JPMorgan Eyes Physical LNG Trading After Dimon Hails Boon

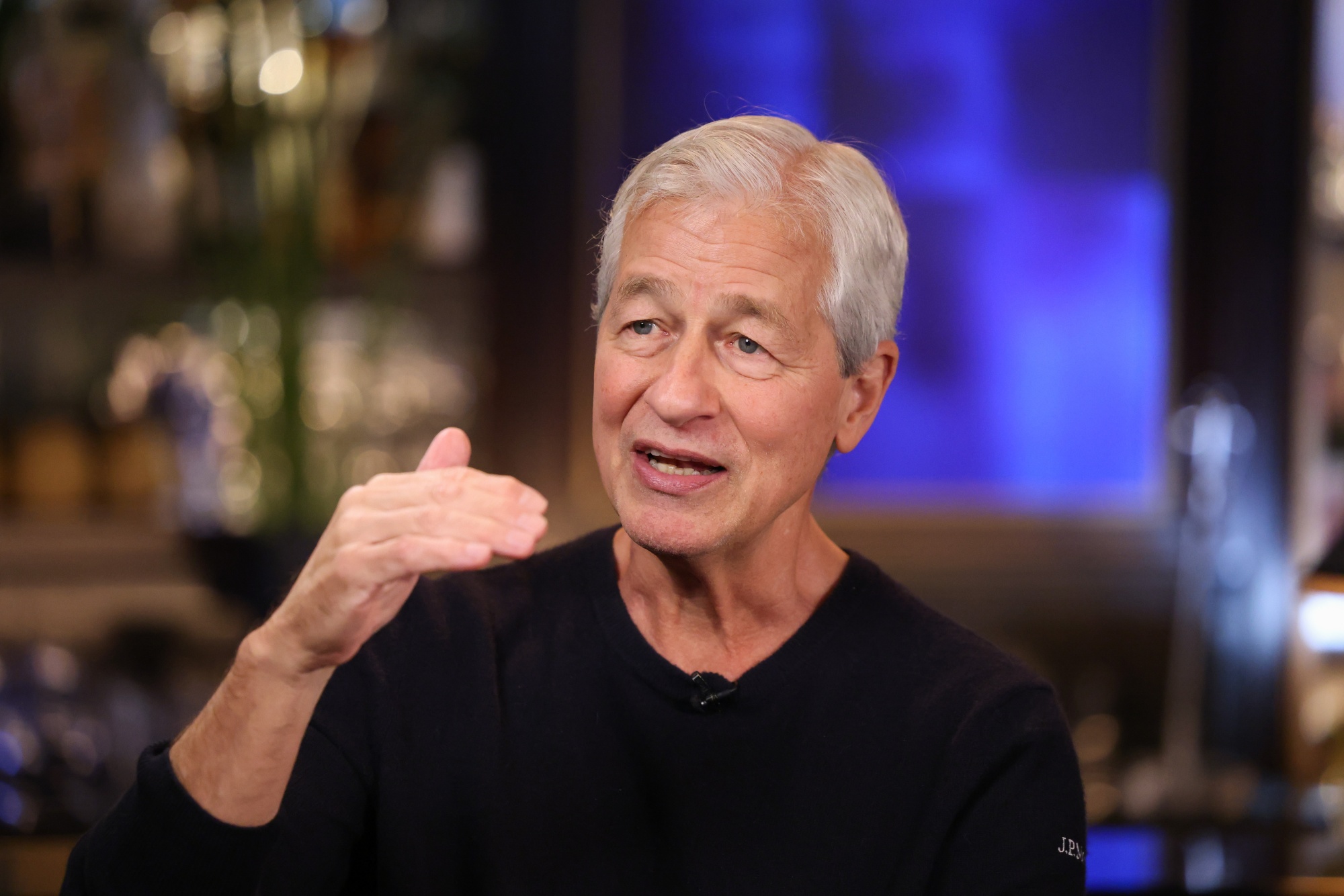

(Bloomberg) -- JPMorgan Chase & Co. is in talks to start trading physical liquefied natural gas again after more than a decade on the sidelines, a move that lines up with Chief Executive Officer Jamie Dimon’s calls for an increase in domestic production and energy exports.

The bank has held talks to secure a longterm LNG supply with at least three projects under development in the Gulf Coast, according to people familiar with the matter. The move is part of a wider push JPMorgan has made in recent years to get back into trading some of the physical commodities it abandoned in 2014.

Discussions are underway between the bank and developers looking to build a project to liquefy and export gas in Louisiana called Commonwealth LNG, Sempra Energy’s expansion of its Port Arthur site under construction in Texas and Energy Transfer LP’s planned Lake Charles LNG facility in Louisiana, the people said, asking not to be identified describing the confidential negotiations.

Spokespeople for JPMorgan, Sempra, and Kimmeridge Energy Management Co., which owns Commonwealth, declined to comment. A representative for Energy Transfer didn’t respond to multiple requests for comment.

Global demand is surging for LNG, with many nations seeking a cleaner-burning alternative to oil and coal as they shift toward renewable energy. The US has emerged as the world’s largest exporter thanks to an abundant supply of gas and the development of huge terminals on the Gulf Coast to liquefy and ship the fuel.

JPMorgan has no plans to physically move LNG on water itself, two of the people said. That strategy would align with how other banks have handled physical energy commodities and differ from traditional trading houses, which typically handle shipping themselves.

JPMorgan’s effort is the latest twist in what’s been a bumpy saga for top Wall Street firms’ involvement in the physical commodity space over the past two decades. JPMorgan inherited Bear Stearns’s energy-trading platform when it bought the failed bank during the financial crisis, and bulked up through additional acquisitions in 2009 and 2010.

By 2014, JPMorgan agreed to sell much of its physical commodities arm — though the New York-based company hung on to its metals desks — as banks grappled with heightened regulatory scrutiny in the business. But within a decade, the firm was back to trading in the physical natural gas space.

JPMorgan has expanded its physical natural gas trading operation in the US since 2022 and is eying US power, as well as gas and power in Europe, where it recently applied for a natural gas shipper license, some of the people said.

Goldman’s Windfall

Russia’s invasion of Ukraine nearly three years ago sparked a massive shift in global energy trade and an ensuing market frenzy. At Goldman Sachs Group Inc., long a dominant force in commodities, that desk pulled in more than $3 billion for 2022 — more than 10 times what it generated in 2017.

Companies in the US have accelerated construction of LNG facilities in recent years, and JPMorgan has long played a financing role for such projects. Furthermore, the build-out of artificial-intelligence infrastructure has sparked heightened client demand for commodities, JPMorgan’s global co-heads of sales and research, Claudia Jury and Scott Hamilton, said in an interview earlier this year.

In his annual letter to shareholders, Dimon wrote about the economic and geopolitical advantages that accompany domestic energy production. That followed earlier dispatches about the need for reliable, affordable energy in conjunction with investments for future efforts to reduce carbon dioxide and other greenhouse gases from the atmosphere.

“The export of LNG is a great economic boon for the United States,” Dimon wrote in April. “But most important is the realpolitik goal: Our allied nations that need secure and affordable energy resources, including critical nations like Japan, Korea and most of our European allies, would like to be able to depend on the United States for energy.”

In the same letter, he decried the Biden Administration’s pause on US LNG permitting, which effectively halted all new export projects from approval — calling the push to stop oil and gas output as “enormously naïve.”

Macquarie Group Ltd., one of North America’s largest energy traders, also has a preliminary agreement for US LNG supply with the project Texas LNG, under development by closely held Glenfarne Group. Macquarie Chairman Glenn Stevens echoed Dimon’s remarks at the Australian bank’s annual meeting in July, telling investors that “we do think that natural gas, in particular, is an important part of the transition path for the world.”

(Adds context in the sixth paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens