Gas Traders Leave Essen Hungry for More on German Storage Plans

(Bloomberg) -- Energy traders flocked to a conference in Germany this week from as far away as Tokyo, seeking clues on how the nation plans to fill up its gas buffers this year. They’re leaving with few answers and even less conviction that the moves being discussed will help ease price volatility.

The central event of the week was a presentation by Trading Hub Europe GmbH, or THE, a small company responsible for the smooth functioning of Germany’s gas market. It shocked traders in January when it published complicated slides on talks with authorities about a possible subsidy for fuel stockpiling, causing a spike in prices.

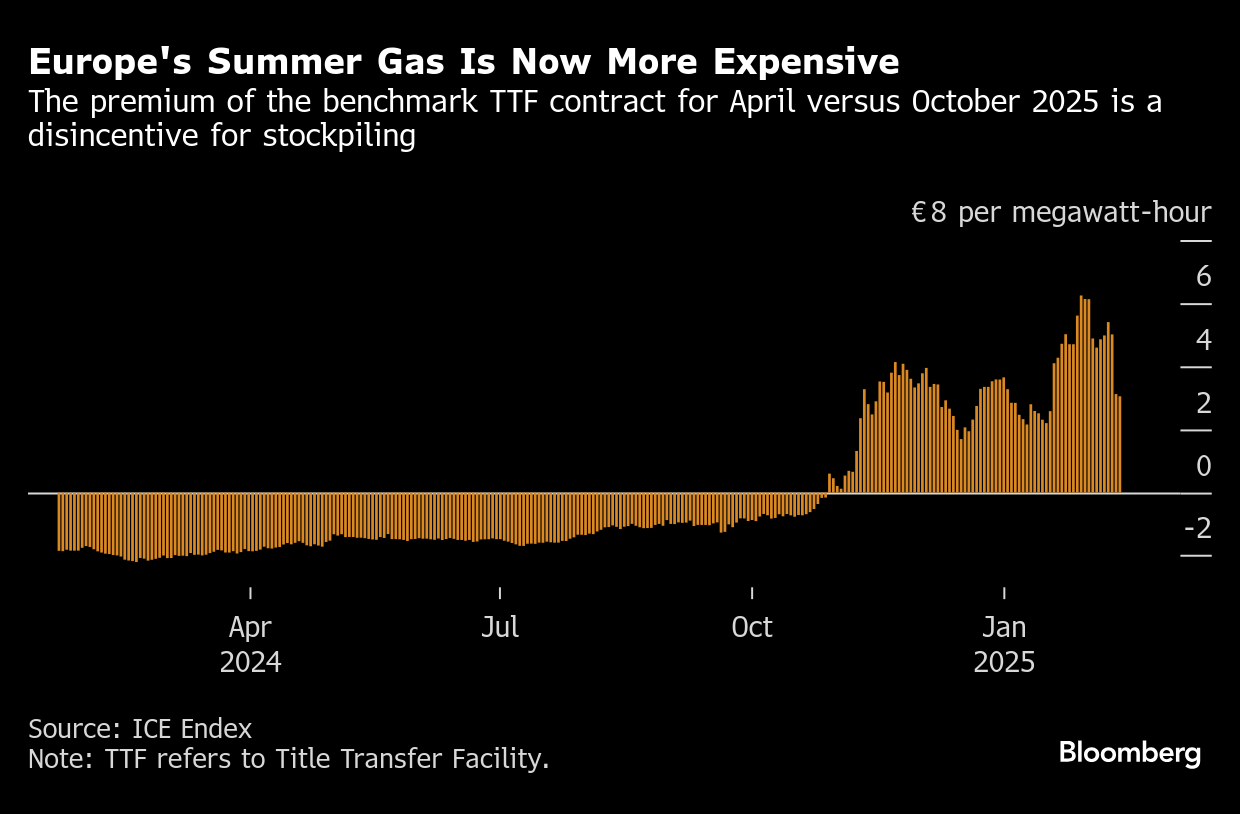

The summer-winter spread is being closely watched by traders after a testing winter — with colder weather and sparse renewables output — has strained Europe’s gas reserves, which have become an important cushion since the energy crisis. Expectations for a challenging stockpiling season have driven up summer prices, discouraging buyers from purchasing fuel to inject into storage sites.

Market participants eager to learn more about THE’s plans filled a cramped room at the Essen-based E-World conference on Tuesday, with only one representative from each company allowed to attend. Names were checked at the door, and the interest was so big that some had to sit on window sills for two hours.

One trader from an international trading firm said they’d been sent to Essen to get intel on the subsidy and bring back trading ideas. After the briefing, they said they felt they had nothing.

“If governments leave it to the market, the market will solve it, but it might be in a way which means that storage levels would fall significantly short of the wanted level,” said Helge Haugane, senior vice president for gas and power at major supplier Equinor ASA, on the sidelines of the same conference.

The summer-winter spread has receded steeply in recent days, suggesting a growing conviction in the market that the tool may not materialize after all, especially amid calls for more flexibility for this year’s targets. Adding to the bearish sentiment are US-Russia talks about ways to end to the war in Ukraine, raising expectations that supplies from Moscow will resume.

To protect against possible shortages, Germany has legally-binding targets for refilling storage sites ahead of the heating season. THE’s hope is that partially covering suppliers’ costs will incentivize them to restock, but others worry the intervention will drive up summer prices further and make it harder for other European countries to buy fuel.

THE didn’t elaborate details or timelines for its plan when it faced representatives from the energy industry but instead repeatedly said that the subsidy plan may not come at all and that no tender is imminent yet, which would be up for German’s economy ministry do decide.

One concern is that it would raise energy bills for businesses and households, as any subsidies would likely have to be financed via a surcharge. An economy ministry spokesperson told Bloomberg this week an intervention would be “challenging” amid a provisional budget framework, with the country heading for federal elections later this month.

But the cost of not acting early to prevent shortages could also be damaging.

“In a scenario when it gets colder than expected, there could be very high price spikes, which could mean serious distress,” said Equinor’s Haugane. “Seen from the government side, I can understand how they say, okay, rather than avoiding that downside scenario, it’s better to take some pain up front.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Thaksin Vows Cheaper Power to Turn Thailand Into Data Center Hub

Oil’s Houston Homecoming Overshadowed by Trade War, Price Drop

US Quietly Tightens Russia Sanctions as It Seeks Ceasefire Deal

Arctic Weather Blast to Put Strain on Europe’s Energy Systems

UK Carbon Prices Surge as Minister Talks About EU Market Linkage

TotalEnergies’ Mozambique LNG Poised for Decision on $4.7 Billion US Loan

European Gas Prices Pare Gain on Russia-Ukraine Truce Hopes

EU Leaders Call for Ukraine Gas Solution on Slovakia’s Push

UAE’s Adnoc Seeks Deals for Gas Fields in Major US Push