Sumitomo Looks to Tap US Shale Boom Despite Exiting Production

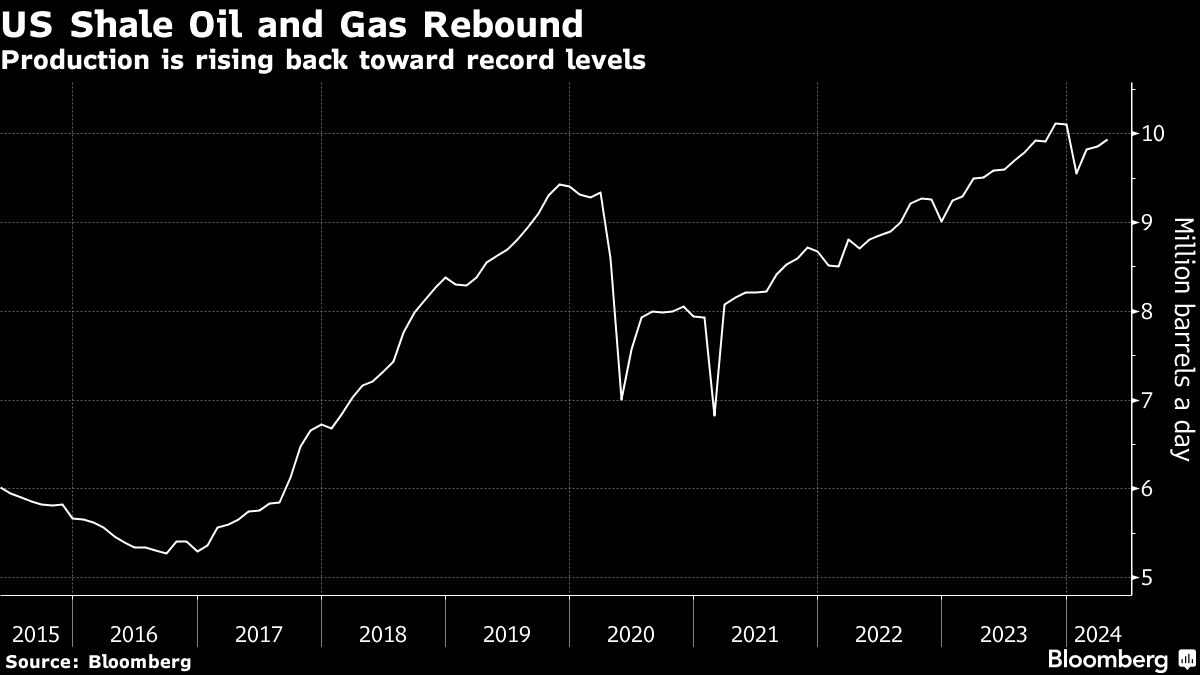

(Bloomberg) -- Japanese trading firm Sumitomo Corp. sees opportunities in US shale oil and natural gas despite exiting production there three years ago.

The company will seek to boost sales of pipelines used in US shale fields, Shingo Ueno, who became president in April, said in an interview. “Shale is perhaps one of the most important natural resources for the US,” the 64-year-old said, adding that Sumitomo will tap its strength in related businesses rather than return directly to output.

Sumitomo’s exit from US shale production contrasts with major energy companies including ConocoPhillips and Exxon Mobil Corp., which are making multibillion-dollar acquisitions in a bet that oil and gas demand will remain robust even as the world transitions away from fossil fuels. Japanese firms have joined the trend, with Mitsui & Co. last month buying a shale gas asset and Tokyo Gas Co. last year purchasing Rockcliff Energy for $2.7 billion.

Sumitomo — one of the opaque Japanese trading companies that Warren Buffett invested in at the start of this decade — was the first of the so-called “sogo shosha” to announce, in 2021, that it would no longer participate in new oil development projects. It aims to more than halve carbon emissions in its business by 2035 from 2019 levels.

While the company will push for renewable energy assets like offshore wind, Ueno said that natural gas will continue to play a role in the energy transition. “It will be physically and theoretically difficult to quit coal and gas altogether, and only use wind and solar,” he said, adding that countries in Southeast Asia will need liquefied natural gas as their economies grow.

Sumitomo last year bought a stake in Woodside Energy Group Ltd.’s Scarborough operation in Australia through a venture with Sojitz Corp., a fellow Japanese trading house. Sumitomo will consider stakes in other gas projects through that business, Ueno said.

The Japanese trading firm said in its latest midterm business plan that it will invest 1.8 trillion yen ($11.2 billion) over the next three years in business areas that it already has a competitive edge in, such as agriculture, real estate and construction equipment. The company will work on improvements at its troubled Ambatovy nickel project in Madagascar in the next six months to a year, and consider options including divestment after that, Ueno said.

Ueno declined to comment on conversations with investors, including Elliott Management Corp., which was said to have built a “large” stake.

“We think that the market has high expectations for us, and we’re hoping to use that as a fuel” to improve the company’s value, he said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

China May Exempt Some US Goods From Tariffs as Costs Rise

Spain Wants EU to Keep Methane Goals in Search for LNG Supplies

Booming Power Demand Means Longer Wait for GE Vernova Customers

US Widens Sanctions on Iran to Target Lucrative Gas Exports

China Stops Imports of US LNG Amid Trade War, Custom Data Shows

China’s Shipowners Seek to Continue Talks With US on Levies

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps

Uniper and Woodside sign LNG supply agreements