Woodside to Buy Tellurian in $900 Million Bet on Gas Demand

(Bloomberg) -- Woodside Energy Group Ltd. has agreed to buy troubled US liquefied natural gas export project developer Tellurian Inc. for about $900 million in a bet on rapid growth in global demand for the fuel.

Australia’s biggest oil and gas producer will pay about $1 a share in cash to take full control of Tellurian, including the proposed US Gulf Coast Driftwood LNG project, it said Monday. Woodside’s shares fell 2.1% in Sydney, their biggest one-day drop since May 1.

Woodside has been one of the most vocal energy companies in arguing that more gas will be needed to complement the expansion of intermittent renewable energy sources. It has been on the hunt for potential US LNG investments to help expand its supply portfolio and Driftwood is just one of the handful that haven’t been affected by President Joe Biden’s pause on approvals in January.

“The acquisition of Tellurian and its Driftwood LNG development opportunity positions Woodside to be a global LNG powerhouse,” Woodside Chief Executive Officer Meg O’Neill said. “A complementary US position would allow us to better serve customers globally and capture further marketing optimization opportunities across both the Atlantic and Pacific Basins.”

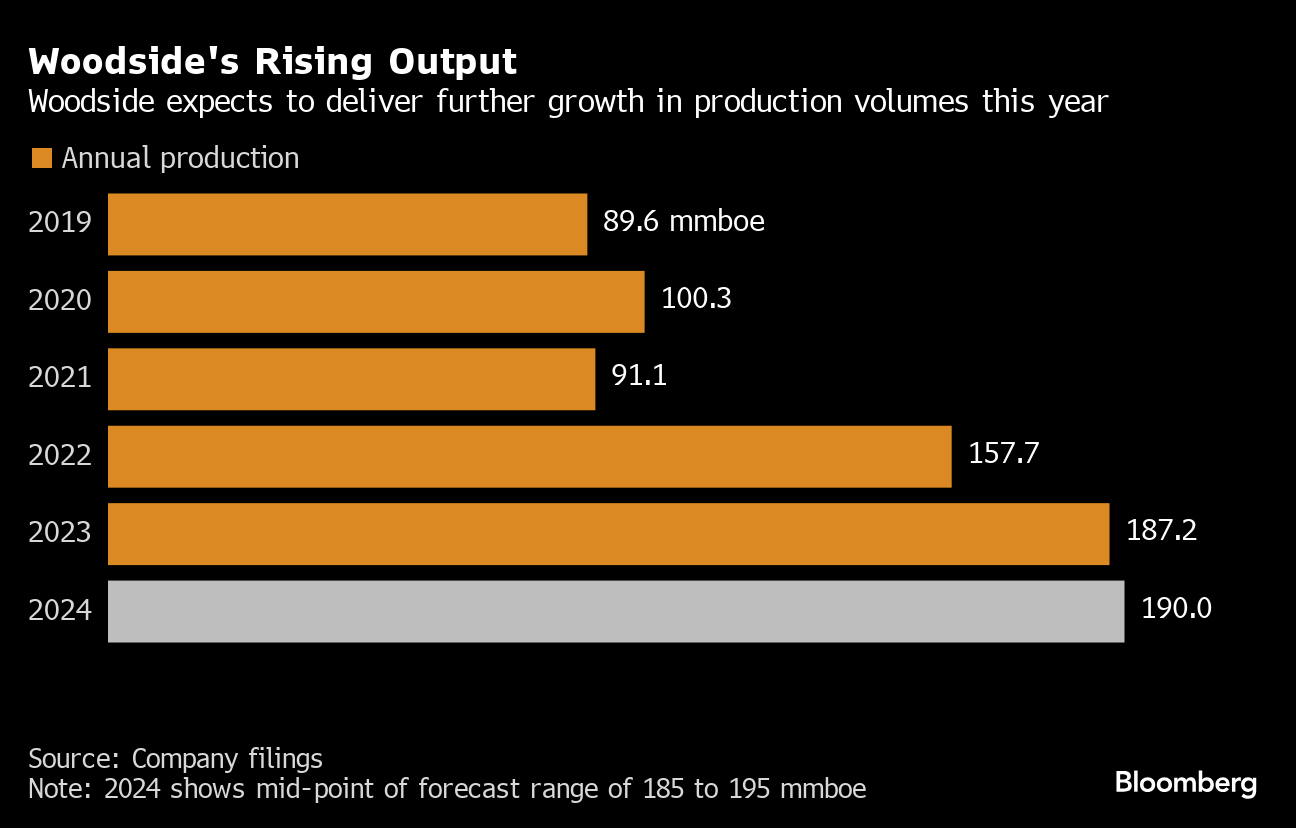

Woodside is targeting a final investment decision for the first phase of the Driftwood project from the first quarter of 2025. If all four phases are completed, the Louisiana facility would be able to export 27.6 million tons a year — almost triple Woodside’s current capacity and nearly 6% of the global total at the end of last year.

Tellurian has been struggling to bring the facility to fruition since its 2016 founding by LNG industry pioneer Charif Souki, who left in December amid his own personal bankruptcy proceedings. Martin Houston — another industry veteran who co-founded Tellurian and is its current chairman — has vowed to slash costs, and there had been earlier discussions to sell the business.

“Woodside stepping into Driftwood provides a high degree of certainty around the project,” Houston said in an interview.

Driftwood has differed from other US LNG projects by inking long-term contracts linked to Asian and European spot prices. That exposed importers to the volatile spot market and ultimately cost Tellurian a number of potential deals, including with a major Indian customer, Shell Plc and Vitol SA.

Woodside “can better take forward the project than Tellurian can,” said Saul Kavonic, an energy analyst at Sydney-based MST Marquee. The Australian company “can remedy marketing relationships, funding, and operator capability deficits. This is the kind of deal Woodside should be doing — where Woodside can enter cheaply and add value.”

US private equity gas driller Aethon Energy has a non-binding agreement to buy LNG from the Driftwood project, after earlier this year acquiring Tellurian’s upstream gas assets. President Gordon Huddleston said in an interview that the firm looks forward to working with Woodside.

Woodside has been exploring opportunities to boost exports. Earlier this year, it ended talks with smaller rival Santos Ltd. that would have made it one the biggest LNG producers in the Asia-Pacific region. The company expects to bring potential partners into the Driftwood project, and aims to sell about 50%, it said in a presentation.

O’Neill said on an analyst call that the company has already received interest to work together on US LNG. The transaction is expected to be completed in the fourth quarter.

(Updates with share price in second paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Trump Schedules Tariff Talks But Plans 104% Hit on China

Shell Cuts Gas Output Guidance on Unplanned Maintenance

China Halts US LNG Imports in Longest Run Since Last Trade War

Texas Attempt to Kickstart New Gas-Fired Power Is Stumbling

Brookfield to Buy Colonial Pipeline Owner in $9 Billion Deal

US Energy Chief Plans to Use Federal Land to Build Data Centers

Eni Is Said to Discuss €13 Billion Valuation for Plenitude

Ecopetrol Eyes Buying Carlyle’s Colombia Asset to Boost Reserves

Shell finalises acquisition of Pavilion Energy