Sugar Giant Cosan Mulls Selling Vale Stake on Leverage Woes

(Bloomberg) -- Billionaire Rubens Ometto’s conglomerate Cosan SA is mulling a sale of assets including its $2.2 billion stake in mining giant Vale SA, according to people familiar with the matter, potentially unwinding a soured bet to pay down debt.

Cosan has told investors that all options are on the table to improve its balance sheet, including selling part or all of its 4.1% interest in the iron ore producer, the people said, asking not be identified because discussions aren’t public. The company has also weighed the sale of an Argentine gasoline distributor it owns in a joint venture with Shell Plc, the people said. No final decision has been made.

Cosan SA — a sugar and ethanol empire that has sprawled into everything from lubricant production and gasoline distribution to rail transportation and natural gas home supply — has seen shares plunge to the lowest level in more than four years this month. Investors are skeptical of its ability to spend cash efficiently since its 2022 decision to take on debt to buy a minority stake in Vale, which has since lost value and provided returns deemed “mediocre” by BTG Pactual SA.

“Cosan continually monitors the best deleveraging opportunities and remains committed to optimizing capital allocation, especially in a scenario of high interest rates and a challenging macroeconomic environment,” the company said in a note to Bloomberg News.

Cosan jumped as much as 2.4% after Bloomberg News reported the discussions. Vale dropped as much as 1.7%.

Cosan is contending with high interest rates in Brazil and lower profits from its sugar and ethanol business. The company has also struggled to move forward with plans to sell shares of its lubricant and gas businesses amid a lack of investor appetite.

“Cosan’s leverage grew rapidly over the last few years and that is bringing some scare to investors,” said Marcelo Ornelas, a portfolio manager at Kinitro Capital. “An IPO window would help Cosan to reduce leverage level, but with higher rates now likely there is no room for that. This will make things even harder.”

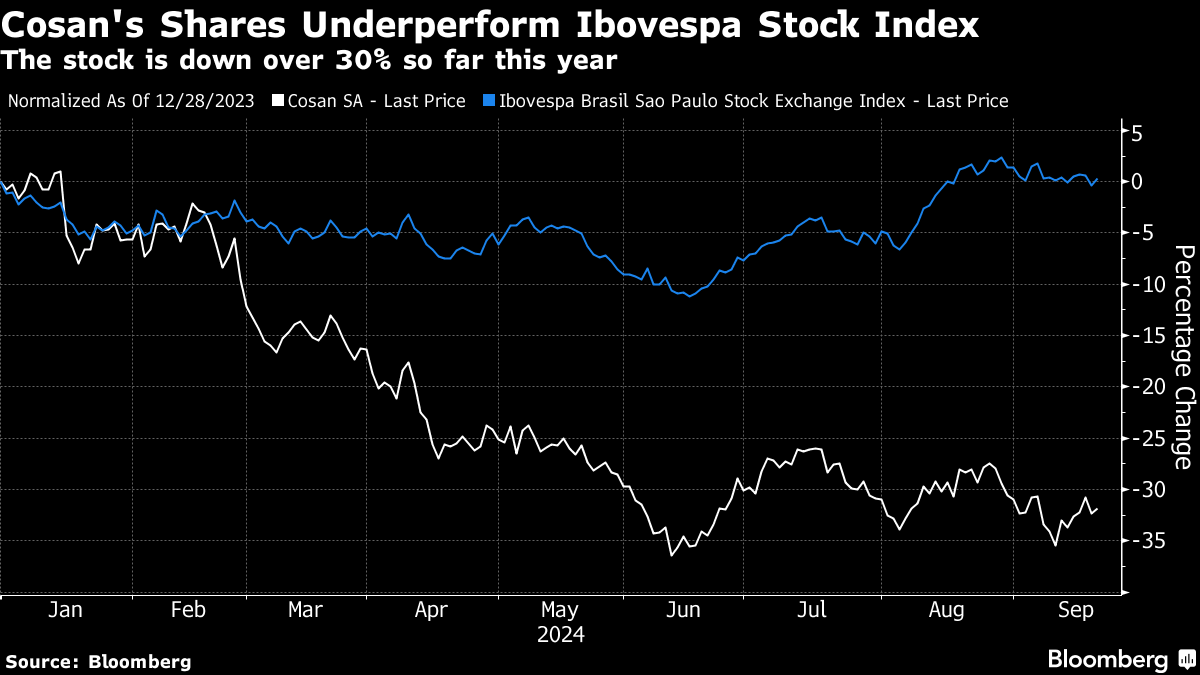

Ometto, 74, has conceded the Vale investment has been unpopular with investors, “because the market didn’t understand.” Since the operation was announced in October 2022, Cosan shares have fallen 32% in dollar terms. The stock is down 39% this year through Thursday, knocking roughly $2.9 billion off its market value.

Vale has been through a messy succession process involving government interference, information leaks and quarrels among board members. Ometto had proposed that Cosan’s former Chief Executive Officer Luiz Henrique Guimarães take the lead role at Vale, the people said, but the job is going to an internal hire instead, Chief Financial Officer Gustavo Pimenta.

Cosan Chief Financial Officer Rodrigo Araújo has acknowledged a need to reduce debt, telling investors on a call in August that the company is “highly focused on capital allocation” and that leverage is a “priority” and a “point of concern.”

The recently announced IPO of Cosan’s lubricant unit Moove will take place in New York, but the plan has done little to calm investors. Shares have barely moved since Bloomberg first reported Moove’s listing was in the works for Cosan. The company is also seeking an opportunity to resume its plans for an IPO of gas unit Compass, a deal that could unlock some more cash, one of the people said.

Debt level

Cosan’s debt burden has made the stock an underperformer in a market that was already mired in malaise. The MSCI Brazil index is down 16% so far this year, lagging a broader gauge of emerging-market stocks.

When it acquired its 5% stake in Vale, Cosan paid around 66.70 reais a share, according to a Bloomberg estimate, compared with 64.25 reais on Thursday. Ometto’s vision to have the companies work together also hasn’t come to fruition. “Cosan has not yet been able to fully achieve this cooperation, with governance becoming an area of concern recently,” Thiago Duarte, an analyst at BTG Pactual, wrote in a note to clients.

Analysts have continued to question whether Cosan is getting enough value for its acquisitions and investments. Through its Compass unit, Cosan recently bought a stake in local gas company Cia. Paranaense de Gas for $167 million (906 million reais), a price Citigroup saw as about $60 million above its estimate for fair value.

Cosan’s net debt was 21.3 billion reais as of the end of June, almost three times the level it was a year earlier, according to data compiled by Bloomberg.

Interest rates aren’t helping. Brazil’s central bank bucked the trend of global easing by hiking the benchmark rate this week to 10.75%, seeking to tamp down stubborn inflation. For the first six months of 2024, Cosan spent 2.17 billion reais on interest on net debt, a 19% increase from the first half of 2023.

“This leads to lower profitability of these investments considering the cost of financing,” says Regis Cardoso, an analyst at XP Inc., adding that the company is working to to reduce leverage levels.

The holding company probably will also avoid using more cash to establish new business lines, at least for now. Ometto and Araújo acknowledged in private meetings with investors that the company will miss out on some investments while it takes time to address its debt.

One example was the privatization earlier this year of Latin America’s biggest sanitation company, Cia. de Saneamento Basico do Estado de Sao Paulo, known as Sabesp. Ometto had been tempted by the idea of becoming a strategic investor in the company, adding water management of Latin America’s largest city to his empire, but ultimately decided not to move forward.

The Vale stake is just one of a range of options Cosan could consider to reduce its debt, Cardoso noted.

“However, in the absence of further divestment, this deleveraging should be gradual over time,” he said.

(Updates with share move in fifth paragraph)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens