China’s Steel Output Recovers as Market Responds to Stimulus

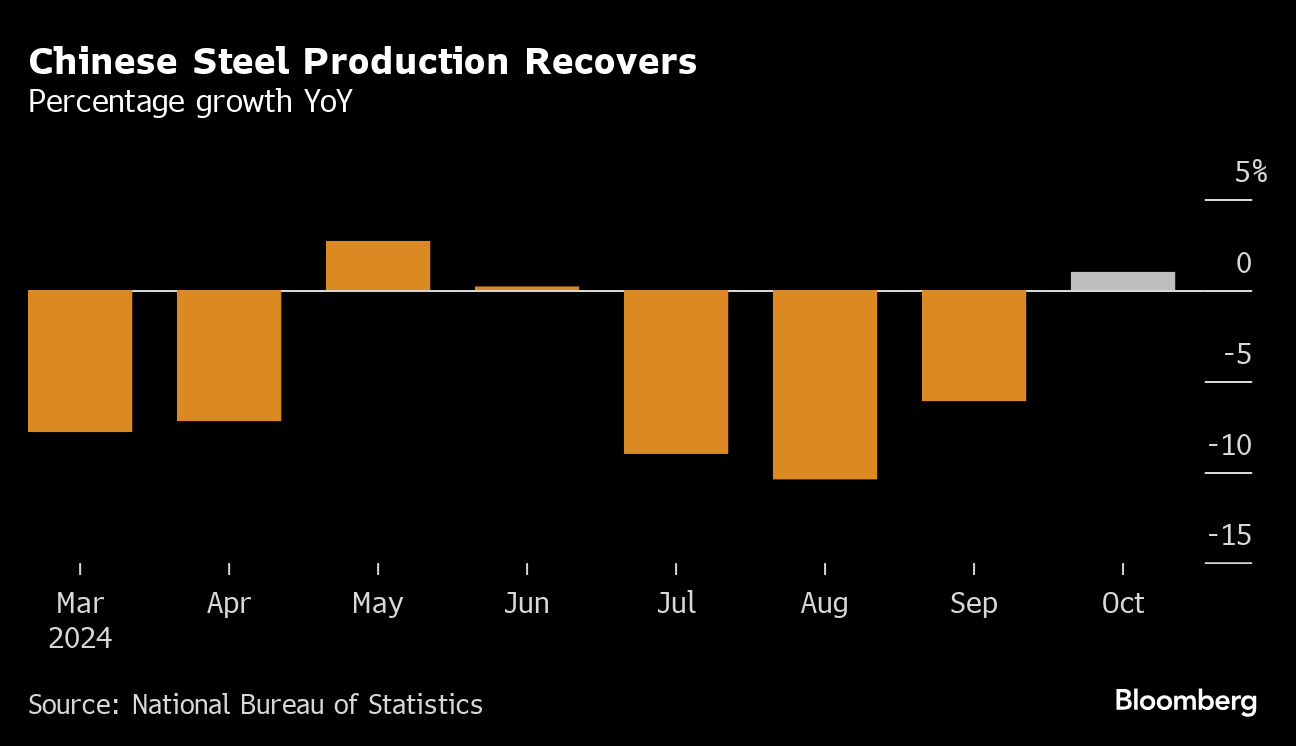

(Bloomberg) -- Chinese steel output recovered in October, snapping four months of declines, as sentiment brightens following Beijing’s efforts to rekindle economic growth.

Healthier margins allowed steelmakers to churn out more metal on a monthly basis for the first time since May, with production rising to 81.88 million tons, an increase of 6.2% on September and 2.9% higher than last year, according to the statistics bureau on Friday.

The increase means that the cumulative drop in output over the first 10 months compared to 2023 has now narrowed to 3%, suggesting the industry is still on track to surpass 1 billion tons for a fifth consecutive year at current operating rates.

Although a lot of mills are still losing money and the property sector continues to drag on demand, analysts cited a pick-up in orders from manufacturing and state-backed construction activity as well as a spike in exports. However, the industry’s long-term prospects remain gloomy.

The main steel association called on mills last month to maintain their production discipline after the rebound in prices, warning that conditions haven’t really changed. While the government has indicated it has the headroom for more stimulus next year, future measures are unlikely to revive the market’s traditional wellsprings of demand — new housing starts and scaled-up, steel-intensive infrastructure.

Among other materials, aluminum output rose 1.6% on year to 3.72 million tons, close to the record set in August, as seasonal consumption of the lightweight metal increased. Smelters have restored some idled capacity while new plants have also come online to meet the extra demand, according to Shanghai Metals Market.

Output of power fuels also rose — coal by 4.6% and natural gas by 8.4% — as China kept supplies elevated ahead of peak winter demand. But feeble margins saw crude oil refiners cut runs, with production dropping 4.6%.

(Updates steel and aluminum figures in third and sixth paragraph)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens