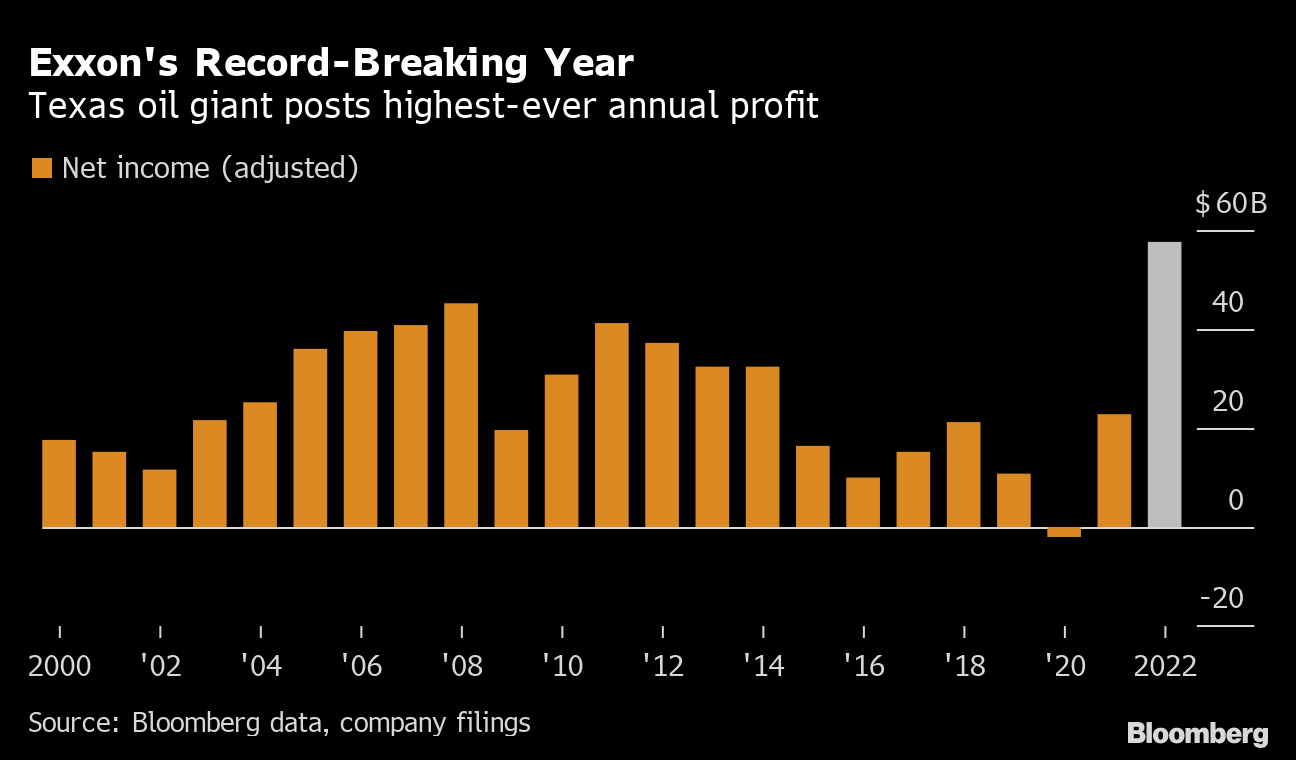

(Bloomberg) -- Exxon Mobil Corp. reaped a record $59 billion annual profit but disappointed some investors by holding the line on share buybacks.

Full-year profit, excluding one-time items, jumped 157% from 2021, far exceeding the driller’s prior record of $45.2 billion in 2008, which at the time marked the biggest in US corporate history.

The stock fell 2.6% to $110.58 at 9:33 a.m. in New York trading. Analysts noted that Tuesday’s company statement lacked any announcement of plans to funnel more of that windfall into additional share repurchases.

Exxon’s results Tuesday followed those of US rival Chevron Corp., which posted a surprise earnings miss last week just days after announcing a mammoth $75 billion share-buyback program.

The five so-called supermajors are swimming in cash after a record 2022 but pressure is mounting on executive teams to satisfy competing demands: investor appetite for bigger payouts and buybacks versus political outrage over windfall profits during a time of war and economic dislocation.

Chevron was excoriated by the White House and Democratic members of Congress when it disclosed plans last week to funnel $75 billion to investors in the form of stock repurchases.

Exxon expanded buybacks multiple times last year and already has signaled its intention to repurchase $50 billion of stock through 2024. The company is pursuing a “balanced” approach to buybacks and dividends while reducing debt and investing in new projects, Chief Financial Officer Kathy Mikells told analysts during a conference call.

She gave no indication that Exxon will be increasing the buyback soon.

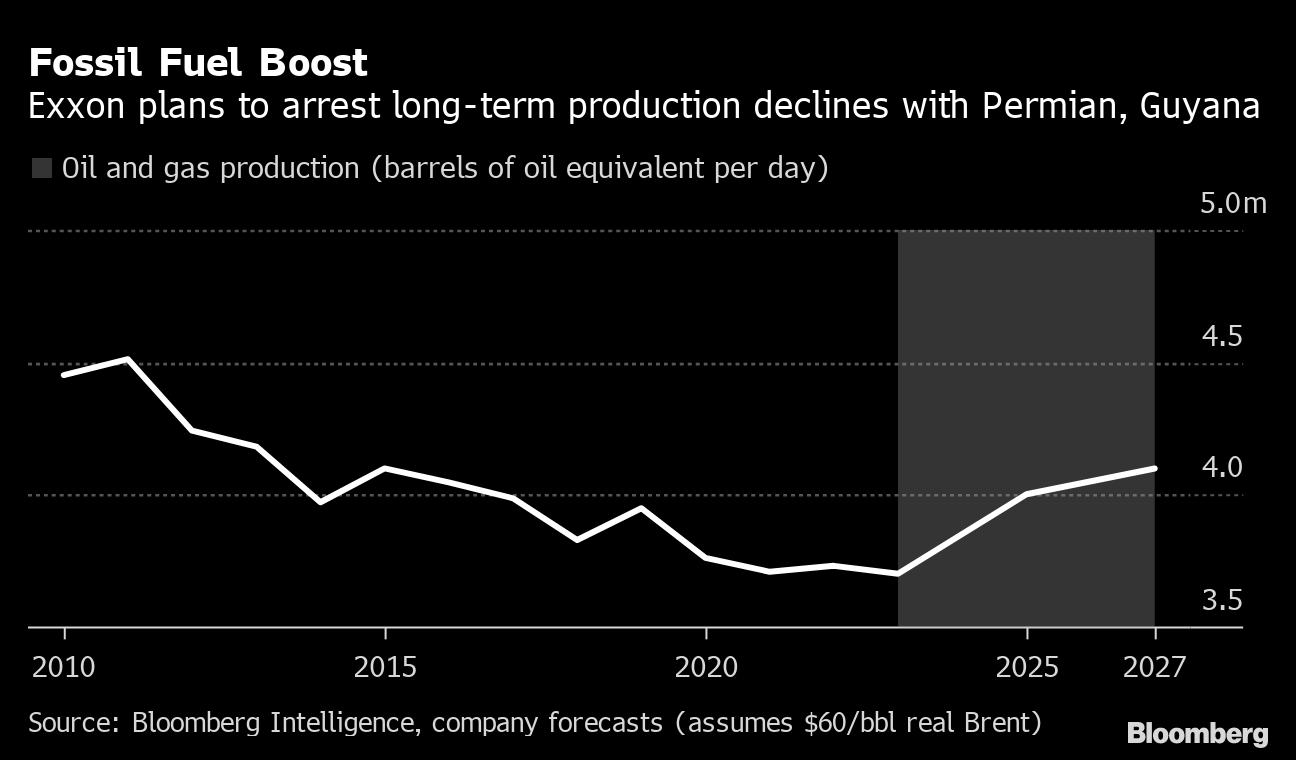

There are also signs that Wall Street, after a long hiatus, is once again keen to see oil explorers increasing crude output. Chevron executives faced multiple questions about growth plans last week, and several analysts noted their disappointment at the California-based company’s outlook for a flat-to-3% increase this year. A slowdown in Chevron’s Permian Basin annual growth to 10% probably will be an “overhang” on the stock, Cowen & Co. said in a note to clients.

That said, Exxon has less reason to be concerned about when it comes to growth than some of its peers. The company has a “differentiated upstream project queue” that should increase return on capital over the coming years, Goldman Sachs wrote in a Jan. 20 note.

On a quarterly basis, Exxon surpassed expectations for the ninth time in 10 periods, posting adjusted fourth-quarter profit of $3.40 a share that was 10 cents higher than the median estimate by analysts in the Bloomberg Consensus.

The Texas oil giant has continued to invest in major projects in Guyana and the Permian region during the pandemic, which by Exxon’s own estimates should have the knock-on effect of driving production to the equivalent of more than 4 million barrels a day by 2027, up about 8% from current levels.

Alongside fossil-fuel growth, Exxon plans to ramp up spending on clean-energy investments by focusing on carbon capture, hydrogen and biofuels. The company cited the Biden administration’s Inflation Reduction Act as a key policy pillar that improves profitability of decarbonizing existing operations, but has said that more government support is needed for big projects such as its proposal to capture emissions from industrial facilities along the Houston Ship Channel.

(Updates share-price move in second paragraph, CFO’s comment in seventh paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens