Russia Oil, Gas Revenue Falls on Higher Fuel Subsidies

(Bloomberg) -- The Russian government’s oil and natural gas revenue sank in August as subsidies to the nation’s refiners offset a surge in crude prices and a weaker ruble.

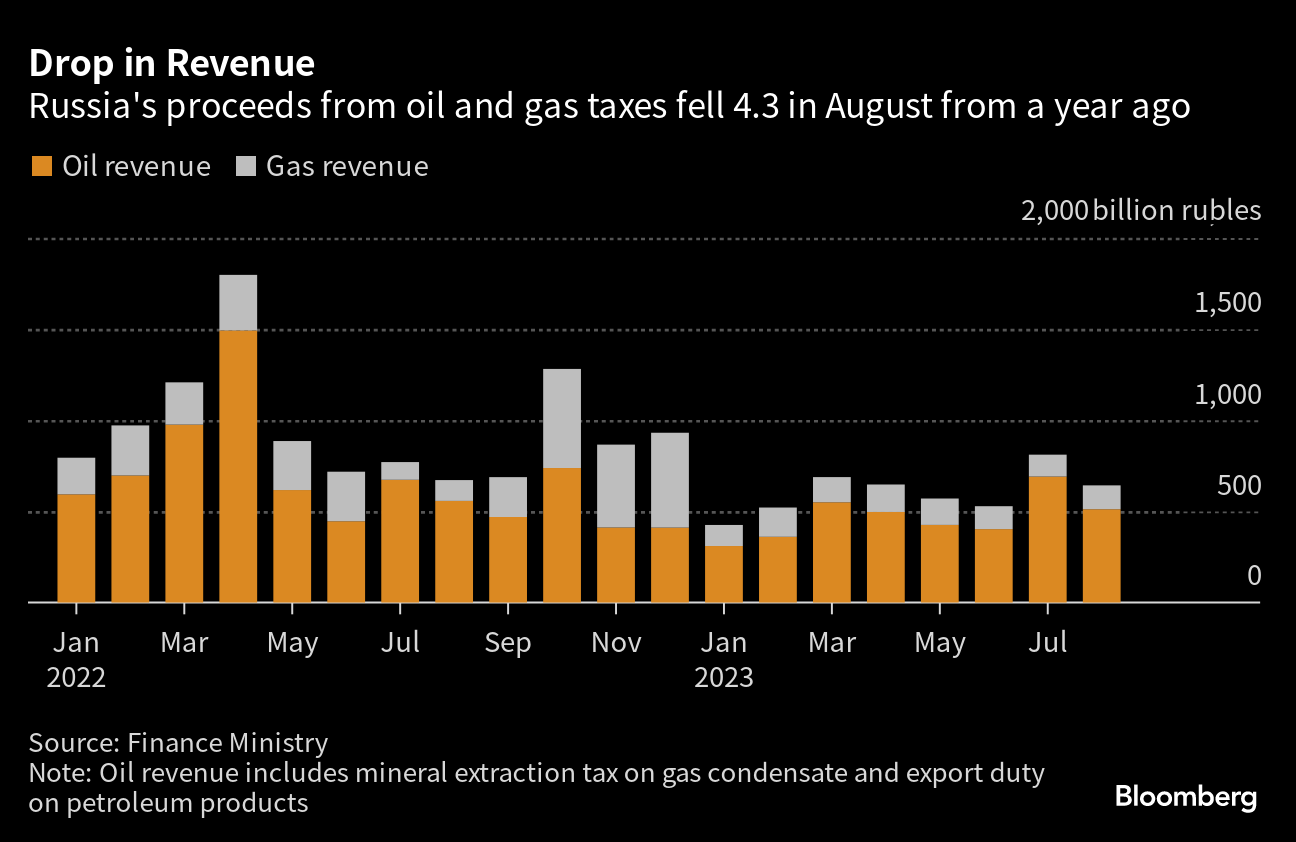

Budget proceeds from oil and gas fell 4.3% from a year ago to 642.7 billion rubles ($6.6 billion), the Finance Ministry said in a statement on Tuesday. Without the significant increase in subsidy payouts to fuel producers last month, the nation’s proceeds from hydrocarbons would have grown on annual basis, as they did in July, according to Bloomberg calculations.

Russia’s oil and gas industry, which accounts for around a third of the country’s government revenue, has been under pressure amid the Kremlin’s war in Ukraine and subsequent Western sanctions. The Group of Seven industrialized nations imposed a price cap on Russian crude and products to limit the inflow of petrodollars and Moscow’s ability to finance its military aggression.

International oil benchmark Brent crude surged above $89 a barrel on Monday, the highest this year, as OPEC+ partners Saudi Arabia and Russia restrict supplies in an effort to bolster prices. Key consumer China has also intensified efforts to strengthen its economy, boosting optimism about the strength of demand.

Last month, Russia’s Urals crude blend averaged $74 a barrel, exceeding the G-7’s $60 price cap for the second consecutive month. Its discount to Brent narrowed to $12.20 a barrel, less than half the level seen in April.

A sharp depreciation of the ruble has also helped boost oil sales, which are denominated in foreign currencies. Last month, the exchange rate to the US currency averaged 95.5 rubles, compared with 60.3 rubles a year earlier. When the Russian currency declines by just one ruble, that amounts to an additional 100 billion-120 billion rubles in budget revenue, adjusted for a 12-month period, according to Bloomberg Economics Russia economist Alexander Isakov.

Taxes on crude and crude and petroleum products — which accounted for almost 80% of the country’s hydrocarbon revenues last month — fell to 511.9 billion rubles, according to Bloomberg calculations. The drop follows subsidies of 185.9 billion rubles to producers of diesel and gasoline for the domestic market supplies, in addition to tax reimbursements and payments for refinery modernization.

Gas revenue rose 14.5% in August from a year ago, to 130.9 billion rubles. The boost came from the gas-extraction tax, which reached 91.1 billion rubles amid a temporary increase in the duty paid by Gazprom PJSC of 50 billion rubles per month from 2023 to 2025.

(Corrects composition of subsidy payment in penultimate paragraph)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

BP’s Strategy Reset: Five Things to Watch as Elliott Circles

Carbon Credits Needed for Hard to Curb Emissions, Woodside Says

Esso, Mitsui, and Woodside commit nearly $200 million to Gippsland Basin gas expansion

US Considering Scrapping Multibillion-Dollar Power Auctions

Tokyo Gas to Sell US Shale Stake Amid Activist Elliott Scrutiny

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs