Carbon Credits Needed for Hard to Curb Emissions, Woodside Says

(Bloomberg) -- Woodside Energy Group Ltd. sees a continued role for carbon credits because of the projected costs of tackling difficult-to-abate emissions.

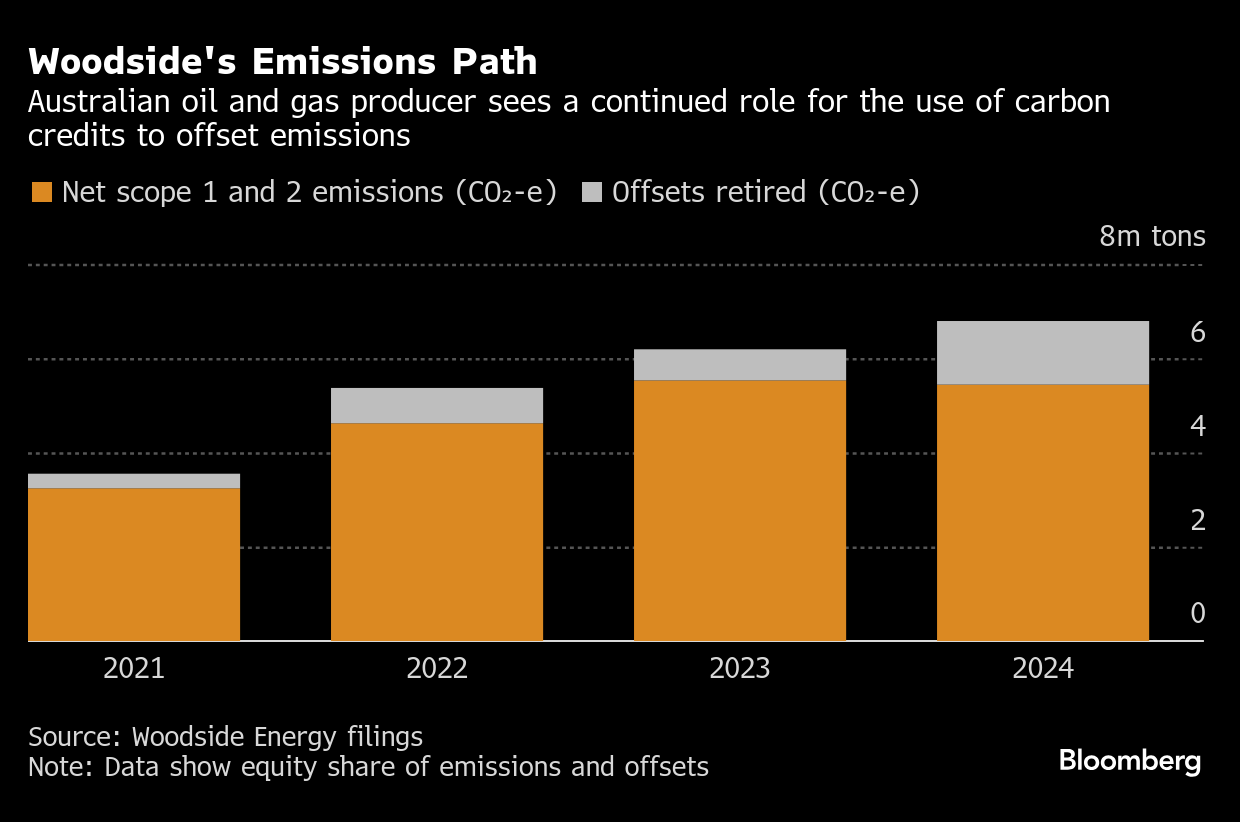

Australia’s biggest oil and natural gas producer retired about 1.3 million credits last year and manages a portfolio of more than 20 million, it said Tuesday in an annual report. Using “credits as offsets remains an important part of Woodside’s approach to Scope 1 and 2 GHG emissions, due to the high potential cost of large scale abatement options,” it said.

Some previous corporate users of credits have limited or halted purchases to focus on emissions reduction, and amid investor concerns about offsetting strategies. Issuance of voluntary carbon offsets fell 4% in 2024 on the previous year on weaker demand, according to BloombergNEF.

In meetings last year, some Woodside investors called on the producer to use fewer credits, while others backed the tactic provided it prioritizes its abatement work, and takes steps to manage the cost and quality of offsets, the company said in a separate document. Woodside holders last year rejected the company’s climate strategy in an advisory vote at an annual meeting.

Woodside’s share of gross scope 1 and scope 2 emissions rose to about 6.78 million tons of carbon dioxide equivalent last year from 6.19 million tons in 2023, partly due to the start of production from the Sangomar oil and gas field in Senegal.

Additional options to cut emissions at liquefied natural gas facilities include post-combustion carbon capture, hydrogen fueling and electrification, and have estimated costs of between $200 and $500 a ton, Woodside said. For other segments like non-routine flaring, the use of credits is currently the only viable option, according to the company.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

China’s US Decoupling Collapses Trade in Key Petroleum Product

FTC Bans on Executives Joining Exxon, Chevron Boards Tested

EPA to Scale Back Emissions Reporting Plan, ProPublica Says

Trade War to Slash China’s Demand for Plastic Feedstock From US

Germany Faces Gas Storage Challenge as Italy Adopts Subsidy

A $20 Billion Gas Plant Exposes Australia’s Energy Conundrum

Woodside announces Louisiana LNG partnership with Stonepeak

Trump Schedules Tariff Talks But Plans 104% Hit on China

NextDecade and Aramco execute 1.2 MTPA LNG agreement from Rio Grande LNG Train 4