Germany Faces Gas Storage Challenge as Italy Adopts Subsidy

(Bloomberg) -- Germany’s bid to rebuild depleted natural gas inventories as the summer refilling season gets under way is leaving it at the mercy of market prices. That’s in contrast to Italy, where subsidies are encouraging stockpiling.

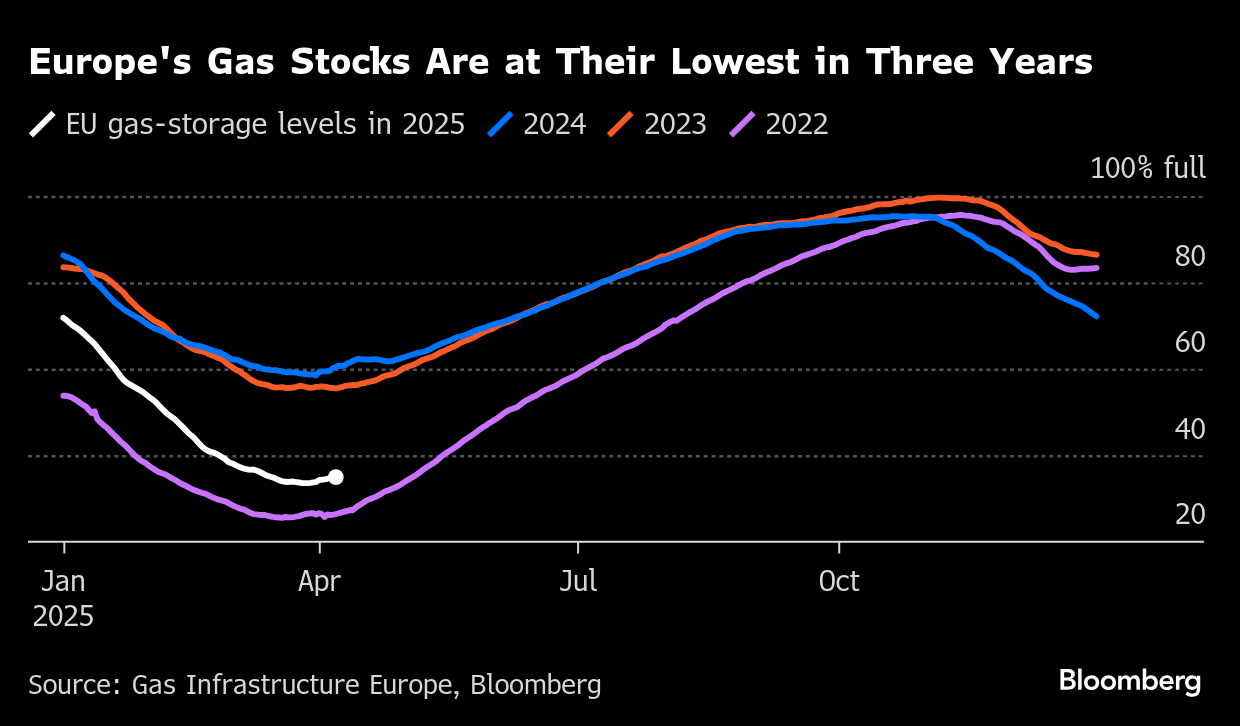

Germany holds Europe’s largest storage sites, and its ability to re-inject gas in the coming months will be crucial to the region meeting its targets after ending the heating season with the smallest stockpiles since 2022. It has recently been uneconomical to refill, as traders need winter gas to trade much higher than summer contracts to turn a profit after factoring in costs such as storage.

Capacity auctions this week underlined the importance of that price spread. After storage was offered Tuesday, German state-owned firm Securing Energy for Europe GmbH said the number of bidders was limited and that allocating capacity remains “challenging.” It saw strong interest on Wednesday after collapsing global energy prices meant the spread moved briefly in support of storage. But an auction Thursday again saw lower uptake.

Italy, however, is finding it easier to attract storage requests, regardless of what prices are doing. The country now offers incentives to store gas, and there were too many requests to inject the fuel in most auctions this week.

That’s highlighting a dilemma for European Union governments. They can either pay up via subsidies to encourage storage now, or let the market take its course and risk facing much higher costs if a crunch emerges later this year.

“The recent selloff in gas prices and the reversal in seasonal spreads has been a welcome market move for operators seeking to auction gas-storage capacity,” Rabobank strategist Florence Schmit said. “Yet refilling storage sites to mandated capacity will remain a key challenge this summer, with seasonal spreads only in moderate contango.”

Weak demand in summer typically encourages traders to stock up on cheaper fuel and sell it in winter. But that dynamic was disrupted in recent months as summer gas fetched an unusual premium to winter contracts, making storage unviable.

At the same time, prices and seasonal spreads are prone to intense volatility as the markets grapple with abrupt shifts in US tariff policy, as seen this week.

With the market much tighter than it was this time last year, that’s stoking concern over whether European reserves will be adequate for the next heating season. Insufficient inventories would leave the region vulnerable to shortages and price spikes. But there’s a risk nations may end up overpaying if they step in to subsidize injections now, especially those struggling economically.

Germany’s market manager, Trading Hub Europe GmbH, shocked traders earlier this year when it suggested storage incentives, but there’s no sign yet of them being introduced, despite the proposal coming well before Italy’s own subsidies. German underground sites are currently less than 30% full.

Italian Interest

Italy earlier this month introduced a measure whereby traders who put the fuel into storage would be paid the difference if summer gas wasn’t cheap enough compared with winter contracts to guarantee profits. Those subsidies were the main driver of interest in auctions this week, traders said.

Italy is heavily dependent on gas, and that reliance may increase even more this year as hydropower reserves have slumped.

The incentives are set to be in place until the nation’s storage sites are 90% full — the crucial threshold for all EU states. Storage facilities in the country, whose capacity ranks behind only Germany’s, are 43% full.

Storage operators have seen strong interest since the Italian subsidies came in, though other nations may wait to see how the trade war impacts price spreads before introducing incentives, Energy Aspects analyst Daniela Miccoli said.

Seasonal auctions can be held to book storage space for up to 12 months ahead until the heating period ends in March. Traders can lock in profit by trading the spread, with the actual injections coming at any point until around October, followed by withdrawals when the weather turns colder.

The premium that summer gas had commanded over winter has disappeared lately, helping to restore some of the financial incentive for stockpiling. Still, traders and officials remain on alert given the risk of a volatile market.

Future auctions should shed more light on traders’ appetite for storing fuel, especially as summer progresses.

“There are still large unbooked volumes, particularly in Germany, which might lead to a late-season scramble to add stockpiles if early-summer injections remain weak,” BloombergNEF analyst Arham Muhammad said. Given the uncertainties in the market and volatile prices, other countries might also have to turn to subsidies to ensure storage refilling, he said.

(Updates with German auction in third paragraph, Italian hydropower in 12th.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Japan Doesn’t Plan to Use US Treasuries as Tariff Talk Leverage

FTC Bans on Executives Joining Exxon, Chevron Boards Tested

Trade War to Slash China’s Demand for Plastic Feedstock From US

A $20 Billion Gas Plant Exposes Australia’s Energy Conundrum

Woodside announces Louisiana LNG partnership with Stonepeak

Trump Schedules Tariff Talks But Plans 104% Hit on China

NextDecade and Aramco execute 1.2 MTPA LNG agreement from Rio Grande LNG Train 4

Shell Cuts Gas Output Guidance on Unplanned Maintenance

China Halts US LNG Imports in Longest Run Since Last Trade War