How Trump Could Turn a $400 Billion Green Bank Into a Fossil Fuel Lender

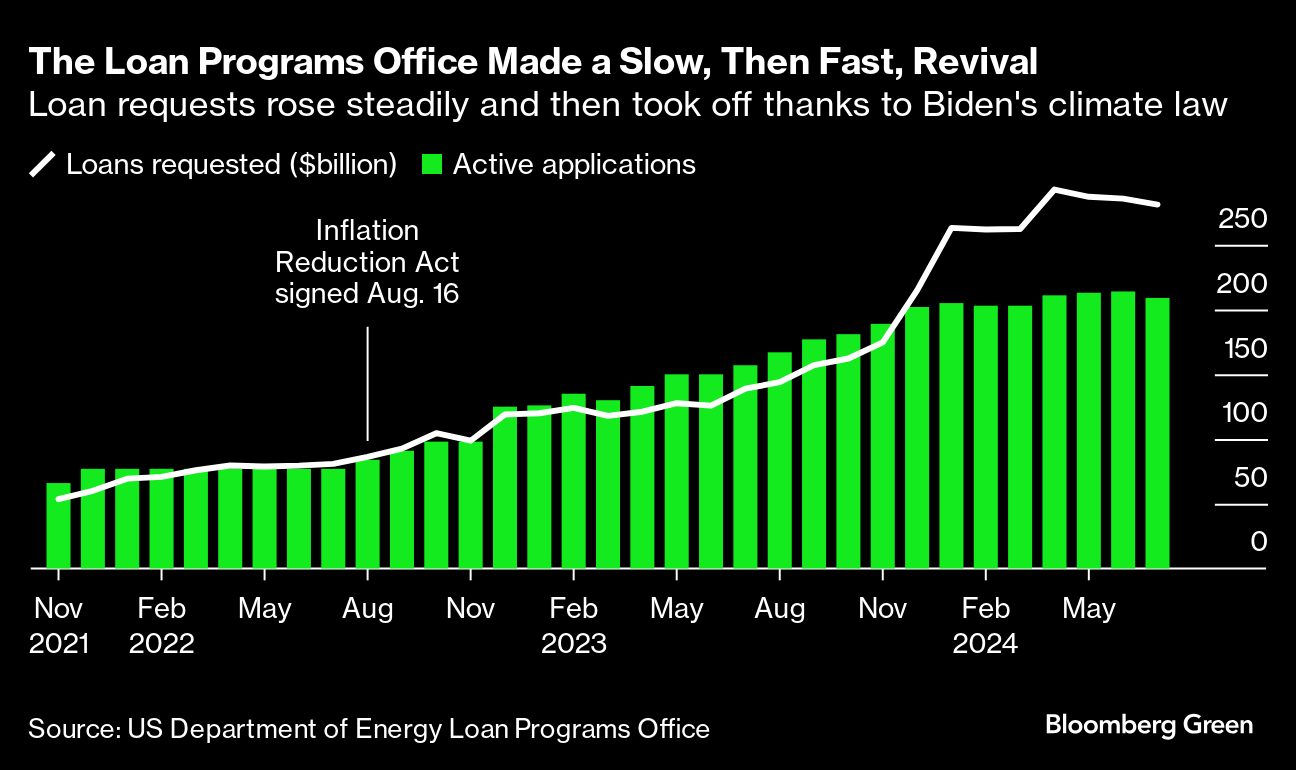

(Bloomberg) -- The US government’s green bank was once marked for death under former President Donald Trump’s administration. But the office survived and flourished under President Joe Biden, with its lending authority swelling to $400 billion for carbon-cutting technologies.

Now, if Trump wins the White House for a second term, some in his inner circle say he may opt to use the lending program to fund fossil fuel and other energy projects favored by Republicans.

“If there are projects he likes, I suspect they will likely be valuable in terms of the ability to produce energy or electricity,” said Thomas Pyle, who previously served as the Energy Department's transition team leader for Trump.

That makes the fate of the Energy Department’s Loan Programs Office, or LPO, a bellwether for how the US energy transition could shift depending on the outcome of November's vote. Repositioning the green bank under a new Trump administration could prove a boon for natural gas and mining. But emerging clean technologies championed by the Biden administration — ones that commercial banks may be too risk-averse to back at the scale needed — stand to lose a critical funding source. That has the potential to stunt the growth of American production of things ranging from batteries to green steel essential to reaching net zero emissions in the coming decades.

“If you take out one of the key building blocks of the energy transition, the whole chain suffers,” said Peter Davidson, the founder and chief executive officer of Aligned Climate Capital who served as the program’s executive director from 2013 to 2015.

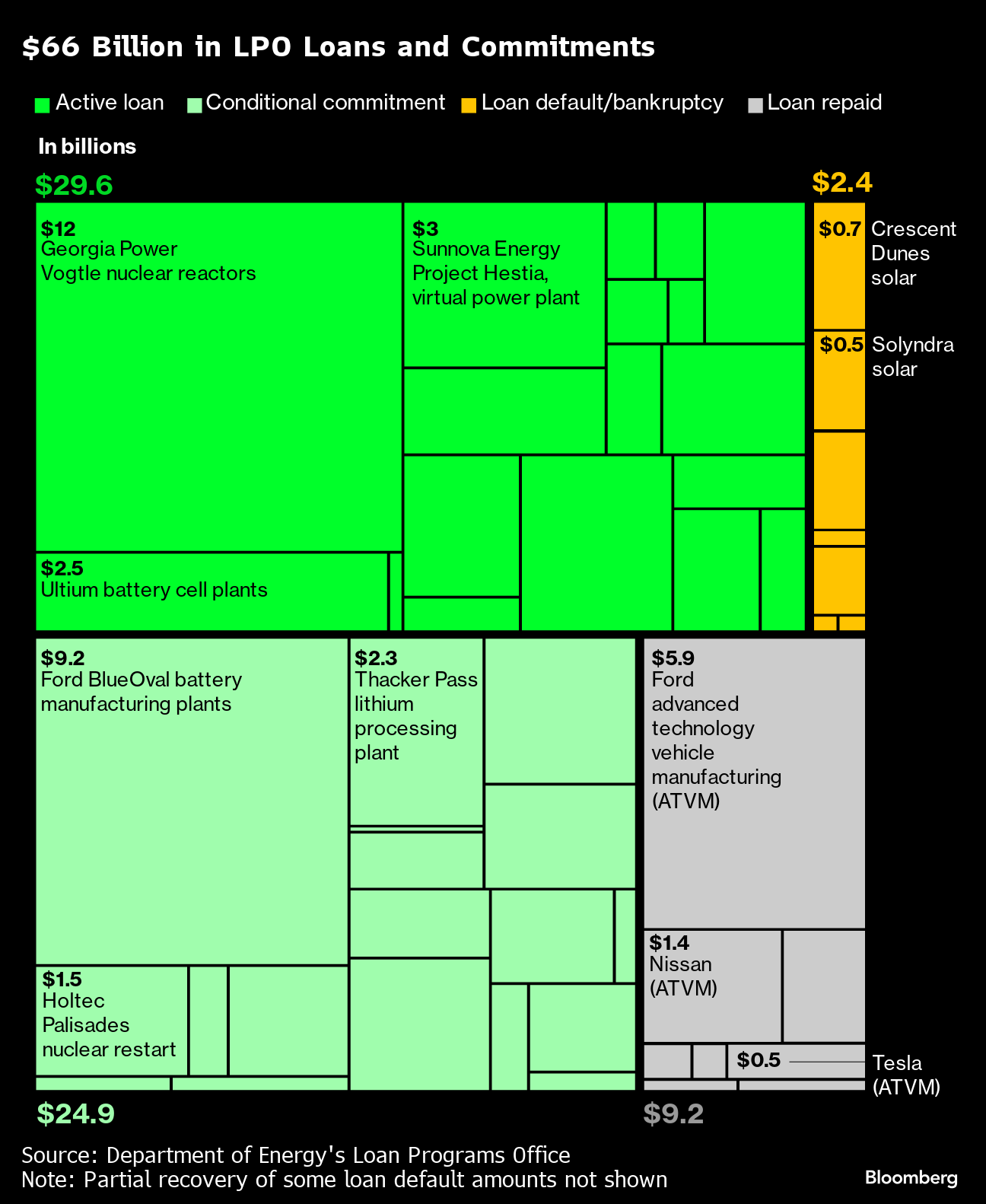

Two loans issued more than a decade ago have helped define the LPO. Tesla Inc. took a $465 million loan in 2010 when the company was struggling to get its breakthrough Model S sedan into production. The backing helped sustain what’s now one of the world’s leading electric vehicle makers. The lending program also supported some of the first large-scale US solar photovoltaic farms and manufacturers, including a $535 million loan guarantee to Solyndra Inc. The eventual default on that loan led the LPO to become a magnet for Republican attacks. Despite critics who worry about the prospect of another major failure, LPO has received roughly $5 billion in interest payments and has a loan-loss ratio on par with commercial banks.

The office received an infusion of spending power in Biden’s signature climate law and has made a number of high-profile loans over the past two years. That includes a major conditional loan of $9.2 billion to Ford Motor Co. to construct three major battery plants as well as a $3 billion loan for solar company Sunnova Energy International Inc. and nearly $2.3 billion in conditional funding for a Nevada mining and processing project run by Lithium Americas Corp. The office had 209 open applications requesting $281 billion in financing, according to the most recent data from July.

“DOE’s LPO has provided a bridge to bankability for American entrepreneurs and innovators for almost 20 years,” an Energy Department spokesperson said. “Federal programs like ours regularly continue across administration changes.”

While Trump initially proposed killing the Energy Department loan program while president, arguing the government had no business picking winners and losers, his administration later sought to issue new loans, said Dan Simmons, who led the Energy Department’s Office of Energy Efficiency and Renewable Energy under Trump.

“The Trump administration was at first against any new loans, but then they actively looked for projects that could work,” he said. Whether Trump would use the program to fund energy projects more to his liking is a “great question,” Simmons added. “I think it’s very much up in the air in a second Trump administration.”

Under Trump, the program issued $3.7 billion in loan guarantees for two nuclear reactors being built by Southern Co. in Georgia, but it was unable to close on other projects, in part because of a lack of eligible projects, Simmons said.

The fate of LPO is the subject of a lively debate among conservatives and former Trump officials who may return to government if he wins a second term, according to people familiar with the matter. Conservative opponents of the office have called on Trump to kill it if elected. That includes Project 2025, a blueprint put together by the Heritage Foundation that has been a lightning rod of controversy. Trump has sought to distance himself from Project 2025 and its director stepped down following criticism. (His campaign didn’t respond to requests for comment.)

“I would like to see them continue to finance projects,” said Hunter Johnston, a partner at law firm Steptoe LLP, who has represented clients seeking financing during the Trump administration, including a Louisiana methanol production plant that was considered for a $2 billion loan guarantee. “Having a loan program will be attractive to project developers that want to lower the cost of their projects.”

Other projects considered for financing during the Trump administration included a $1.9 billion loan guarantee to create a natural gas storage hub in Appalachia that could have spurred the building out of new chemical and refining facilities in the area as well as ones related to carbon capture and the production of ammonia.

LPO, which was signed into law by President George W. Bush, is required to fund innovative energy projects that reduce carbon emissions. But projects related to carbon capture, and other “advanced fossil energy technology” projects are still eligible for billions of dollars in funds. Those may see renewed interest if Trump wins as could zero- or lower-carbon energy projects favored by Republicans such as hydrogen and small modular reactors.

Trump, who has rallied against what he's termed Democrats "Green New Scam" and vowed to rescind unspent climate law spending, wouldn’t have the authority to unilaterally disband LPO because it was established by Congress, according to Martin Lockman, a climate law fellow at the Sabin Center for Climate Change Law. But a Trump administration could opt to simply not approve new loans — something it was accused of its first time in office.

Such a move could be particularly effective for Trump: Biden’s signature climate law boosted the program from about $44 billion in spending power to nearly $400 billion, but that move comes with deadlines to spend the money by September 2026 or 2028 depending on the type of loan sought.

LPO expects to close $27 billion of loans in funding year 2024, with that number set to rise to $50 billion the following funding year. Progressive groups have advocated for getting as much money out the door ahead of a possible second Trump term, but the office has a due diligence process that can last for months.

A repeat loan program dormancy would be “a big setback” for the energy transition, due to the critical and unique role the office plays in bringing advanced tech to market quickly, according to Sasha Mackler, executive director of the Energy Program at the Bipartisan Policy Center. Although the private sector has poured money into clean tech, none of those investors fulfill the same function as LPO, which has a larger team, more capital and “the imprimatur of the US government,” he said.

“Any CEO worth their salt is thinking hard about this right now,” said Matthew Nordan, co-founder and general partner of Azolla Ventures, a climate tech investing firm. “It’s a constant topic of discussion in any board meeting.”

©2024 Bloomberg L.P.