Shale-Oil Drilling Is Getting Cheaper as Demand Outlook Weakens

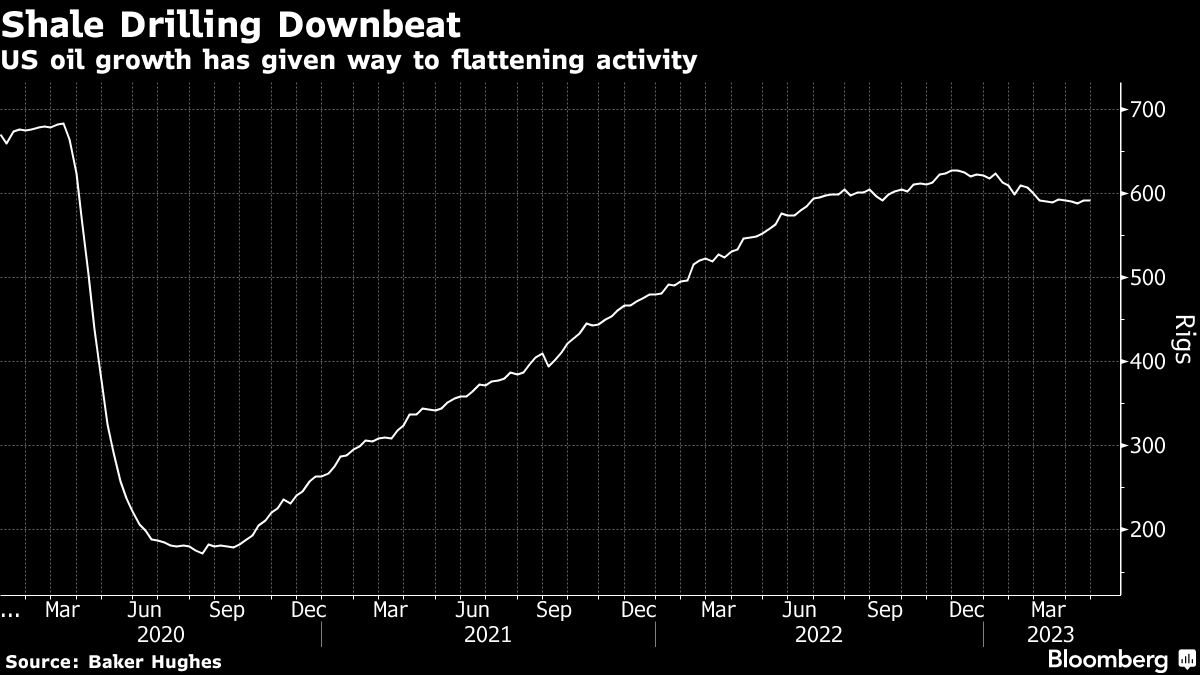

(Bloomberg) -- The cost of drilling for shale oil is dropping for the first time in about two years as demand for equipment and workers wavers.

Prices for key oilfield inputs such as steel pipe and fracking crews are softening, according to executives from shale specialists such as Diamondback Energy Inc. and Marathon Oil Corp. The timing is problematic, however, after US crude prices posted their worst start to the year since the lockdowns of early 2020, raising doubts about the wisdom of adding more oil supplies to global markets.

Some of the price relief for shale-oil explorers has been driven by a deep depression in natural gas markets that is spurring companies to suspend or cancel drilling, freeing up rigs to migrate to more-profitable crude projects.

“It is a cost deflation,” Diamondback Chief Executive Officer Travis Stice said this week, citing a $25-a-foot drop in the cost of steel pipe as an example.

At the same time, oilfield-service providers like Halliburton Co. are pushing back, pledging to mothball equipment rather than see their fees shrink. Halliburton and fellow oilfield titan SLB have been among this year’s worst-performing energy stocks in the S&P 500 Index.

“This is the first real test that the service companies have faced this cycle,” J. David Anderson, an analyst at Barclays Capital Inc., said during a phone interview. “Can service companies hold the line here?”

Analysts and investors will be listening for additional insights into oilfield costs when one of the most-closely watched shale drillers — EOG Resources Inc. — hosts a conference call scheduled for 10 a.m. New York time.

Even before this year’s 15% slump in benchmark US oil prices, shale drillers were exercising restraint in expanding output. Rewarding investors with dividend increases and share buybacks took precedence over production growth for the first time in the industry’s young life.

That has left oilfield-service executives with the tricky choice of holding the line on pricing or discounting to retain customers and market share.

“The energy market in North America is in a state of flux, with mixed opinions and perspectives among oilfield services companies,” James West, an analyst at Evercore, wrote in a note to clients. Some oilfield contractors are offering discounts to ensure their fleets remain employed “while others are increasing pricing or remaining firm on pricing.”

Helmerich & Payne Inc., the biggest provider of rigs in the Permian Basin, is idling equipment rather than reducing fees.

Rig leases account for about 15% of drilling a new well, so lowering the fee doesn’t guarantee the equipment will be used, according to Helmerich CFO Mark Smith. Rather, price concessions are broadly detrimental to rig owners because they put downward pressure on rents come contract-renewal time, he said.

“Pricing is so easy to give up and so hard to get back,” Barclays’ Anderson said.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens