Qatar Picks QIA’s Americas Boss to Run $510 Billion Fund

(Bloomberg) -- Qatar named Mohammed Al Sowaidi as the chief executive officer of its $510 billion sovereign wealth fund, which is set to acquire even more financial firepower in coming years.

Al Sowaidi, who joined the fund in 2010, was most recently its chief investment officer for the Americas region and helped establish a US office. He replaces Mansoor Al Mahmoud, who’s led the entity since 2018 — longer than a typical four-year term.

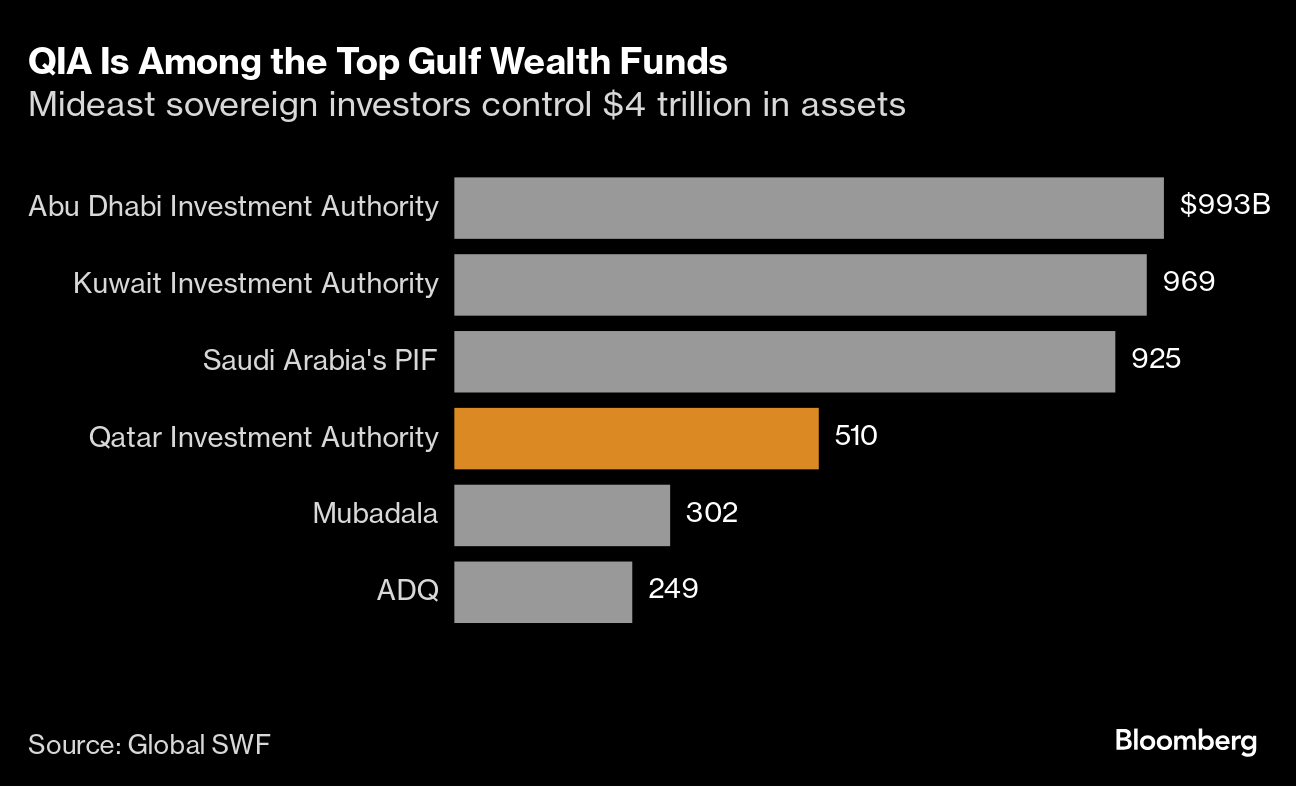

The QIA was founded in 2005 to handle the country’s revenue from liquefied natural gas, of which Qatar is one of the biggest exporters. It’s currently the world’s eighth-largest sovereign fund with $510 billion in assets under management, according to consultancy Global SWF.

The fund’s expected to reap a windfall from an enormous expansion of Qatar’s gas output that could add more than $30 billion to state revenues, meaning its size could increase sharply in coming years. At the same time, Doha’s domestic spending needs are winding down after the 2022 FIFA World Cup.

“The appointment signals QIA is at a critical juncture, calling for a big-picture approach to navigate strategic asset allocation,” said Salar Ghahramani, a SWF expert at Pennsylvania State University and the founder of Global Policy Advisors. By selecting a CEO with extensive US experience, Qatar’s rulers are “possibly anticipating the dynamics of a Trump presidency,” he added.

Al Sowaidi’s appointment comes at a time when deep-pocketed Gulf wealth funds are playing an increasingly important role in global finance. The biggest state-backed wealth entities in the region oversee assets of about $4 trillion, and many of them have been ramping up, boosting trade links to Asia and betting on new technologies like artificial intelligence.

In the first nine months of 2024, sovereign funds from Abu Dhabi, Saudi Arabia and Qatar made up 40% of the value of all deals done by global state-backed investors, according to Global SWF. While most of the money was poured into the US and the UK, investments in China have also picked up. The QIA, for one, agreed to buy a 10% stake in China Asset Management Co., one of the nation’s largest mutual fund firms.

During the past five years, the QIA has looked to invest more into the US, partly to re-balance its portfolio away from Europe. It has plowed money into sectors like technology and health care, and plans to deploy more into Asia and the US, as well as sectors including digitization and infrastructure.

Previously known for a penchant for trophy assets, including the iconic Harrods department store in London’s upmarket Knightsbridge neighborhood, the QIA also played a key role in supporting lenders during the 2008 financial crisis, backing the likes of Barclays Plc and Credit Suisse

The fund’s publicly disclosed holdings amount to $78 billion and include stakes in Iberdrola SA, Glencore Plc, Siemens AG and Volkswagen AG, according to data compiled by Bloomberg. Its property holdings include the Shard skyscraper in London, and the QIA is an investor in Canary Wharf Group.

The fund employs about 650 people.

(Updates throughout with details)

©2024 Bloomberg L.P.