Russia’s Crude Exports Slump to the Lowest in 11 Months

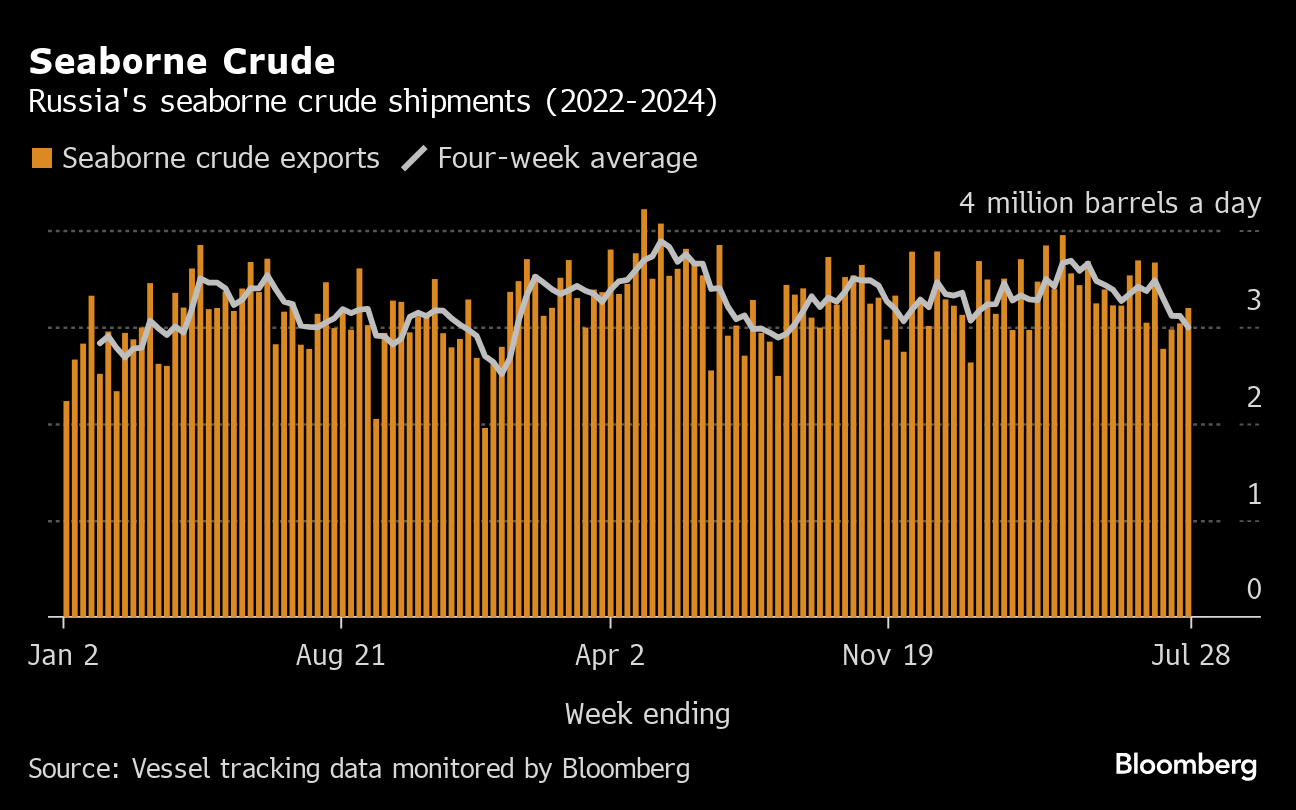

(Bloomberg) -- Russia’s four-week average crude exports dropped to the lowest since late August of last year amid a plunge that’s cut 710,000 barrels a day from the recent peak in April. The slump comes despite a small increase in weekly flows.

The decline — the fourth straight — likely stems from Russia’s improving compliance with an OPEC+ output target, coupled with a recovery in domestic refining. Moscow plans to make extra production cuts later this year and during the warmer months of 2025 to compensate for pumping above its quota, set by the group, earlier this year. Meanwhile, refinery runs are edging closer to a six-month high in July. A Ukrainian drone attack on July 22 caused a fire at Rosneft’s Tuapse refinery, but didn’t stop the plant from running.

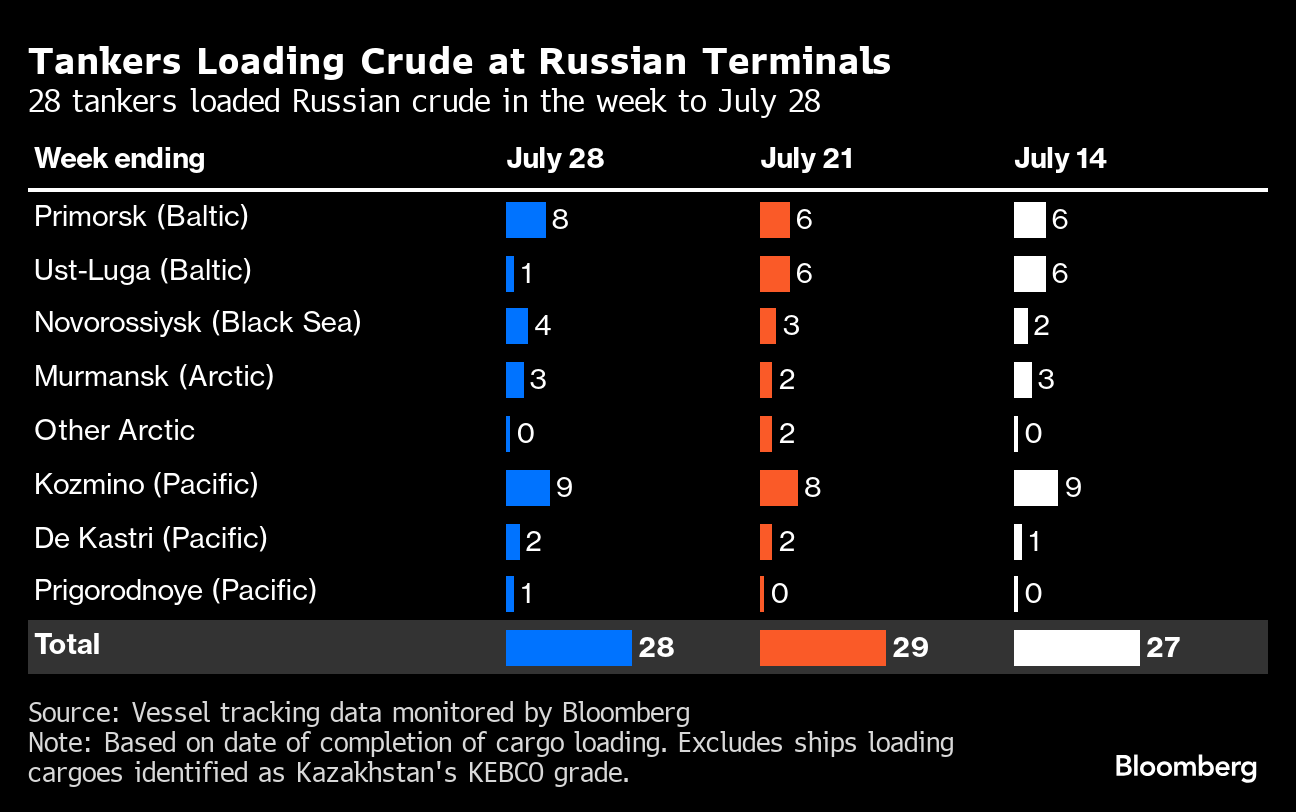

A five-day gap in the loading program for Ust-Luga, covering most of the past week, suggests that maintenance cut into flows from the port, with just a single tanker leaving in the seven days to July 28. Shipments from Baltic ports fell below 1 million barrels a day, equaling their lowest since December 2022. But the drop was offset by an increase in shipments from other terminals.

Separately, Ukraine has toughened sanctions on Russia’s Lukoil PJSC, preventing it from supplying piped crude to refineries in Central Europe across Ukrainian territory. Lukoil will divert about 90,000 barrels a day of crude that it is unable to deliver to Hungary and Slovakia to other destinations. Two late-July Lukoil cargoes have been added to the loading program from Primorsk, also on the Baltic.

A fourth sanctioned Russian tanker has now loaded a cargo. The Viktor Bakaev left Primorsk on July 21 and is now heading for the Northern Sea Route to China. All three of the other designated vessels that have hauled Russian crude subsequently switched their cargoes onto other ships while obscuring their positions from automated tracking systems. The first barrels have now been offloaded in China, according to TankerTrackers.com Inc., which specializes in detecting secretive cargo movements. The other two appear to have been transferred onto the supertanker Oxis in the Gulf of Oman and area now heading through the Strait of Malacca.

Sanctions are increasingly delaying or disrupting payments to and from places like China, India and Turkey. That’s making it difficult, and sometimes impossible, to execute transactions, particularly with China.

Crude Shipments

A total of 28 tankers loaded 21.78 million barrels of Russian crude in the week to July 28, vessel-tracking data and port-agent reports show. The volume was up from a revised 21.24 million barrels on 29 ships the previous week, which included one of the Arctic Gates shuttle tankers that headed directly to China via the Northern Sea Route and another small tanker that loaded the first cargo in at least a year from the small oil field on Kolguyev Island.

It means Russia’s seaborne daily crude flows in the week to July 28 rose by about 75,000 barrels to 3.11 million, their third straight increase. But it wasn’t enough to reverse the continuing fall in the less volatile four-week average, which dropped by another 140,000 barrels a day to 2.97 million, its lowest since August 2023.

The Sakhalin Island terminal of Prigorodnoye saw its first crude shipment of the month. Only one of the shuttle tankers used by the Sakhalin 2 project appears to be operating normally. One other has been at a Chinese shipyard since mid-June and the third remains anchored off the export terminal after loading a partial cargo in late June.

Crude shipments so far this year are about 30,000 barrels a day below the average for the whole of 2023.

Russia terminated its export targets at the end of May, opting instead to restrict production, in line with its partners in the OPEC+ oil producers’ group. The country’s output target is set at 8.978 million barrels a day until the end of September, after which it is scheduled to rise at a rate of 39,000 barrels a day each month until September 2025, as long as market conditions allow.

Moscow has also pledged to make deeper output cuts in October and November this year, then between March and September of 2025, to compensate for pumping above its OPEC+ quota earlier this year.

One cargo of Kazakhstan’s KEBCO crude was loaded at Novorossiysk and one at Ust-Luga during the week.

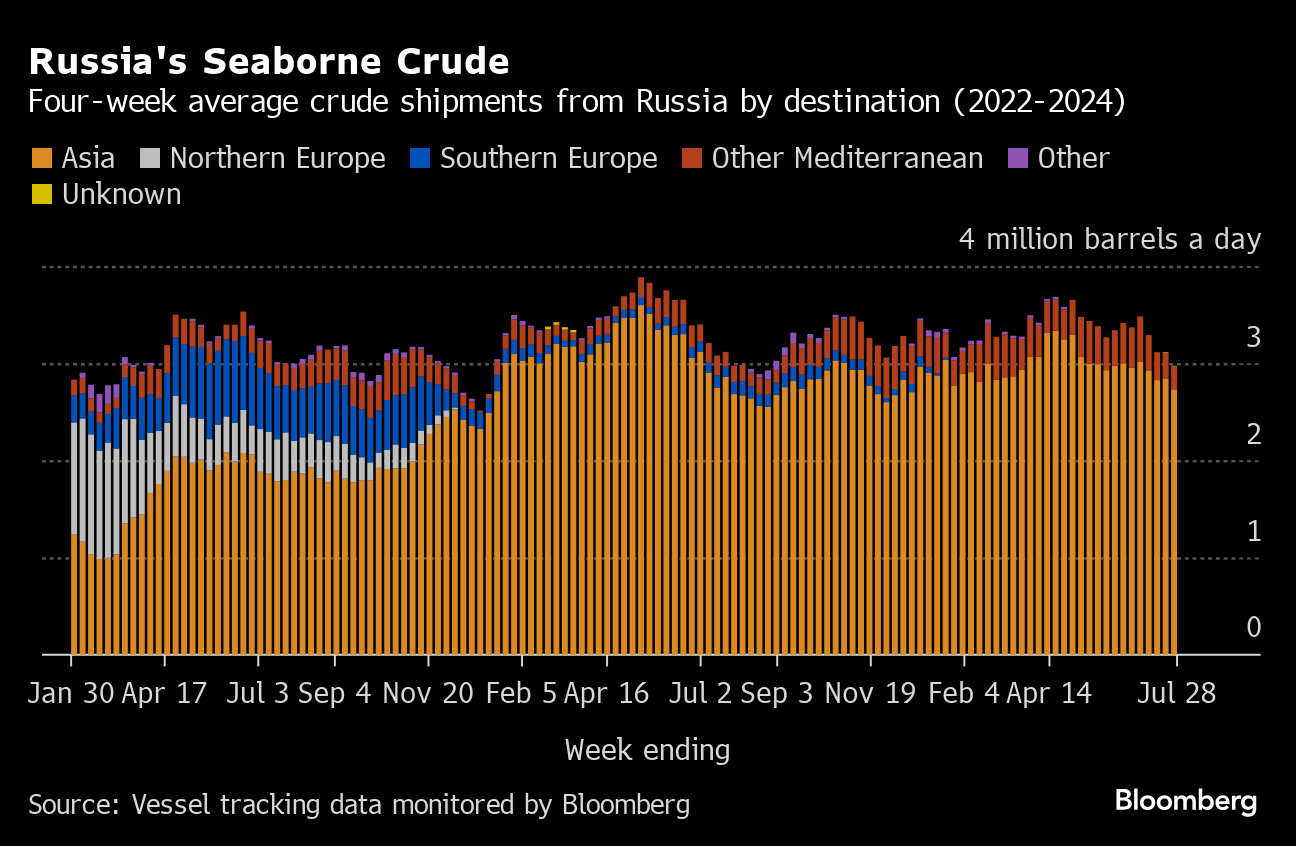

Flows by Destination

-

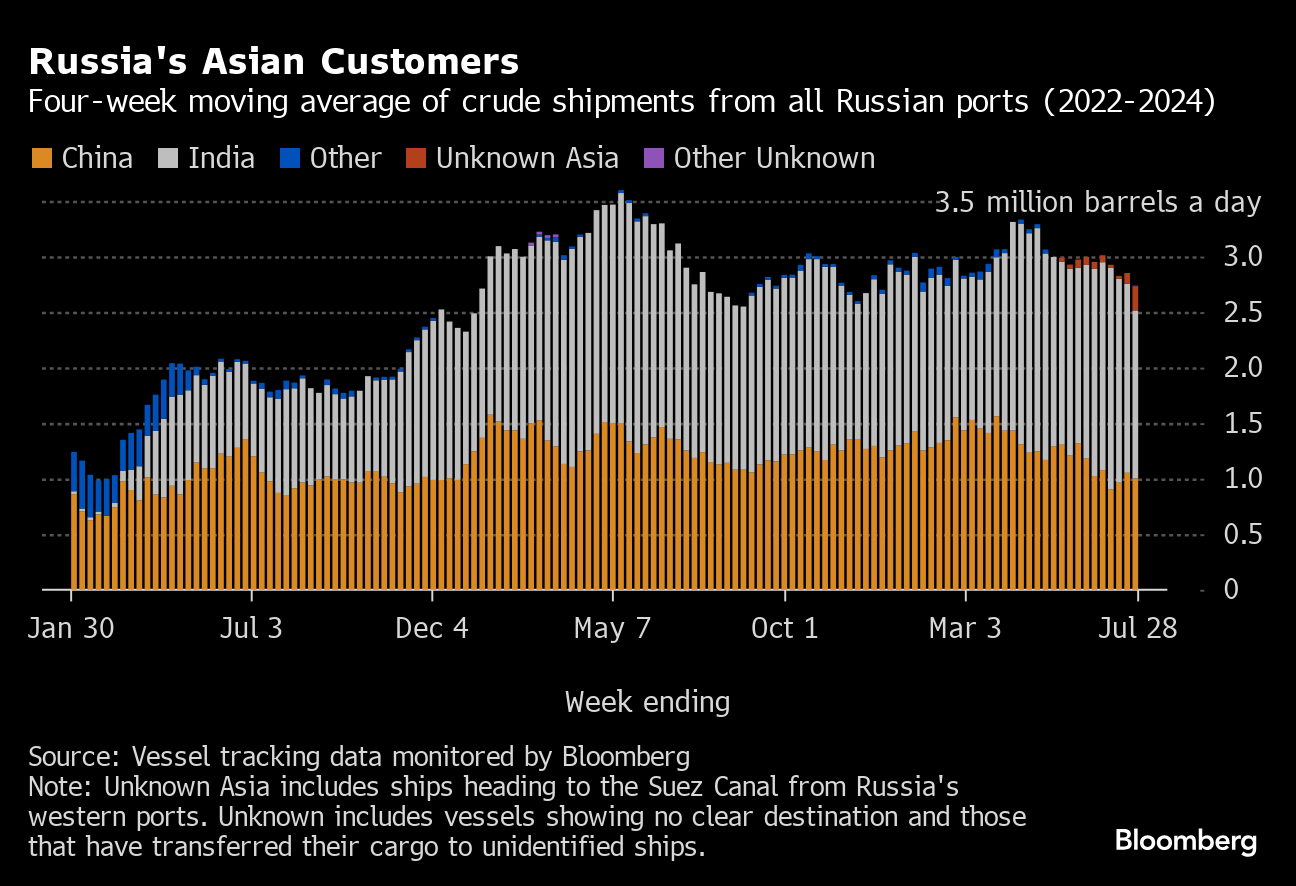

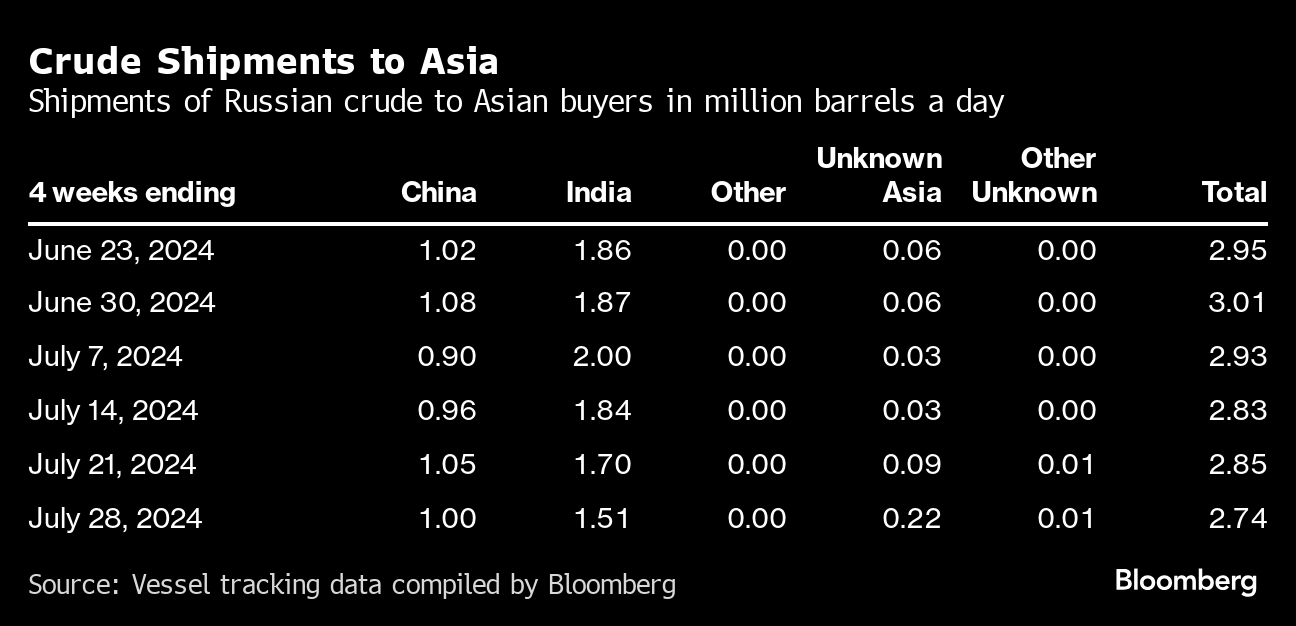

Asia

Observed shipments to Russia’s Asian customers, including those showing no final destination, fell to a seven-month low of 2.74 million barrels a day in the four weeks to July 28.

About 1 million barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged 1.51 million barrels a day, down from the revised figure of 1.7 million for the period to July 21.

Both the Chinese and Indian figures are likely to rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 220,000 barrels a day was on vessels signaling Port Said or Suez in Egypt. Those voyages typically end at ports in India or China and show up as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 10,000 barrels a day in the four weeks to July 28, are those on tankers showing no clear destination. Most originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others may be moved from one vessel to another, with the majority of such transfers now taking place in the Mediterranean, most recently off Morocco, or near Sohar in Oman.

Russia’s oil flows continue to be complicated by the Greek navy carrying out exercises in an area that’s become associated with the transfer of Russian crude. These naval drills have now been extended to Sep. 15.

-

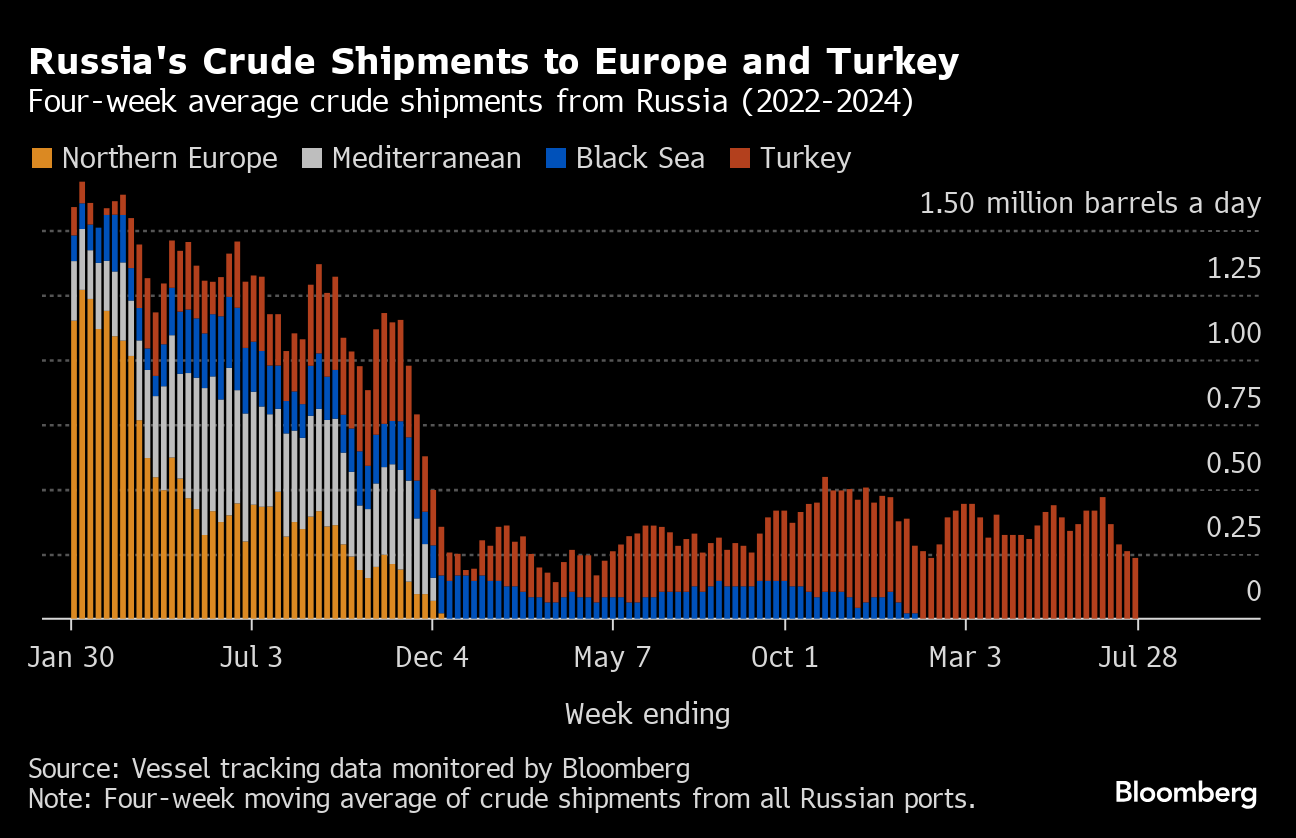

Europe and Turkey

Russia’s seaborne crude exports to European countries have ceased, with flows to Bulgaria halted at the end of last year. Moscow also lost about 500,000 barrels a day of pipeline exports to Poland and Germany at the start of 2023, when those countries stopped purchases.

Turkey is now the only short-haul market for shipments from Russia’s western ports, with flows in the 28 days to July 28 edging lower to about 235,000 barrels a day, their lowest since February.

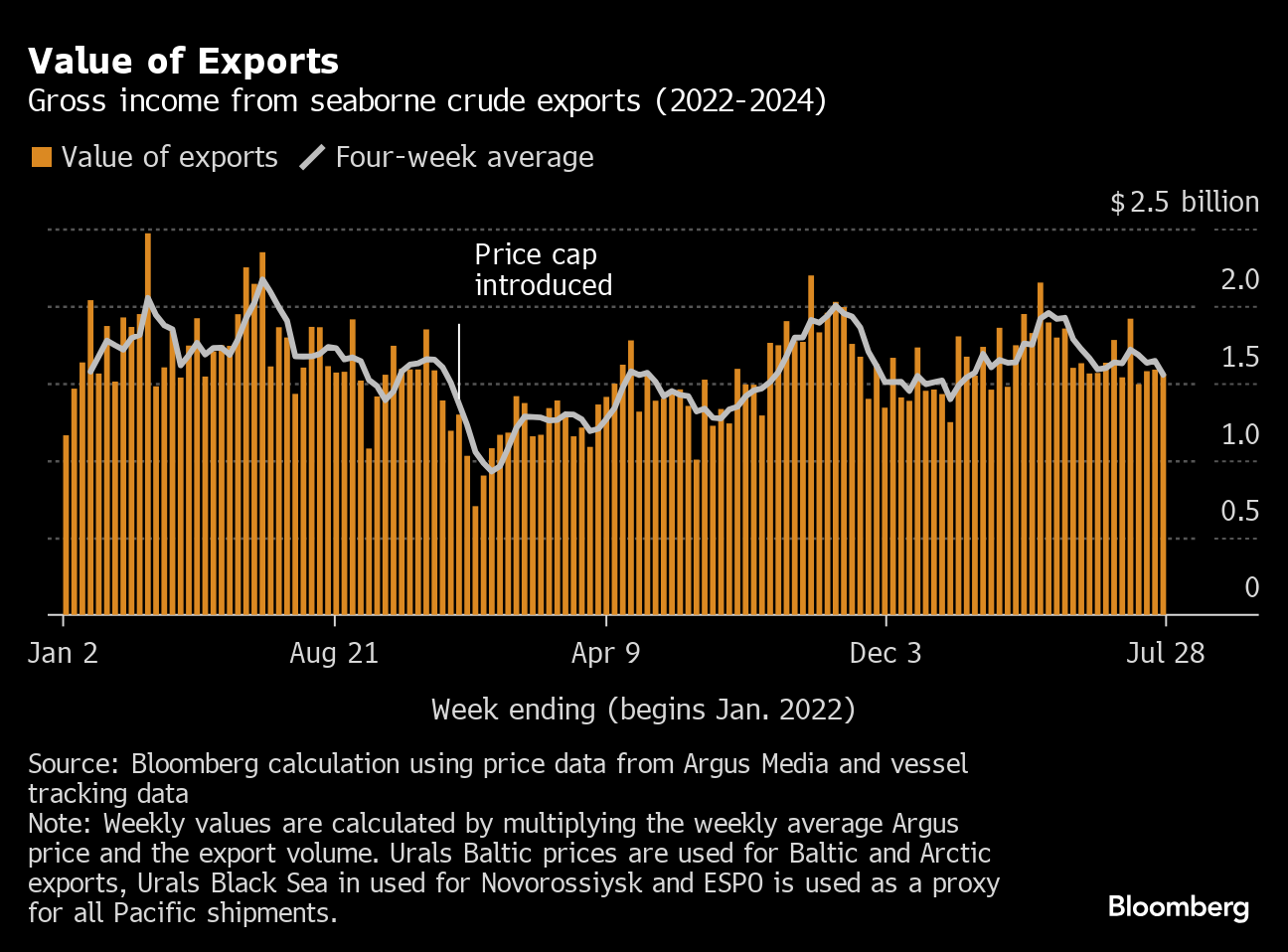

Export Value

The gross value of Russia’s crude exports fell back to $1.56 billion in the seven days to July 28, from a revised $1.59 billion in the period to July 21. The higher weekly flows were more than offset by a third weekly drop in prices for Russia’s major crude streams.

Export values at Baltic and Black Sea ports were down week-on-week by more than $3.50 a barrel, while key Pacific grade ESPO fell by about $3.10 a barrel. Delivered prices in India also dropped, down by about $3.60 a barrel, all according to numbers from Argus Media.

Four-week average income was also down, falling by about $90 million to $1.55 billion a week. The four-week average peak of $2.17 billion a week was reached in the period to June 19, 2022.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

NOTES

This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. The next update will be on Wednesday, Aug. 14.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and Ust-Luga and are not subject to European Union sanctions or a price cap. The Kazakh barrels are blended with crude of Russian origin to create a uniform export stream. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

If you are reading this story on the Bloomberg terminal, click for a link to a PDF file of four-week average flows from Russia to key destinations.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens