Barclays CEO Says Bank Can’t Go ‘Cold Turkey’ on Oil Clients

(Bloomberg) -- The chief executive of Barclays Plc said it would be unrealistic for the bank to heed growing calls from climate activists for the finance industry to abandon fossil-fuel clients.

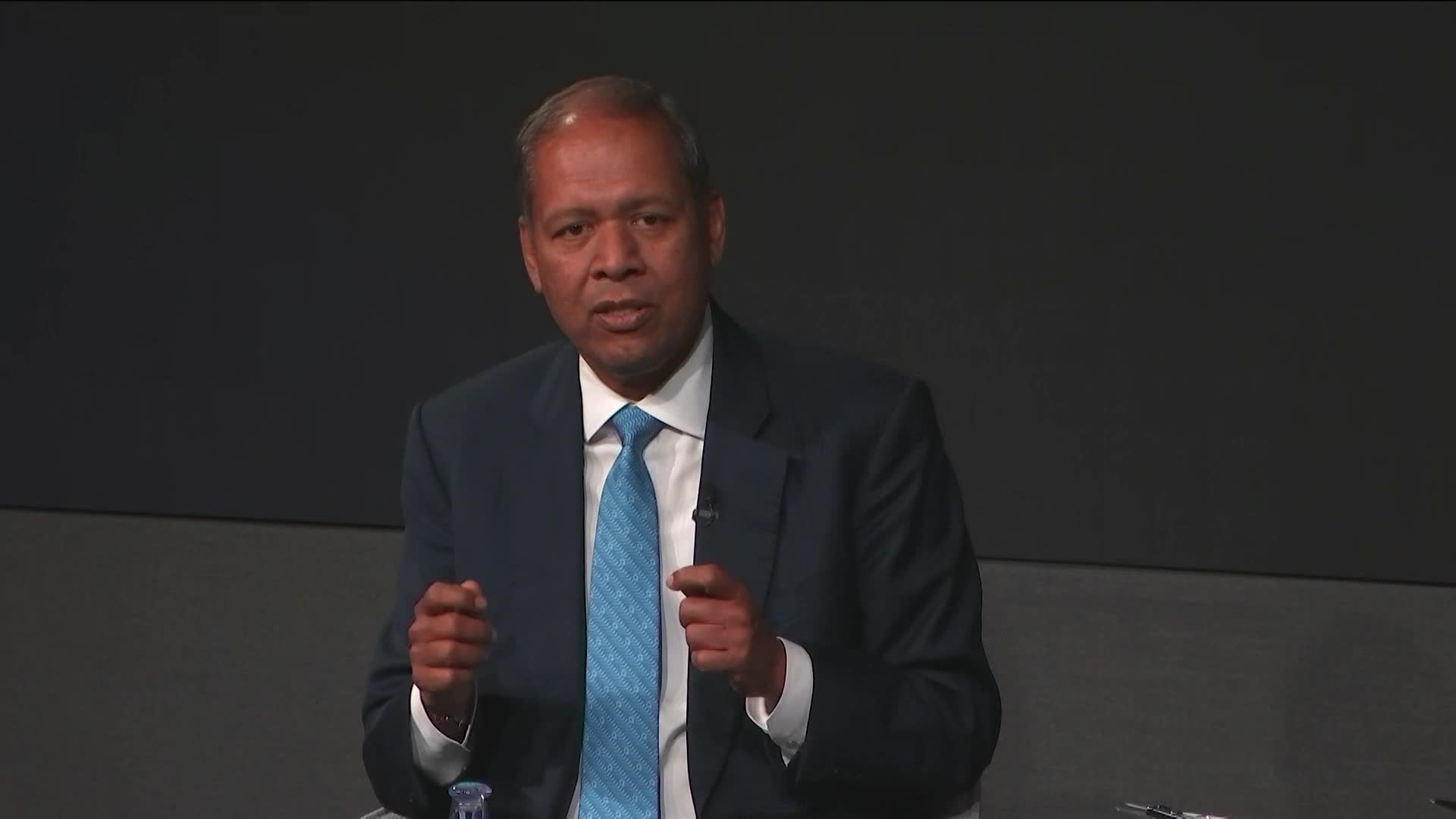

Banks “cannot go cold turkey” on the oil and gas industry, Barclays CEO CS Venkatakrishnan told Bloomberg’s Anna Edwards at the Bloomberg Sustainable Finance Forum in London on Tuesday.

While Barclays is “very much moving away from” coal and oil, the “reality is that for quite some time, fossil fuels will be with us” and that’s especially true of natural gas, he said. The “glide path” toward cleaner energy is long.

He joins a growing chorus of Wall Street CEOs from Citigroup Inc.’s Jane Fraser to JPMorgan Chase & Co.’s Jamie Dimon and Goldman Sachs Group Inc.’s David Solomon, who have all cautioned that a complete withdrawal from fossil fuels comes with unacceptable energy security risks. KKR & Co. founder Henry Kravis recently accused climate protesters of underestimating the scale of the transition needed.

Their warnings come as banks and asset managers find themselves at the receiving end of vocal — and sometimes violent — protests in response to their support of fossil fuels. A case in point is Citigroup, whose Manhattan headquarters are currently the target of what activists say will be a months-long campaign against the bank.

At the same time, banks face bans in a number of Republican-led US states due to their alleged “boycott” of the fossil fuel industry. Barclays, which has also been targeted in such campaigns, finds itself caught between two extremes, according to Venkatakrishnan.

As examples, the Barclays CEO cited a Texas ban that hit the bank’s municipal bond business. Not long after, Barclays found itself targeted by a number of UK universities, “saying they didn’t want to do business with us because we were not green enough,” he said.

Barclays is facing some “extremes” but the business “will manage,” Venkatakrishnan said. “It’s part of being a large, diversified bank.”

Barclays this year created a dedicated team of more than 100 bankers to focus on financial products and deals pegged to the energy transition. The unit, which brings together bankers from power markets, natural resources and sustainable and impact investment banking, is one of many being built across global banks all keen to get a foothold in what could become a multitrillion-dollar market.

Earlier this year, Barclays pledged to halt the direct financing of new oil and gas projects, and to restrict financing for companies that focus exclusively on fossil-fuel exploration and extraction. And like a number of its European peers, the UK bank is stepping up pressure on energy clients to adjust their business so they can be treated as transition assets.

“It’s a complicated world, and as a global bank, you’ve got to navigate that,” said Ilan Jacobs, managing director and head of UK government affairs at Citigroup, at the same forum.

“You have to support our clients through” the energy transition, he said. “And ultimately, these competing interests that you have to manage is stuff that we have to work on with our clients very closely.”

(Adds comment from Citigroup in final paragraphs.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens