Exxon, Chevron Brave DeepSeek Risk to Chase AI Future as Oil Glow Fades

(Bloomberg) -- Big Oil was once the antithesis of the asset-light, hyper-growth world of Silicon Valley. Now it’s looking to Big Tech to stay relevant.

Exxon Mobil Corp., Chevron Corp. and Shell Plc’s fourth-quarter earnings suffered from a familiar trend of too much fossil fuel supply and not enough demand, causing refining margins to collapse. All three are now betting at least part of their future lies in supplying the energy needed for America’s tech giants to win the race for artificial intelligence supremacy.

But those plans took a significant knock this week when China’s low-cost DeepSeek AI model appeared to rival those of OpenAI and Meta Platforms Inc. despite using a fraction of the power, potentially slashing the need for expensive, power-hungry data centers. Even so, the world’s largest oil companies are betting on growing demand for electricity generated from natural gas in a future where crude consumption peaks due to the energy transition.

“DeepSeek actually underscores how competitive global and urgent the race for AI leadership is,” Chevron Chief Executive Officer Mike Wirth said in an interview. “We will see the use of these models proliferate across the economy. Demand for AI, the demand for power will grow and reflect that.”

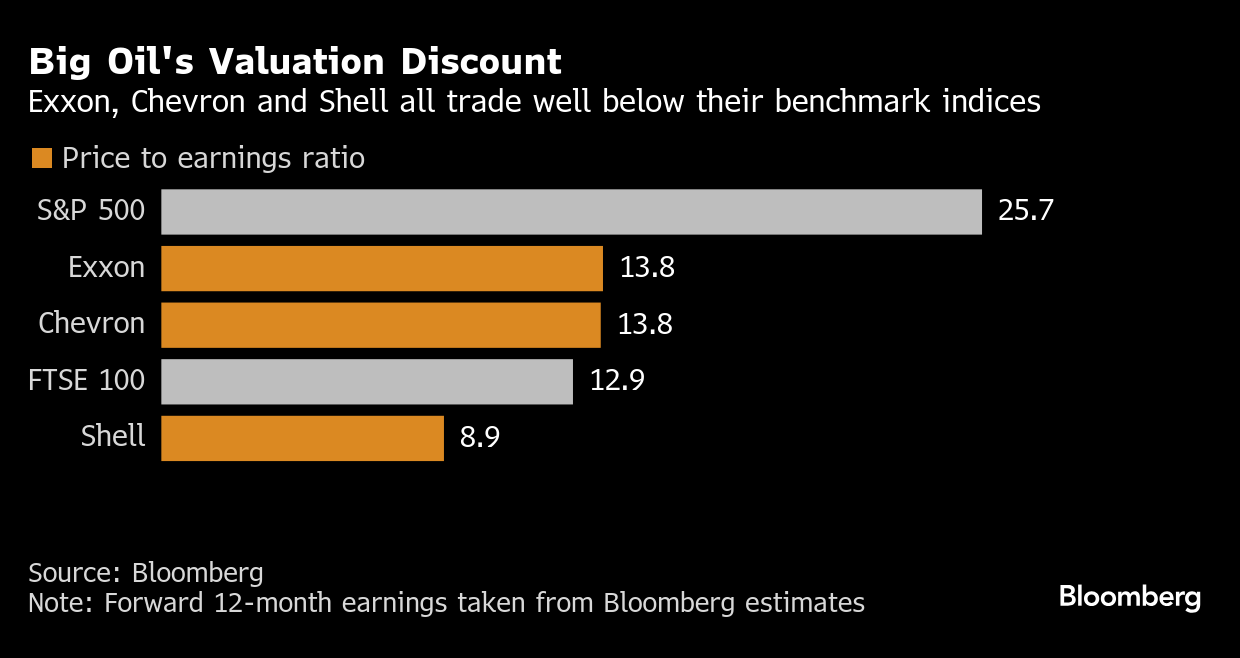

Big Oil has made buybacks and dividends the cornerstone of its pitch to Wall Street as the prospect of peak oil demand looms. But there are signs the strategy is reaching its limits — Exxon paid out nearly all of its roughly $36 billion in free cash flow last year yet still trades at a 46% discount to the S&P 500 Index average. Executives see the future in talking up demand for natural gas and its ability to serve as feedstock for the data centers needed for artificial intelligence.

“We’re also well-positioned to meet surging demand from data centers for low-carbon power, and on a timetable that alternatives such as nuclear simply can’t match,” Exxon CEO Darren Woods said on a call with analysts. DeepSeek “hasn’t impacted the conversations to date that we’re having with our customers.”

The US is now the world’s biggest oil producer, pumping almost 50% more each day than Saudi Arabia, and recently overtook Australia and Qatar as the biggest liquefied natural gas exporter. Yet energy stocks make up just 3.2% of the S&P 500, less than half the level a decade ago.

“It’s a point of frustration,” Wirth said in a conversation with Goldman Sachs Group Inc. CEO David Solomon last month. “We are underappreciated in the investment community.”

Part of Big Oil’s discounted valuation is due to to its addiction to capital spending, especially the over-budget megaprojects that swallowed up billions of dollars in the 2010s and dragged down equity returns for years later. Another part is investor concern over the sustainability of dividends and buybacks due to the energy transition, despite the expectation oil consumption will reach record levels this year and next. Volatility of commodity-price swings is another consistent drawback for fossil fuels compared with the cash-flow behemoths of Big Tech.

But rather than compete with the Big Tech firms, Big Oil wants to join them. Every industry conference and investor presentation is filled with optimistic projections of power demand needed for the data centers behind artificial intelligence and computer processing.

Exxon and Chevron were clear their ventures into power won’t transform their businesses into utilities. Chevron will form partnerships to meet the specific needs of hyperscalers like Amazon.com Inc. or Meta while Exxon’s focus will be on providing low-carbon power through its carbon capture business. Shell wants to use its solar energy and battery storage arm as well as its newly acquired natural gas plant in Rhode Island.

“It’s still early days in terms of how profitable and how large this market can be,” said Nick Hummel, a St. Louis-based analyst at Edward Jones & Co. “But it’s clear AI infrastructure will need to grow in the United States. The big energy customers, the hyperscalers of the world don’t seem to be pulling back the throttle yet.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Spain Wants EU to Keep Methane Goals in Search for LNG Supplies

Booming Power Demand Means Longer Wait for GE Vernova Customers

US Widens Sanctions on Iran to Target Lucrative Gas Exports

China Stops Imports of US LNG Amid Trade War, Custom Data Shows

China’s Shipowners Seek to Continue Talks With US on Levies

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps

Uniper and Woodside sign LNG supply agreements

Vista Buys Petronas’ Argentina Oil Stake in $1.5 Billion Deal