China Stops Imports of US LNG Amid Trade War, Custom Data Shows

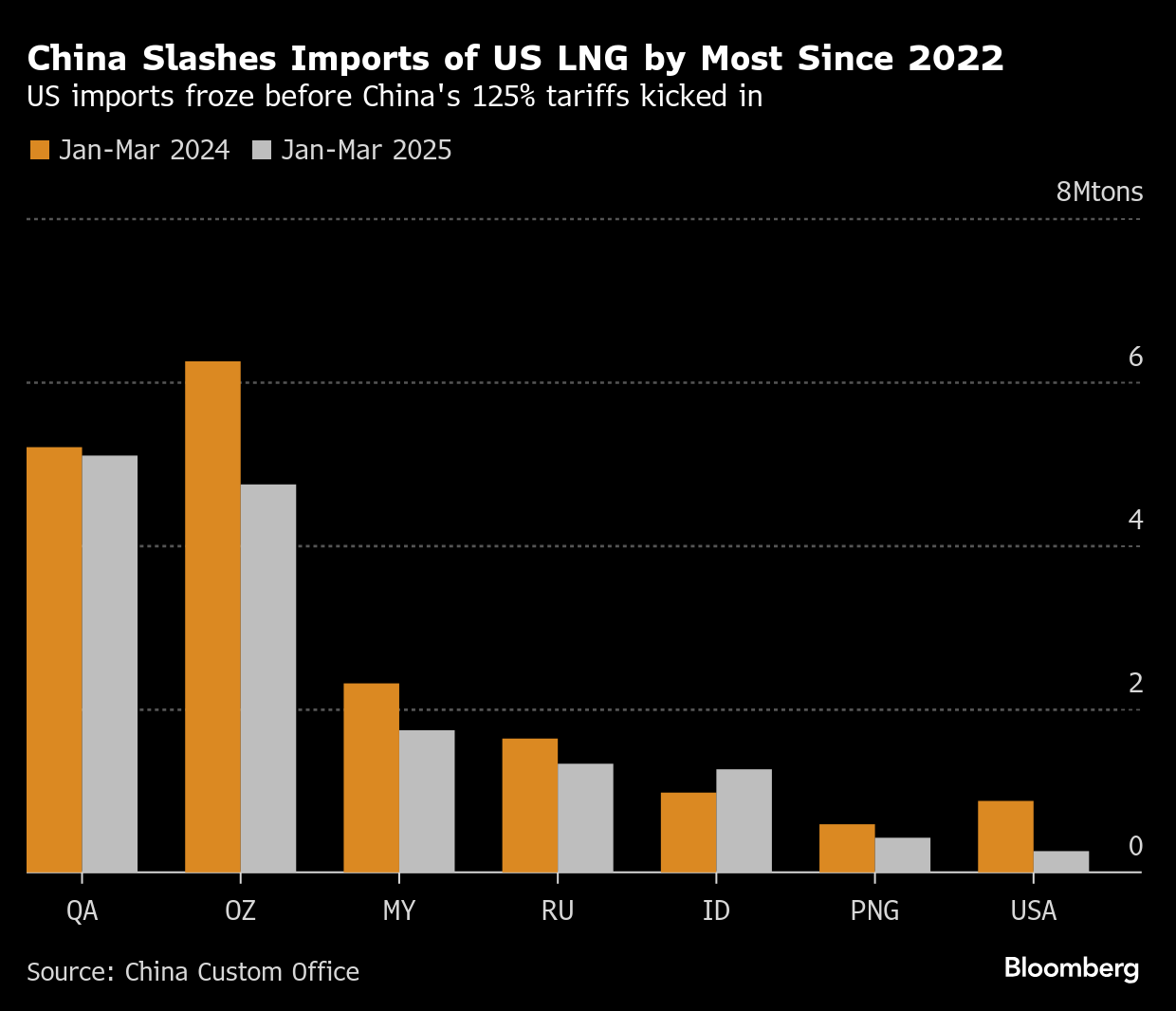

(Bloomberg) -- China’s purchases of US liquefied natural gas plunged to zero in March after a sharp decline in the previous two months, as the trade war between the two biggest economies alters shipping routes.

Overall delivery of US LNG shipments in the first quarter of 2025 fell by 70%, according to Chinese official custom data released on Sunday. The hiatus is the longest since the last trade war triggered during US President Trump’s first tenure, when China didn’t receive cargoes for about 400 days.

The geopolitical conflict is once again decoupling the world’s largest LNG buyer and seller. An escalation in mutual tariffs has led China to impose a 125% tariff on all US goods, turning to Indonesia and Qatar for supplies.

Imports of the super-chilled fuel have been lower than the previous year for five months in a row, with a 24.5% drop in March marking the biggest slump since November 2022. Pipeline gas, mainly from Russia, posted a marginal increase in the first quarter, though total volumes remained lower than seaborne shipments.

China has been relying on coal and renewables rather than on the spot LNG market to shield its energy security against trade turbulence, according to BloombergNEF’s analyst Daniela Li. The country may see minimal growth in its total gas consumption this year, and may slash LNG imports by as much as 12% compared with last year if tariffs remain above 100% for the next six months, she said.

More News:

- KUFPEC Australia, a unit of Kuwait Foreign Petroleum Exploration Co., sold an LNG cargo for June 5-9 loading from Australia’s Wheatstone plant

- Hai Linh purchased a commissioning cargo for delivery in the second half of May to the Cai Mep LNG terminal in Vietnam

- A partial LNG cargo was likely exported from the Idku facility in Egypt on the Santander Knutsen vessel around April 20, according to ship-tracking data compiled by Bloomberg

- A total of 11 ballast LNG vessels are waiting near the Bintulu export plant in Malaysia, according to ship-tracking data compiled by Bloomberg, indicating that the facility will need to work through a backlog of shipments as it ramps up output

- The Sputnik Energy vessel, which last year exported fuel from Russia’s Arctic LNG 2 plant sanctioned by the US, is currently passing through South Korea and is heading toward China

Drivers:

- Estimated flows to all US export terminals were ~15.5 bcf/day on April 20, -4.6% w/w: BNEF

- China’s 30-day moving average for LNG imports was 158k tons/day on April 16, 29% lower than this time last year, according to ship-tracking data compiled by Bloomberg

- European gas storage levels were ~37% full on April 19, compared with the five-year seasonal average of ~47%

Buy tender:

Sell tender:

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

China’s Shipowners Seek to Continue Talks With US on Levies

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps

Uniper and Woodside sign LNG supply agreements

Vista Buys Petronas’ Argentina Oil Stake in $1.5 Billion Deal

Emerson launches Global LNG Solutions Centre in Qatar

Woodside hires Mexico Pacific CEO Sarah Bairstow as Louisiana LNG head

US Junk Bond Market Defrosts After Long Period Without Deals

China’s US Decoupling Collapses Trade in Key Petroleum Product