BP’s Turnaround Plan Tested by Weak Earnings, Falling Shares

(Bloomberg) -- BP Plc’s plan to turn around years of poor performance got off to a rocky start as the first set of earnings since the company’s big strategy reset disappointed investors.

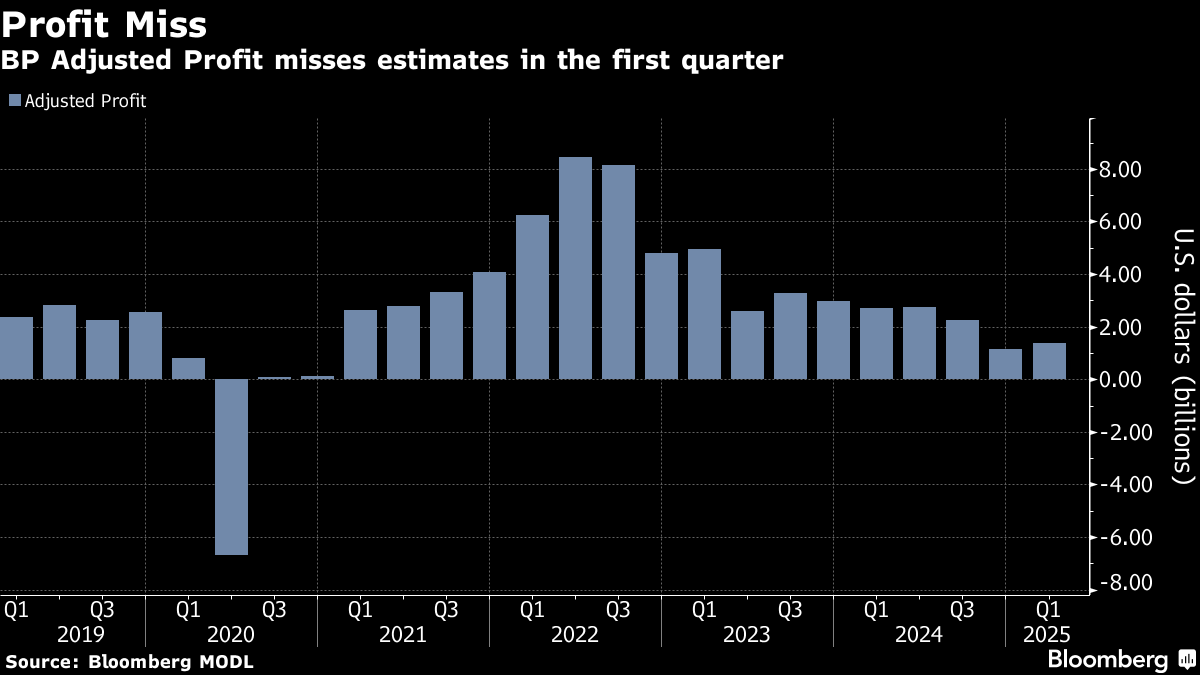

Shares of the company fell as much as 4.7% on Tuesday as its finances took a battering in the first quarter, with profits well below expectations, rising debt and the weakest cash flow in more than four years.

That all happened before President Donald Trump’s trade war pushed Brent crude well below $70 a barrel — the price assumption for BP’s financial targets. Analysts questioned whether share buybacks, already set to a much lower level, would have to be cut again.

“BP starts its three-year 2025 to 2027 turnaround plan with an 11% net income miss — not exactly auspicious,” said HSBC analyst Kim Fustier.

BP needs to win back investors’ confidence in a difficult economic environment, and the first-quarter performance also does little to ease growing pressure from activist shareholder Elliott Investment Management, which has become increasingly public in its campaign for greater change at BP.

Chairman Helge Lund had already announced that he will step down. BP also said on Tuesday that Giulia Chierchia, a executive vice president for strategy, sustainability and ventures, will leave the company and won’t be replaced. Both were seen as important architects of the failed 2020 plan to rapidly shift away from oil and gas into clean energy, and their departure appears to be a nod to some of Elliott’s demands.

“I’m confident that our plans to strengthen the balance sheet, reduce costs, and improve cash flow and returns will grow long-term shareholder value and strengthen the resilience of BP,” Chief Executive Officer Murray Auchincloss said in a statement on Tuesday.

BP reduced its share buyback to $750 million, from $1.75 billion in the prior quarter. Adjusted net income was $1.38 billion, according to the statement, about half the level of a year earlier and missing the average analyst estimate of $1.64 billion.

