A $20 Billion Gas Plant Exposes Australia’s Energy Conundrum

(Bloomberg) -- Just four days before he called a federal election last month, Australian Prime Minister Anthony Albanese’s government quietly pushed back a decision that will set the country’s energy path for decades to come.

Few will wonder why. A ruling on whether or not to extend the life of Australia’s biggest and oldest liquefied natural gas export facility, North West Shelf, will help determine how the country will fuel itself and its growth for decades. It’s also guaranteed to create backlash.

As head of a government that emphasizes its green credentials, should Albanese win May’s election, many voters will expect his Labor Party to ultimately turn the project down — incurring the wrath of fossil fuel powerhouses that account for a chunk of Australia’s exports and of overseas gas buyers. If Albanese or Liberal Party opponent Peter Dutton go the other way, there will be the ire from Indigenous groups and environmental campaigners, seeking to protect cultural heritage and move the country toward cleaner alternatives.

The vast project has become a symbol of the difficult choices facing one of the world’s largest energy exporters.

“Australia doesn’t want to make a decision because that opens a detailed consideration about needing to replace gas — a major export — with something else, to avoid a major hit to our economy,” said Tina Soliman Hunter, co-director of Macquarie University’s Transforming Energy Markets Research Centre. “You’re damned if you do, you’re damned if you don’t.”

Even by Australian standards, the Woodside Energy Group Ltd.-operated North West Shelf facility is large. The A$34 billion ($20 billion) project on the edge of Western Australia’s Pilbara region has shipped more than 6,000 LNG cargoes since its first in 1989. Every year it processes enough gas from fields in the Indian Ocean to meet the LNG needs of a medium-sized importer such as Spain.

NWS, as the facility is known, set off what became one of the biggest capital inflows in Australian history — when major oil companies including Chevron Corp., Exxon Mobil Corp. and Shell Plc reached investment decisions on eight LNG projects in the five years through 2012, a splurge that would turn the nation into one of the biggest sellers of the fuel.

But that is now nearing an end. The fields are depleted. As soon as this year, Woodside and its venture partners face the prospect of being forced to shut one of the project’s five trains, the production units that chill natural gas to minus 160C (-256F) so it can be transported.

That is, unless a decision is taken to prolong its life — and to tie Australia’s near-term fate to gas.

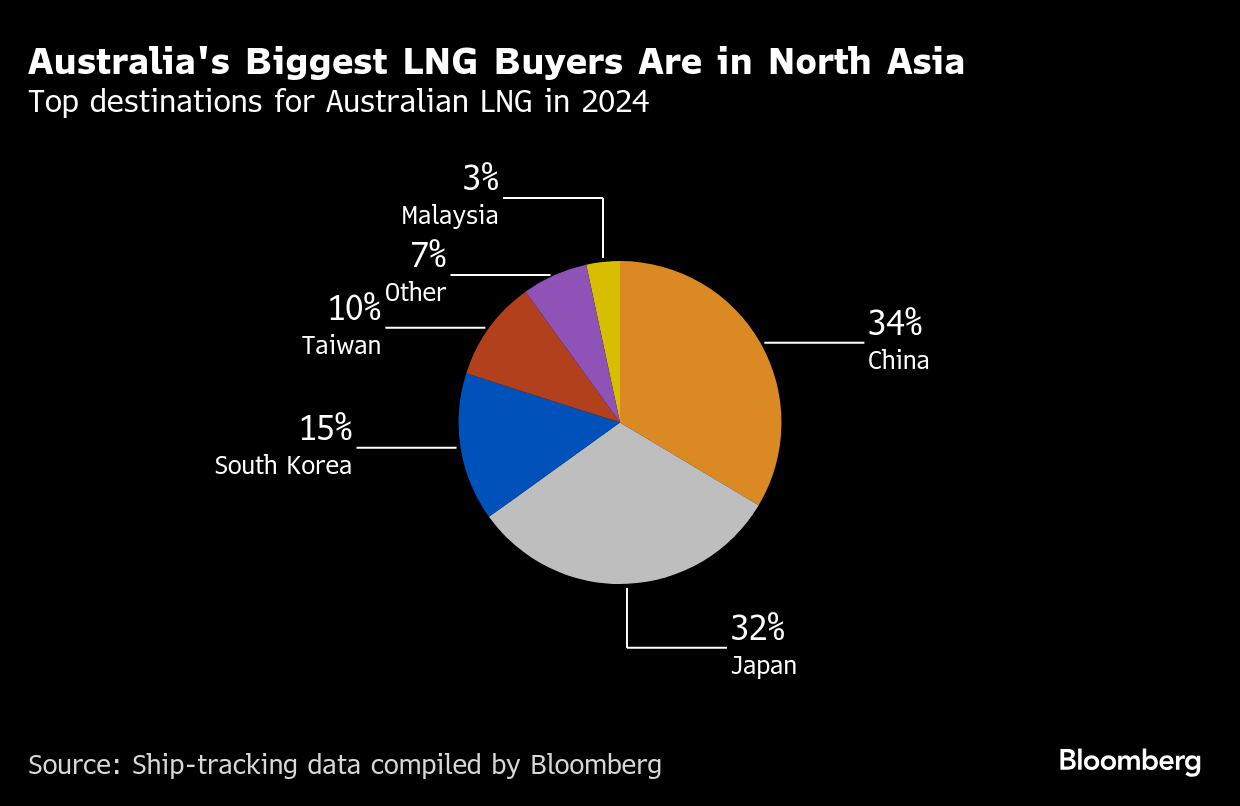

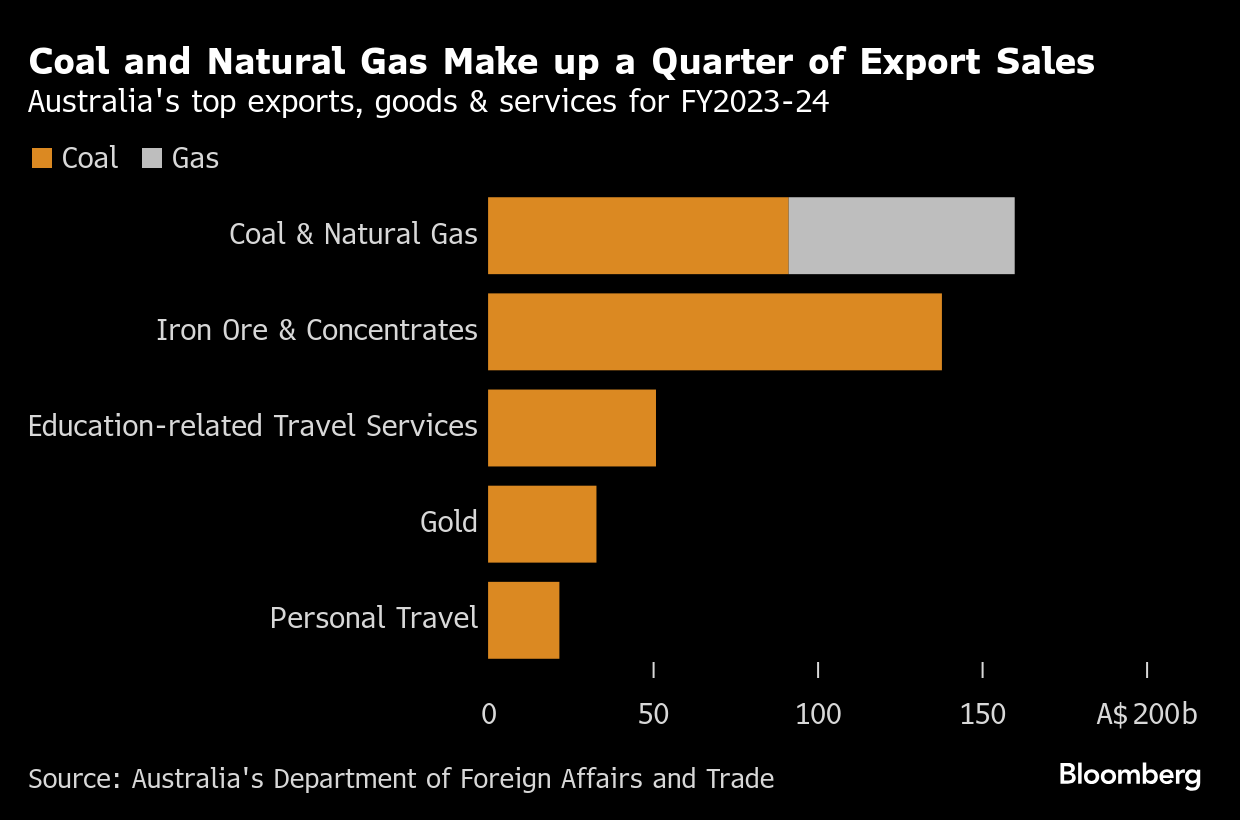

Albanese’s Labor party won the latest election in 2022 on a platform that included shedding the country’s reputation as a climate laggard — partly because its natural gas and coal industries had turned it into one of the world’s biggest per-capita emitters. But fossil fuels are also core to Australia’s economy, with combined sales that make up nearly a quarter of exports and have helped forge key partnerships with Japan, South Korea and China.

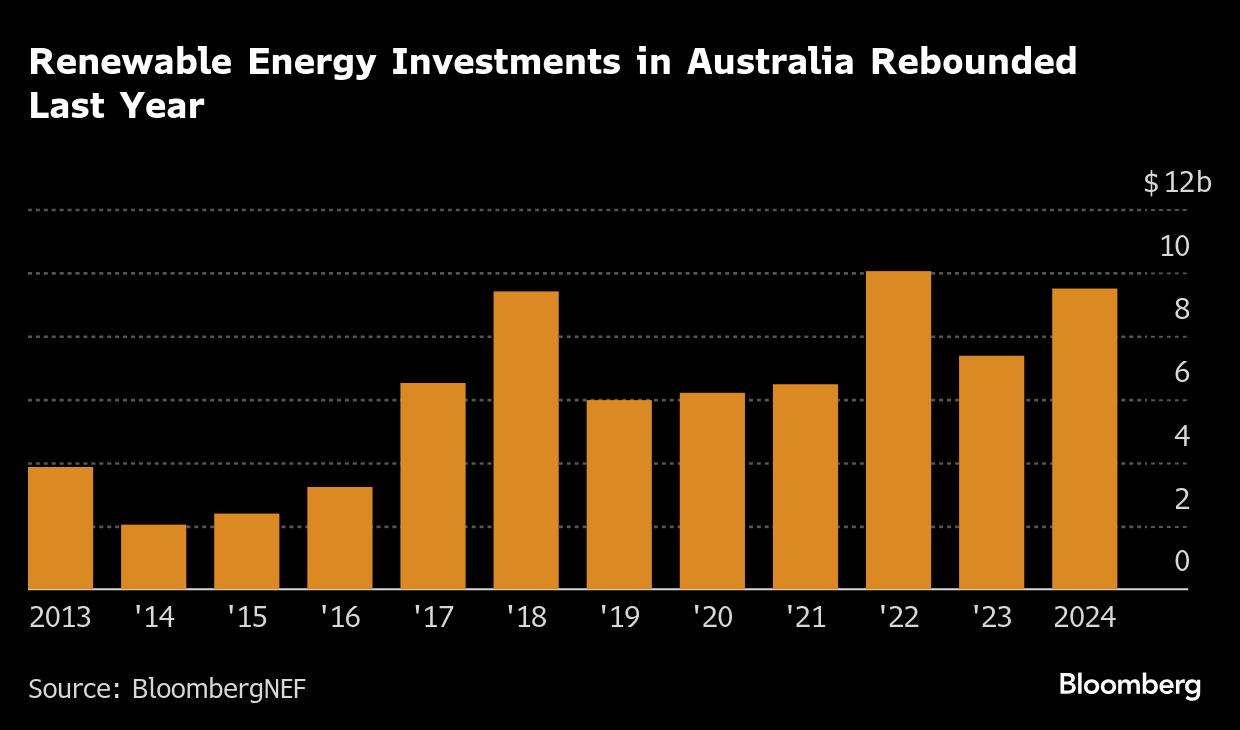

The current government has promised more investment in renewable energy and plans to boost green jobs in its bid to cut carbon emissions by 43% by 2030 from 2005 levels.

However, it has also approved 10 coal mining projects, despite global pledges to limit use of the most polluting fossil fuel — and it has supported the gas sector, which says it employs about 30,000 people directly. Resource Minister Madeleine King last year released a gas strategy that described the fuel as “an important source of energy through to 2050 and beyond.”

The Greens, which may play the role of kingmaker if the May 3 federal election is as close as predicted, have called on Environment Minister Tanya Plibersek to block the extension. “Labor and Liberal have proven themselves climate criminals,” Greens leader Adam Bandt said in an emailed statement, vowing the party would “get Labor to take strong climate action by stopping new coal and gas projects.”

The main opposition group under Dutton, meanwhile, has expressed support for the gas industry, and promised a decision on North West Shelf within 30 days of being elected. A Coalition government would designate gas as a critical mineral, allowing projects to unlock funding from the A$4 billion Critical Mineral Facility, Australian Energy Producers’ Chief Executive Officer Samantha McCulloch said last week at a conference.

Backers argue that thousands of jobs rely on the North West Shelf gas — and many more rely on the dollars paid in taxes and royalties.

“All we need is certainty around ongoing operations,” Liz Westcott, the chief operating officer for Australia at Woodside, said at the conference in Sydney.

Woodside is developing a separate deposit called Browse, which would supply the plant through a 1,000-kilometer (620-mile) pipeline. To move this strategy forward, though, Woodside and its international partners need permission for NWS to operate beyond 2030, which it lodged in 2018. An extension would allow NWS to operate until around 2070.

A Woodside spokesperson said the North West Shelf operation would support jobs, taxes and royalties, and secure gas supply to Western Australia. Browse is subject to separate approvals.

The state of Western Australia approved the plan in December after lengthy delays. That left the last stage of the decision with the federal government, right before a tightly contested election. Environment Minister Plibersek — who will make the final ruling — is the member for Sydney, traditionally a Labor safe seat, but one increasingly targeted by the Greens.

A spokeswoman for Plibersek said the Department of Climate Change, Energy, the Environment and Water needed more time to prepare a brief before the minister could make her decision. The spokeswoman said the process followed procedures put in place more than two decades ago.

Whatever happens next month, supporters and opponents describe the project as a bellwether — at a time when US President Donald Trump is vowing to maximize hydrocarbon production and to roll back green incentives.

Kevin Gallagher, CEO of Australian energy producer Santos Ltd., said that the new government must set policies that help to unlock more gas supply, pointing to lengthy approvals holding up its Narrabri project.

“Whoever wins the federal election must work with state and territory governments to address the quagmire of project approvals complexity and uncertainty that is stifling investment in energy and infrastructure around the country,” Gallagher said in a copy of his speech to the company’s annual general meeting on Thursday.

Critics are undeterred. They argue LNG production’s massive cost overruns and expensive government concessions mean the industry has already been detrimental for shareholders and taxpayers. Other opponents have warned that extending North West Shelf would seriously jeopardize emission targets and threaten coral reefs. The Australia Institute, a research body, says keeping the plant running would be equivalent to opening 12 new coal-fired power stations and further corrode the Murujaga rock art.

“This is the biggest climate and cultural heritage decision in Australia, and deciding about a 50 year extension requires proper consideration of all available evidence,” Mia Pepper, the acting executive director of the Conservation Council of Western Australia, said at the end of last month. “A project at this scale with impacts that have intergenerational consequences should not be rushed.”

A decision is now due on May 31.

(Updates with comment from Santos CEO in 22nd paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

FTC Bans on Executives Joining Exxon, Chevron Boards Tested

Trade War to Slash China’s Demand for Plastic Feedstock From US

Germany Faces Gas Storage Challenge as Italy Adopts Subsidy

Woodside announces Louisiana LNG partnership with Stonepeak

Trump Schedules Tariff Talks But Plans 104% Hit on China

NextDecade and Aramco execute 1.2 MTPA LNG agreement from Rio Grande LNG Train 4

Shell Cuts Gas Output Guidance on Unplanned Maintenance

China Halts US LNG Imports in Longest Run Since Last Trade War

Texas Attempt to Kickstart New Gas-Fired Power Is Stumbling