Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

(Bloomberg) -- The future of Oman’s next liquefied natural gas production facility hinges on private investments from some of the world’s biggest energy companies.

Oman’s economy relies heavily on oil and gas production and increasing its exports would bolster its strained finances. But the government is no longer willing to provide state funds and future projects must be financially viable on their own.

To gauge interest, the Ministry of Energy and Minerals will open discussions with companies that produce gas in Oman, including BP Plc, Shell Plc and TotalEnergies SE in the first quarter of next year, Energy Minister Salim Al-Aufi said in an interview on Wednesday.

“If we are unable to get enough gas suppliers participating, then the whole project will be canceled,” he said. “It all depends on being able to secure — without government intervention — the gas feedstock to the fourth train. If we are unable to secure the gas feedstock, then we call it a day.”

Oman’s public finances have long been among the weakest in the Gulf region. Since taking power in January 2020, Sultan Haitham bin Tariq has taken measures to balance the finances that took a hit during the pandemic, and its credit rating has improved in the past few years.

The government holds majority stakes in the country’s three operational LNG production facilities, alongside minority investors including international oil companies and large gas buyers. However, only companies that can commit gas supplies to the plant would be eligible to take an equity stake in Oman’s fourth LNG train.

“Anyone who’s producing gas and thinks they can monetize it as LNG, they’re welcome to talk to us,” said Al-Aufi. “But if you are not a gas producer and don’t have gas equity then there is no discussion really at this stage.”

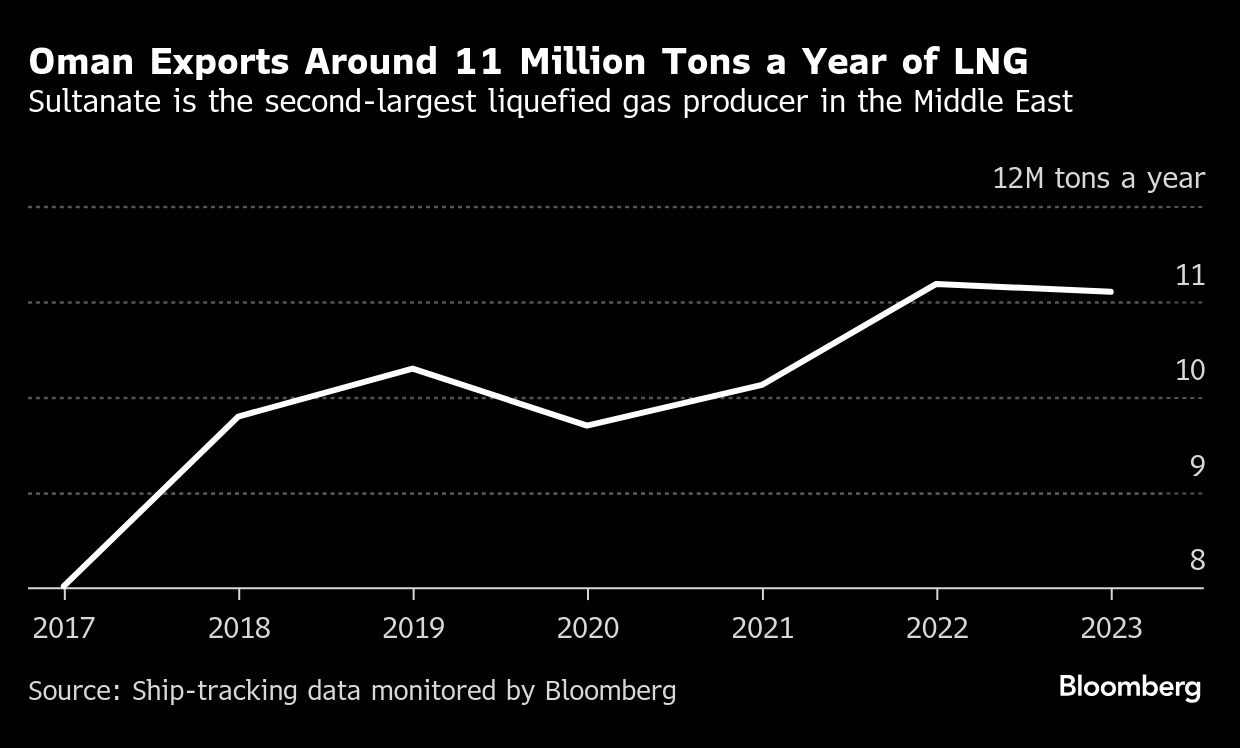

Oman is carrying out a study for the 3.8-million-ton-per-year train near existing facilities in Qalhat. If it comes online, the nation’s LNG production capacity would rise to 15.2 million tons a year.

Oman is the second-largest LNG exporter in the Middle East, but produces just a fraction of the volumes regional leader Qatar sends out.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Booming Power Demand Means Longer Wait for GE Vernova Customers

US Widens Sanctions on Iran to Target Lucrative Gas Exports

China Stops Imports of US LNG Amid Trade War, Custom Data Shows

China’s Shipowners Seek to Continue Talks With US on Levies

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps

Uniper and Woodside sign LNG supply agreements

Vista Buys Petronas’ Argentina Oil Stake in $1.5 Billion Deal

Emerson launches Global LNG Solutions Centre in Qatar