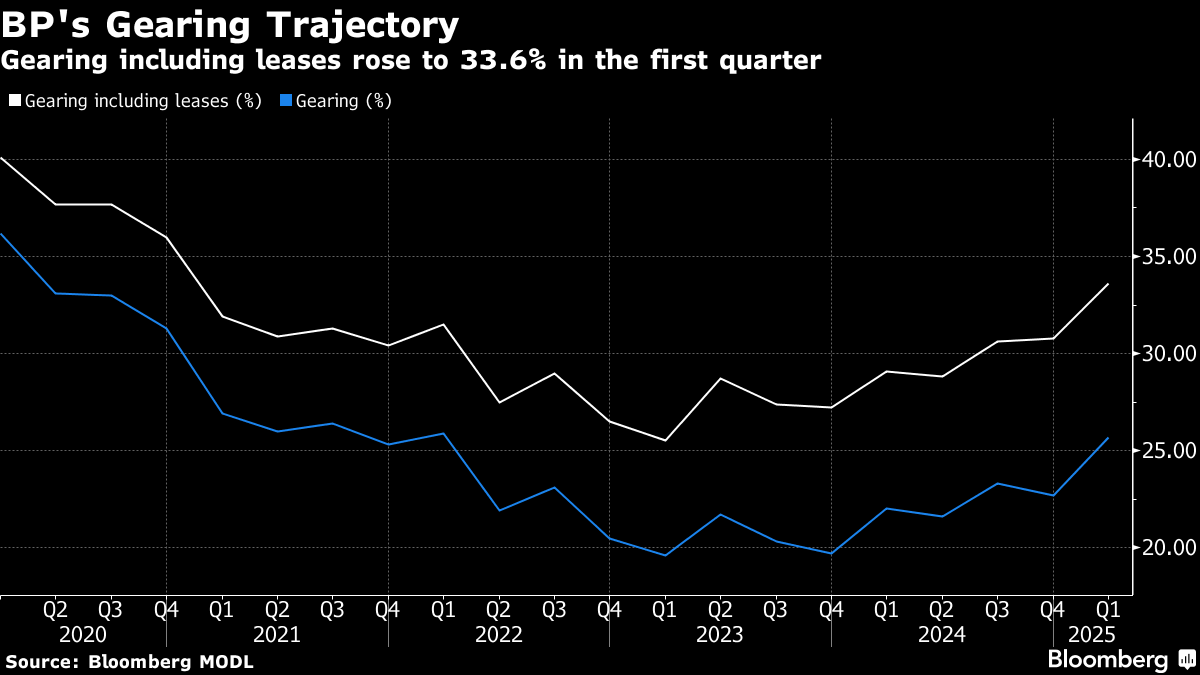

Net debt increased by about $4 billion to almost $27 billion, primarily due to a plunge in operating cash flow to $2.83 billion, which the company attributed to movements in working capital.

The increase in net debt “will cast doubt on BP’s ability to continue to buy back shares in a weakening macro environment,” Jefferies analyst Giacomo Romeo said in a research note.

BP has been lagging significantly behind its oil and gas peers. After several years of poor performance, and amid intense pressure from Elliott, the company in February announced a major pivot back to fossil fuels, slashing clean-energy spending.

Elliott has called on BP to deepen spending cuts and make further divestments. The investor wants BP to target $20 billion in free cash flow by 2027, which is roughly 40% higher than the company’s current goal.

To reduce costs, BP is reviewing 3,400 contractor roles, executives said on a conference call with analysts. The company has avoided any material impacts from Trump’s tariffs, they said.

The firm is also closely monitoring upcoming meetings between Organization of Petroleum Exporting Countries and its allies, as well as the Trump administration’s negotiations with Iran — both of which may have a significant impact on oil markets.

While BP has no plans to change its US onshore oil output, if prices remain low then it may moderate its activity in the Permian Basin, which straddles West Texas and southeast New Mexico, Auchincloss said.

(Updates with CEo comment from the 13th paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Woodside gives green light to massive Louisiana LNG project

China Re-Exports Record Monthly Volume of LNG on Weak Demand

Alaska LNG project aims to transform US energy exports to Asia

US Eyes Post-War Joint Business With Russia in Energy, Metals

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

China May Exempt Some US Goods From Tariffs as Costs Rise

Spain Wants EU to Keep Methane Goals in Search for LNG Supplies

Booming Power Demand Means Longer Wait for GE Vernova Customers

US Widens Sanctions on Iran to Target Lucrative Gas Exports