Moldova Seeks Deal to Keep the Lights on After Russia Cut Gas Supply

(Bloomberg) -- Oxana is running out of time. Along with thousands of others in Transnistria, the 38-year-old housewife is caught in a political tug-of-war that could see her home plunged into darkness next week.

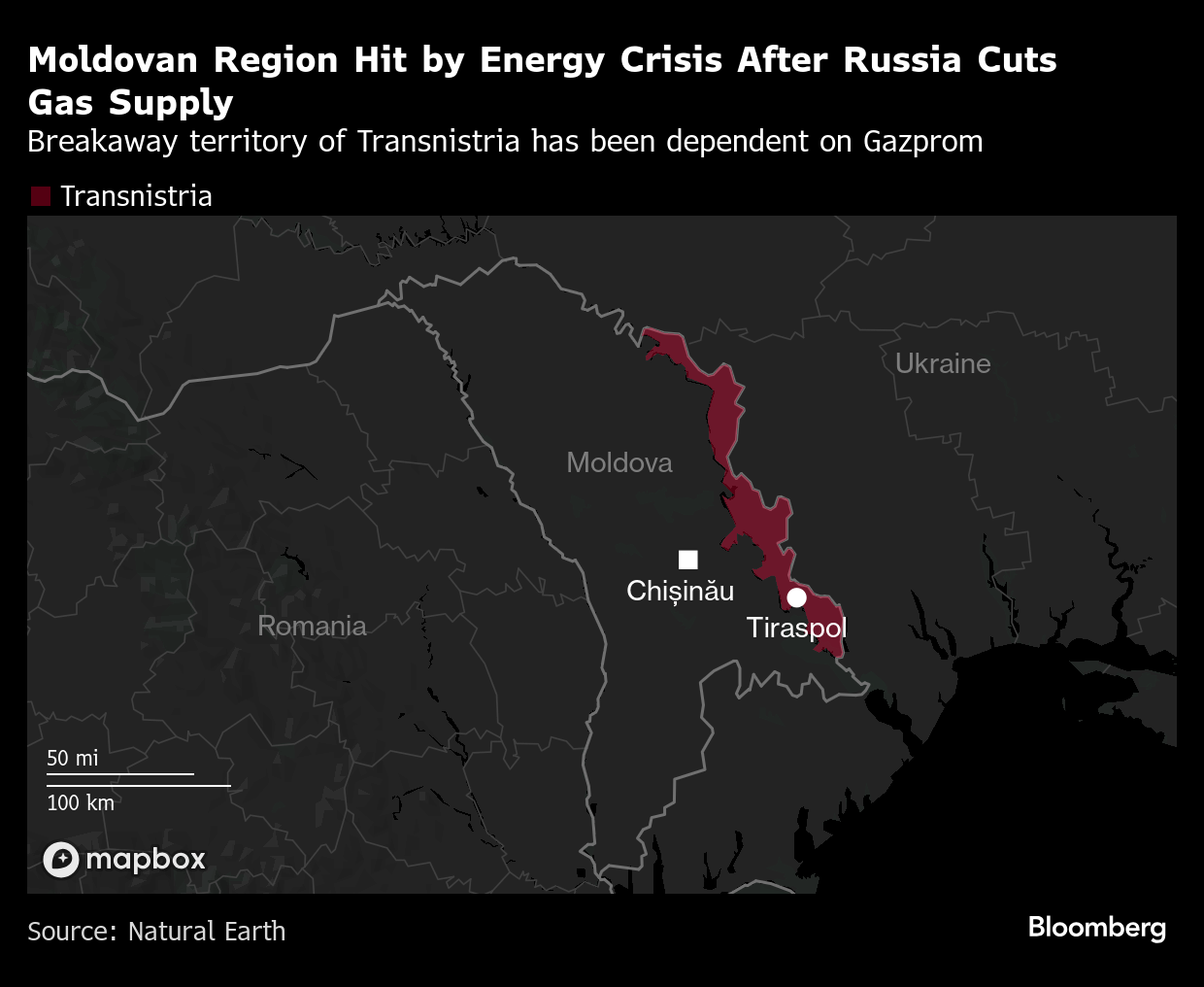

On one side is Russia — which has effectively provided Transnistria, the breakaway pro-Kremlin region in Moldova, with free gas for more than two decades. On the other is the Moldovan government, which has ambitions to join the European Union by 2030, and move away from Moscow’s orbit.

Russia’s gas giant Gazprom PJSC turned off supplies to Transnistria on Jan. 1 forcing it to halt almost all industrial activity, impose rolling blackouts and shut off central heating. Although it hasn’t bought any gas from Russia since late 2022, Moldova — a former Soviet republic — has also suffered from the collapse in supply, as it sources the majority of its electricity from Transnistria.

A €20 million ($21 million) portion of a European emergency package brought some respite and allowed gas purchases for Transnistria to temporarily halt the blackouts in the region.

That help runs out on Feb. 10.

If a deal between Moldova and Transnistria to restore longer-term gas supply isn’t agreed by Monday, Oxana’s lights and power could be cut off again just as an unusually mild January tips into a much colder February.

“We live day to day," says Oxana, who asked not to give her surname because of the sensitivity of the subject. “Right now we are waiting for Feb. 10 and hoping that politicians will finally come to an agreement. If they don't, then there will be no electricity, no heating.”

Moscow has previously been accused of weaponizing its energy supplies for political reasons.

Moldova’s President Maia Sandu — reelected in November after an election overshadowed by allegations of Russian interference — is a supporter of neighboring Ukraine in its conflict with Moscow and wants to join the EU within five years. Her government accused Russia of deliberately engineering the energy crisis to try and influence Moldovan parliamentary elections, scheduled for later this year. It also warned that a pro-Kremlin government in the country of 2.4 million people could allow Moscow to consolidate its military capacity in Transnistria, which already hosts 1,500 Russian soldiers.

Gazprom has traditionally been the sole gas supplier to Moldova, exporting around 3 billion cubic meters a year, with roughly two thirds going to Transnistria. It was the primary fuel used at the Moldavskaya GRES power station which produces electricity for the whole of the country. Although the Russian gas supply to the breakaway region continued until the end of last year, the rest of Moldova diversified in 2022, creating a gas trading unit inside the state-owned company Energocom to buy from European traders, according to Moldova’s energy ministry.

Since the early 2000s, the cost of the Russian gas flowing into Transnistria has exceeded $11 billion, according to estimates from the Moldovan energy ministry. But Gazprom has never asked for any payment. Households and companies paid for the gas they consumed and the Transnistrian authorities used those payments for budget needs, effectively converting the money into a form of subsidy from Moscow to the pro-Kremlin enclave.

The current crisis hinges on a much smaller debt of $709 million which Gazprom says Moldova — excluding Transnistria — owes it. The authorities in Chisinau, the Moldovan capital, believe the amount owed is much smaller, $8.6 million, and say they have an international audit to support their case.

“Why did a Russian gas producer start to focus on Moldova’s debt only in 2021,” asks Constantin Borosan, Moldova’s state secretary for energy, in an interview. “Maybe because since 2020, we have had a pro-European government. It became clear in 2022 that we needed to fight against Gazprom’s blackmail.”

Gazprom didn’t immediately respond to a Bloomberg request for comment.

Keeping the Gas On

Transnistria is a sliver of mainly Russian-speaking territory on the left bank of the Dniester river. Home to more than 350,000 people and adjacent to Ukraine, the landlocked breakaway state is recognized as part of Moldova, but it has had a strained relationship with the central government since it fought a brief separatist war with it in the early 1990s.

With no sign from Gazprom that it will restore gas flows to Transnistria, the leader of the self-proclaimed region, Vadim Krasnoselsky, visited Moscow in January to ask for help. Krasnoselsky said he returned with a promise from Russia that it would loan money to Transnistria allowing it to finance gas purchases through a local distributor, Tiraspoltransgaz, via a long-term contract with Moldovan gas company Moldovagaz. But he gave few details, adding only that a European company would supply the gas.

This intricate process involves Tiraspoltransgaz paying Moldovagaz which then passes that money on to suppliers to deliver the fuel to the western border of Moldova. At that stage Moldovagaz ships it into Transnistria. But the Moldovan company and officials have to walk a legal tightrope to ensure that the trades don’t violate EU rules and practices, including sanctions on Russia.

Moldovagaz is pivotal. It’s the only Moldovan company legally allowed to deliver gas to Transnistria. “It’s the most difficult period in my career,” says Vadim Ceban, the acting director of Moldovagaz, in an interview, “we’re running out of time.”

Counting the ‘Price of Freedom’

For Moldova there are also major costs. The country was reliant on cheap electricity produced in Transnistria. Since Jan. 1 Moldova has had to replace that by boosting imports of electricity from Romania and paying much higher prices.

“It was easy with Moldavskaya GRES, which covered our consumption, especially in peak hours,” says Eugeniu Buzatu, the acting head of Energocom. “Now we need to book capacities even on a day-ahead basis on the power exchange.”

To reflect increased costs for imported electricity, the government has raised tariffs by 65% to 75% in one of Europe’s poorest countries. “Why do I need electricity that I can’t pay for? I’d rather sit in the dark,” says Anastasia Anina, who lives in the village of Copanca, which is connected to Transnistria’s power grid and has suffered severe power outages.

The main target for the villagers’ anger is not Russia, but Sandu, the Moldovan president, and the authorities who have been accused of trying to lock them into an electricity grid where the prices are almost five times higher than they previously paid.

Daniel Voda, spokesman for the Moldovan government, said in late December that such hardships were “the price of freedom” from a dependence on Russia. But Copanca reflects a stark reality for the authorities ahead of elections: Not all voters in Moldova believe it’s a freedom they can afford.

The EU has agreed a two year financial package with Moldova to completely wean it off Russian energy which would amount to €250 million in 2025. It would allow the government to compensate households for some “excess electricity costs” and help schools and hospitals deal with higher prices. A portion is also earmarked for investment in energy projects.

Another €60 million in EU funding has been made available to Transnistria, but the European Commission has made that offer “subject to steps being taken on fundamental freedoms and human rights.” The authorities of the self-proclaimed Transnistria region haven't yet responded to the offer.

For Oxana the demands are simple. She just wants to know that she will have electricity after Monday. “We hope that after Feb. 10 there will be no blackouts, we're hoping for the best.”

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

China Re-Exports Record Monthly Volume of LNG on Weak Demand

US Eyes Post-War Joint Business With Russia in Energy, Metals

Hedge Funds Seek Out Ways to Navigate Trump’s Anti-Climate Agenda

China May Exempt Some US Goods From Tariffs as Costs Rise

Spain Wants EU to Keep Methane Goals in Search for LNG Supplies

Booming Power Demand Means Longer Wait for GE Vernova Customers

US Widens Sanctions on Iran to Target Lucrative Gas Exports

China Stops Imports of US LNG Amid Trade War, Custom Data Shows

China’s Shipowners Seek to Continue Talks With US on Levies