Commodities Slide as Trump Win Boosts Dollar, Threatens Trade

(Bloomberg) -- Commodities broadly declined on prospects that a stronger dollar and potential trade disputes under a Donald Trump presidency will weaken the appeal of raw materials in global markets.

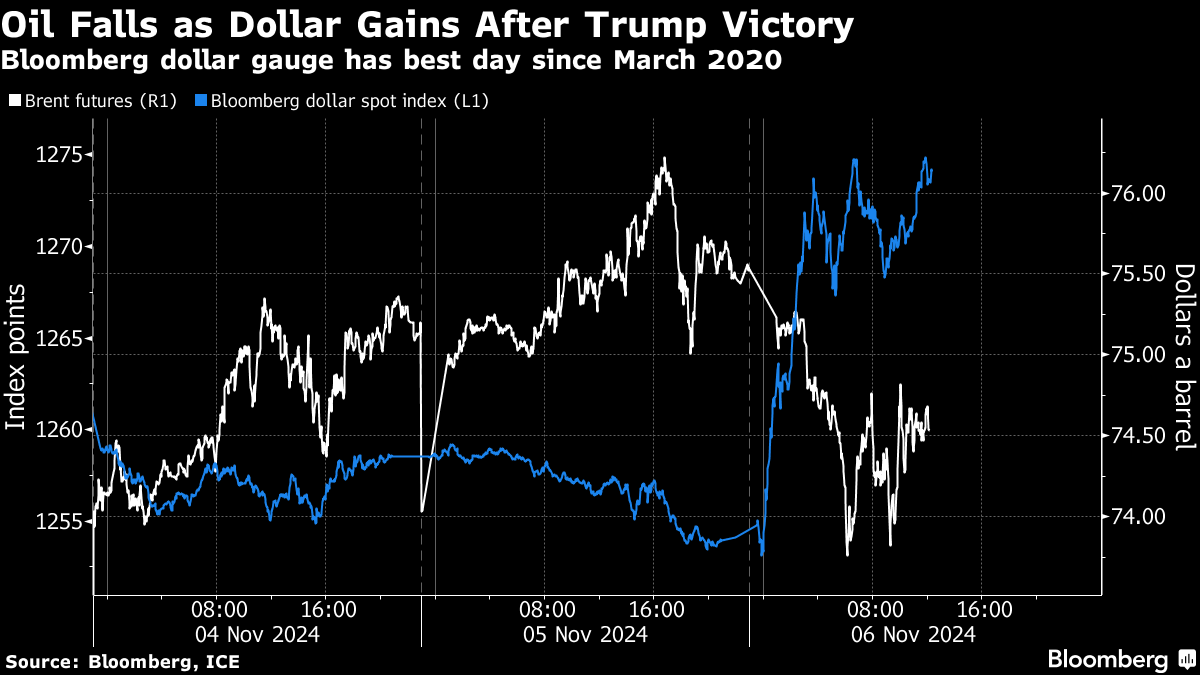

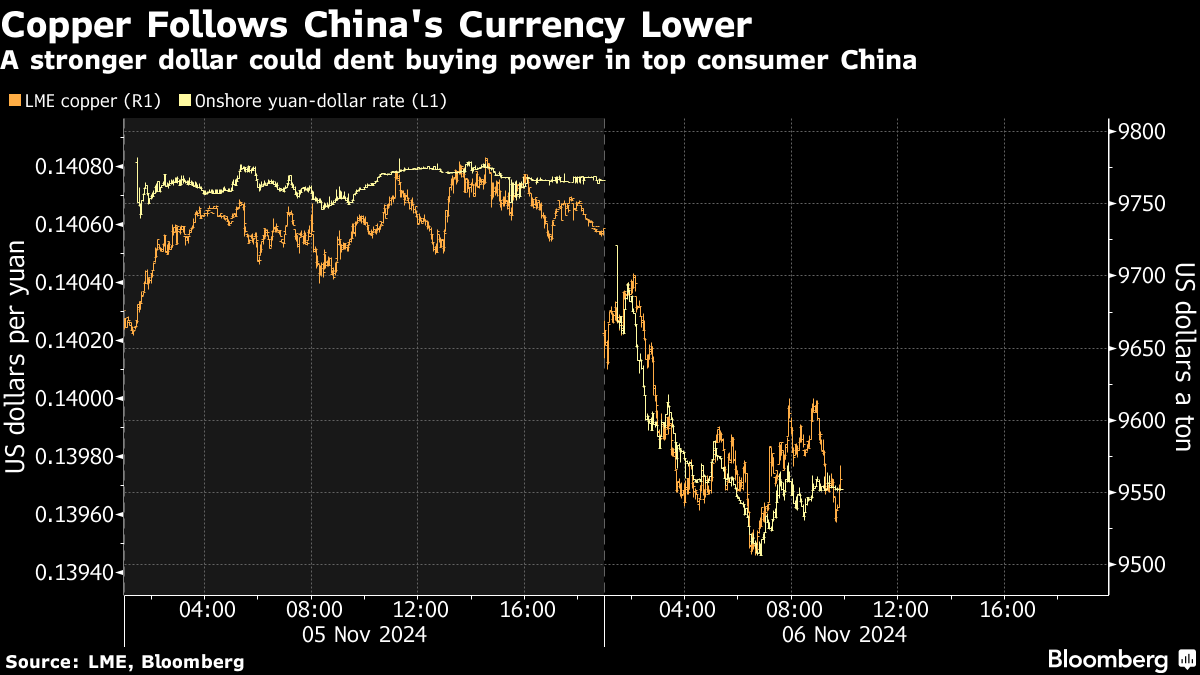

Brent crude futures fell as much as 2.9% in London, soybeans slid the most in a month in Chicago, while copper led industrial metals lower with a 4% slump. Gold dropped below $2,700 an ounce.

With Trump clinching back the White House, a gauge of the dollar posted its biggest gain against major currencies since 2020, making raw materials priced in the greenback more costly for many buyers. The likelihood of trade disputes with China is particularly concerning for agricultural markets.

“Overnight trading saw widespread losses across the commodities sector,” said Ole Hansen, head of commodities strategy at Saxo Bank. Markets believe a Trump presidency “is expected to bring about the promised tariffs on imported goods, particularly targeting China, potentially triggering a new wave of trade tensions and economic disruptions.”

There were also ripples across a host of equities tied to commodity markets.

US steel stocks rose pre-market Wednesday morning on the anticipation that Trump will return to the White House, favoring one of his top priorities during the first administration: tariffs on imports of the commodity from across the globe. Container shipping equities also plunged on the specter of potential tariffs curbing seaborne trade.

Crude Swings

Crude has already suffered a series of major price swings throughout October, and a Trump win could mean that curbs on Russian exports are eased, while there may also be tighter sanctions on Iranian flows, RBC Capital Markets analysts wrote previously.

“US foreign policy is shaping up to be a potential factor for oil markets in the near term” over Iran, said Vivek Dhar, an analyst at Commonwealth Bank of Australia.

For metals, both a stronger dollar and the possibility of a deeper US-China trade war would create headwinds for prices, said Marcus Garvey, head of commodities strategy at Macquarie. Still, investors will also be mindful that Beijing could respond with stimulus measures to invigorate domestic demand.

Gold fell on dollar strength, though a number of analysts believe a Trump victory could be bullish for bullion in the longer run, fueled by US inflationary pressures and currency weakness in China.

“I think anyone who’s super high conviction on how it all nets out is much smarter than I am,” Macquarie’s Garvey said, referring to Trump’s possible foreign policy plans. “Or maybe being a bit naive.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens