How a Crack in a Pipe Caused Panic in Europe’s Gas Market

(Bloomberg) -- Urgent repairs to a pipe on a gas platform in Norway are underway but the event served as a grim reminder that small outages can send European prices soaring.

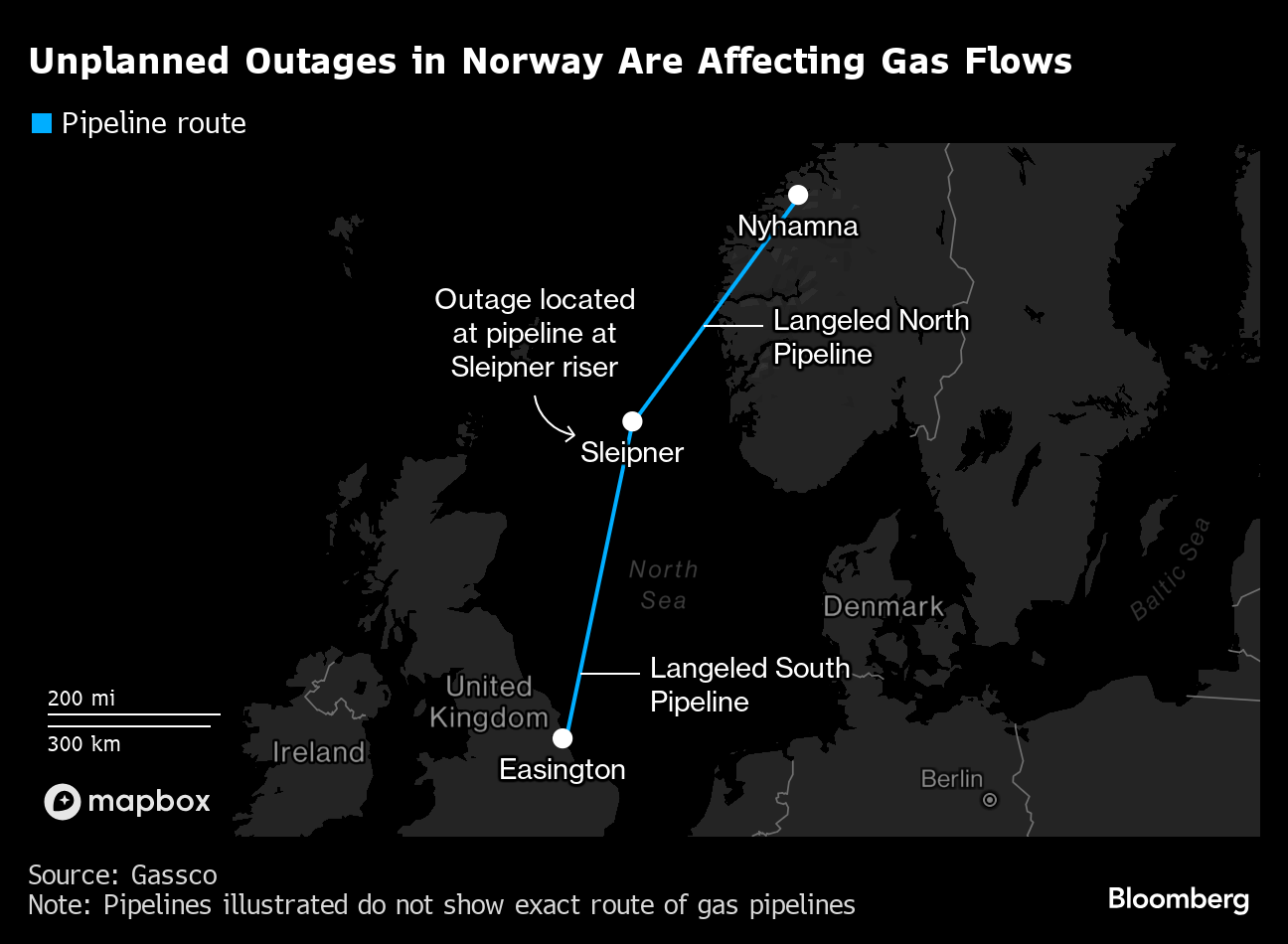

Helicopters carrying equipment and engineers have arrived at the Sleipner platform 250 kilometers (160 miles) off the coast of Norway to repair a small crack in a pipeline that’s the width of golf ball. The field’s riser platform is a key connection point in Europe’s gas network.

Prices jumped to the highest this year as Europe risked losing 20% of its Norwegian gas imports and traders began to grumble about the scant information available on the extent of the problem and how long it would last.

That an issue with such a small pipeline could cause such a big impact underscores the influence Norway now has on Europe’s energy security. The country is viewed as a steady trading partner with a long and consistent history of delivering energy to Europe, but its system for exporting gas is in the spotlight as never before. Questions swirl in the market about whether the age of a platform could prolong repairs, how a cautious safety culture could affect shutdowns and why there aren’t more workarounds to compensate for pinch points.

“Given the enlarged European reliance on Norway, any disruption is likely to have an out-sized impact on prices,” Adnan Dhanani, an analyst at RBC Europe Ltd.

The Sleipner R platform at the center of this week’s outage, operated by Equinor ASA, stands at the point where the 627-kilometer-long Langeled North pipe meets the 523-kilometer-long Langeled South. Together, these link the Nyhamna gas processing facility in central Norway with the Easington terminal near Hull in the UK, the entry point for a third of Britain’s total supply.

In other words, in order to avoid a buildup of pressure that can cause accidents like explosions, operations were stopped so that gas could not be processed at one end or delivered at the other.

A spokesperson for Gassco AS, the operator of Europe’s largest gas network, didn’t immediately respond to a request for comment about the market reaction.

“Together with our partners and Gassco we have for decades invested to maintain and upgrade our infrastructure,” Equinor spokesman Gisle Ledel Johannessen said. “Our data show long-term positive trends on technical condition, regularity and export capacity on our operated Norwegian continental shelf infrastructure, regardless of age.”

Prices rose as much as 13% on June 3 but retreated after it became clear that the repairs could be quickly carried out — highlighting extreme moves in Europe’s gas markets.

“The kind of price volatility that we did see despite seasonally record storage levels serves as a great anecdote on how much more tightness there is in Europe’s supply situation,” Christopher Kuplent, Bank of America Corp.’s head of European energy research, said. “Previously, it just wasn’t the case when Nord Stream and a few more pipelines from Russia were still full.”

The focus on safety is an integral part of the culture on Norway’s Continental Shelf. The collapse of the Alexander Kielland platform at the Ekofisk oil field in 1980 — an accident that killed 123 people — still lives in the memories of many Norwegians.

“Safe and efficient operations” is a phrase often repeated by Equinor’s executive vice president of production Kjetil Hove, who is a regular visitor offshore.

The age of Norway’s oil and gas infrastructure varies. Fields discovered early in the country’s oil and gas history in the late 1960s, such as Balder and Ekofisk, are still producing hydrocarbons. The Sleipner riser, connected by a long gangway to the main platform, went into use in 1993 and has a design life that extends until 2043.

“When facilities get closer to their design lifetime, they will require more attention,” said Alireza Nahvi, a gas analyst at BloombergNEF. “Aging infrastructure in Norway is a real issue and what we saw on Monday will happen more and more often, the increase in required maintenance and unexpected outages is going to be a theme.”

Still, of the more than 90 fields in operation today up and down the Norwegian continental shelf, more than half came on stream after 2000. All facilities are in good condition and held to strict safety standards, according to Gassco. But the North Sea is a punishing environment, and it is not uncommon for additional work to be discovered during scheduled maintenance.

Last summer, the Nyhamna processing plant was closed for an extended period after gas was found in a cooling system. The associated Ormen Lange and Aasta Hansteen fields also came to a halt during the extended maintenance period. The uncertainty created by these events can have had a severe impact on the region’s gas prices.

This time around, Norway ramped up exports of gas to St. Fergus in Scotland to make up for lost flows. The terminal is the only other point where gas from the Norwegian Continental Shelf can enter the UK network, and it can then be exported back to Europe.

The curbs at Nyhamna and Easington are expected to end June 8, according to a notice from the network operator.

(Updates with analyst comment in 11th paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Gazprom Refiner Gets Fresh Reprieve on US Sanctions, Vucic Says

China May Exempt Some US Goods From Tariffs as Costs Rise

Spain Wants EU to Keep Methane Goals in Search for LNG Supplies

Booming Power Demand Means Longer Wait for GE Vernova Customers

US Widens Sanctions on Iran to Target Lucrative Gas Exports

China Stops Imports of US LNG Amid Trade War, Custom Data Shows

China’s Shipowners Seek to Continue Talks With US on Levies

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps