EU Gas Firms Seek Ukraine Transit as Time Runs Out for Deal

(Bloomberg) -- Key companies from central Europe are pushing for a deal that will allow the continued transit of gas through Ukraine next year, as time runs out to avoid an interruption of supplies that could trigger price spikes.

Slovakia’s SPP and its gas network operator, Eustream AS, as well as Hungary’s MOL Hungarian Oil and Gas Plc and MVM Zrt are among companies that have signed a declaration supporting continuation of the transit. Signatories also include trade associations and large industrial customers from Hungary, Austria, Italy and Slovakia, according to an SPP statement.

“We will present the declaration to the President of the European Commission, Ursula von der Leyen, so that she has first-hand information about the threat to energy and economic security in our region,” SPP Chairman of the Board and Chief Executive Officer Vojtech Ferencz said.

The move puts the commission, the EU’s executive, front and center as it seeks to phase out Russian fossil fuels. For central European countries that traditionally rely on gas from Moscow, the energy crisis that followed the Kremlin’s invasion of Ukraine is still a fresh memory.

Europe Can’t Seem to Kick Its Russian Energy Habit: QuickTake

Talks have been ongoing for months to keep the transit alive, with buyers now stepping up pressure. The crucial question will be whether Russia and Ukraine can agree terms that are acceptable to both sides as tensions deepen.

“The Commission has no interest in the continuation of Russian gas transit via Ukraine,” the EU executive said via email, echoing previous statements it has made publicly. “The EU is prepared for the end of the transit and alternatives are in place.”

Ukraine has said it won’t sign any contract for gas that comes from Russia but is otherwise open to talks if the EU requests continued transit.

Options have included intermediates moving gas via Ukraine, sparking concerns that Russian gas will still be used in the mix.

Slovakia, the biggest remaining buyer of Russian gas from the Ukraine route, has been leading efforts to aggregate support for continued transit. The nation aims to have a deal by the end of the year as talks are under way with several partners who would be able to deliver and transit the fuel, Slovakian Deputy Prime Minister Denisa Sakova said Monday.

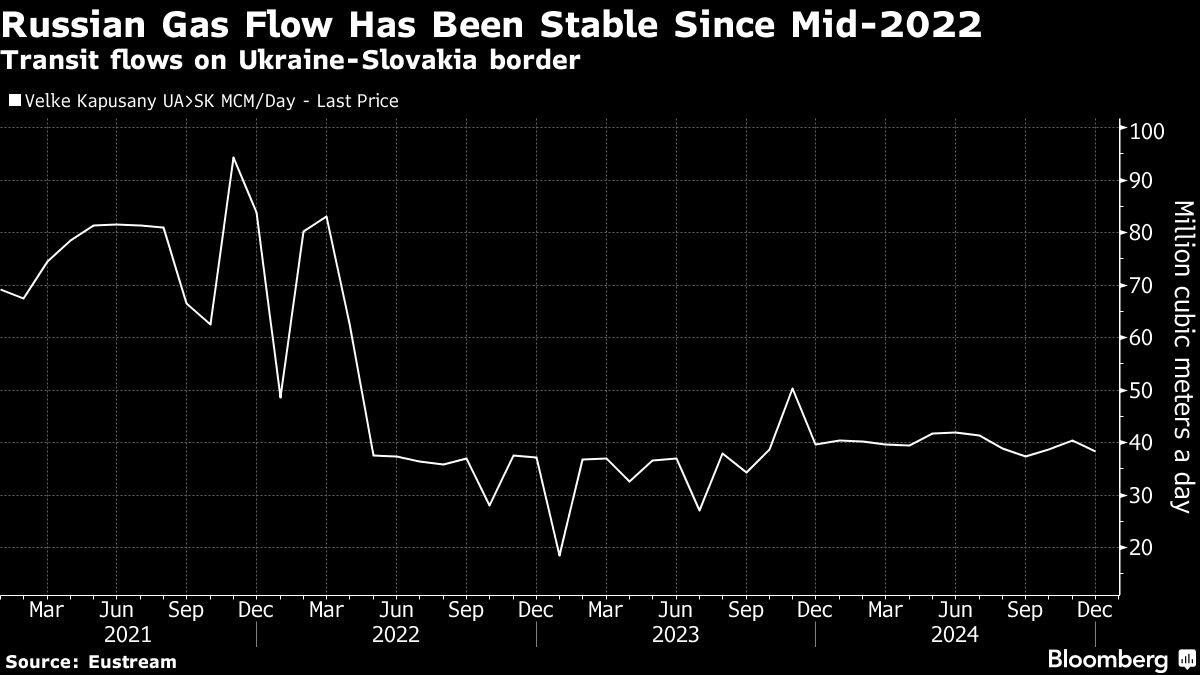

The volume being discussed is 15 billion cubic meters a year, the amount that currently moves along Ukrainian pipelines. European gas prices have been volatile amid tight supplies, leaving the market vulnerable to any potential disruption in flows.

The “continuation of gas supply from the Ukrainian side will contribute to keeping gas prices low and help support the competitiveness of industries,” the companies said in their joint declaration.

‘Significant’ Damage

The region may “suffer significant economic damage in the near future” without the transit deal, SPP said in its statement, noting that a in the flow would cost Slovakia more than €220 million ($231 million) to purchase and transit gas from another source.

For Ukraine, the ceased transit would “lead to irreversible damage to the Ukrainian gas infrastructure,” it added.

However, the commission has said the end of gas flows through Ukraine will have a “negligible” impact on European gas prices, noting that the end of the transit deal has already been priced into the region’s markets.

While Europe as a whole moved to reduce dependency on Russian gas, landlocked nations in the eastern portion of the bloc depend on cheaper Russian supplies, as alternatives such as liquefied natural gas imports via Germany would be costly.

“The interruption of natural gas supplies through Ukraine will naturally also result in an increase in its prices on the markets,” SPP’s Ferencz said in the statement . “In addition, if a cold winter comes, this situation can cause a shortage of gas and problems with its supplies throughout Europe.”

(Updates with additional details from third paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens