UK Energy Industry Pushes to Link With Europe’s Carbon Market

(Bloomberg) -- The UK risks missing out on as much as £8 billion ($10.2 billion) of revenue over the next five years if it stays outside the European Union’s carbon market, according to a study backed by some of the nation’s key power producers.

Linking the two emissions trading systems would raise the price of Britain’s carbon allowances, boosting government income, said the report by Frontier Economics and commissioned by firms including National Grid Plc, Centrica Plc, and Drax Group Plc. But it could also increase power prices for UK consumers and earnings for generators.

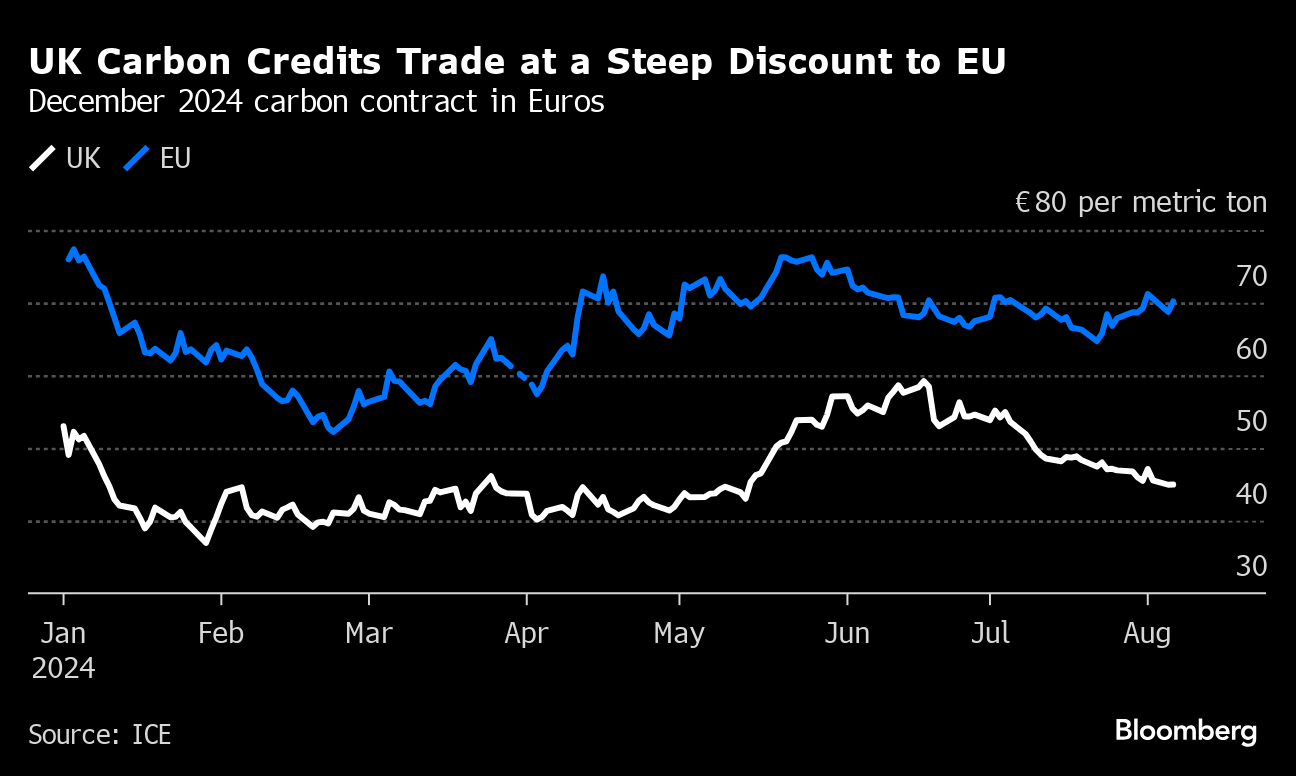

It’s an important issue for traders too. UK allowances are currently trading at a 36% discount to the EU and prices are likely to jump on an indication from government that linking the systems will happen.

British industry operated under the EU emissions trading system until the UK left the bloc and set up its own similar, but separate system. Companies are pushing the idea of reintegration as Britain’s new Labour government — seen as more friendly to the EU than its Conservative predecessors — sets its agenda.

The firms are also keen to see changes before some EU rules take effect, such as a tax on carbon-intensive imports from 2026. Both the UK and EU are seeking to lower emissions to meet net zero goals while keeping costs low as the region recovers from an energy crisis.

Price convergence from linking the markets can help “can support efficient UK-EU trade and reduce the costs to both the UK and EU of meeting decarbonisation goals,” said the report, which was also backed by Equinor ASA, SSE Plc and Uniper SE.

Officials from the UK Treasury and Department for Energy Security and Net Zero didn’t respond to a request for comment.

©2024 Bloomberg L.P.