Russia, Turkey Discuss Gas Swap to Pay for Nuclear Plant

(Bloomberg) -- Russia is in talks to use natural gas to pay for the construction of a nuclear power plant in Turkey, according to people in both countries with knowledge of the matter, as an alternative to cross-border transfers that are being held up by sanctions.

Russia proposed that Turkey take over some of the building costs of the $20 billion Akkuyu plant from state-run developer Rosatom, the people said, asking not to be identified as the talks are private. Rosatom would pay the equivalent amount in rubles to gas exporter Gazprom PJSC, which would in turn deduct it from Ankara’s monthly import bill for the fuel.

The proposed swap would offer an alternative to conventional international bank transfers from Russia to Turkey that have funded the megaproject so far.

Neither Rosatom, Gazprom nor the Akkuyu project itself are sanctioned, but payments to and from Russia have increasingly faced delays because foreign banks fear exposure to US penalties, particularly since June when Washington said it would clamp down on third-country financial institutions that deal with Russia’s war economy.

It’s the latest example of Russia’s creative ways to get around efforts by Washington and its allies to isolate Moscow over the war in Ukraine. It also shows how western sanctions have hampered a flagship energy project in Turkey, a key NATO ally that’s sought to position itself as a neutral broker between Russia and Ukraine.

Turkey’s gas payments to Russia typically range between €300 million to €800 million per month, depending on consumption, one of the people said.

Rosatom and Turkey’s energy ministry declined to comment. Gazprom didn’t respond to requests for comment.

The US froze $2 billion of Russian payments to Turkey for Akkuyu in 2024 on suspicion that the transfers were being used to circumvent sanctions on Russia’s central bank, the Wall Street Journal reported on Feb. 2, citing people familiar with the matter.

Rosatom expects the issue of “funds that have been unjustly withheld through third parties’ influence” to be resolved, a company spokeswoman told the paper.

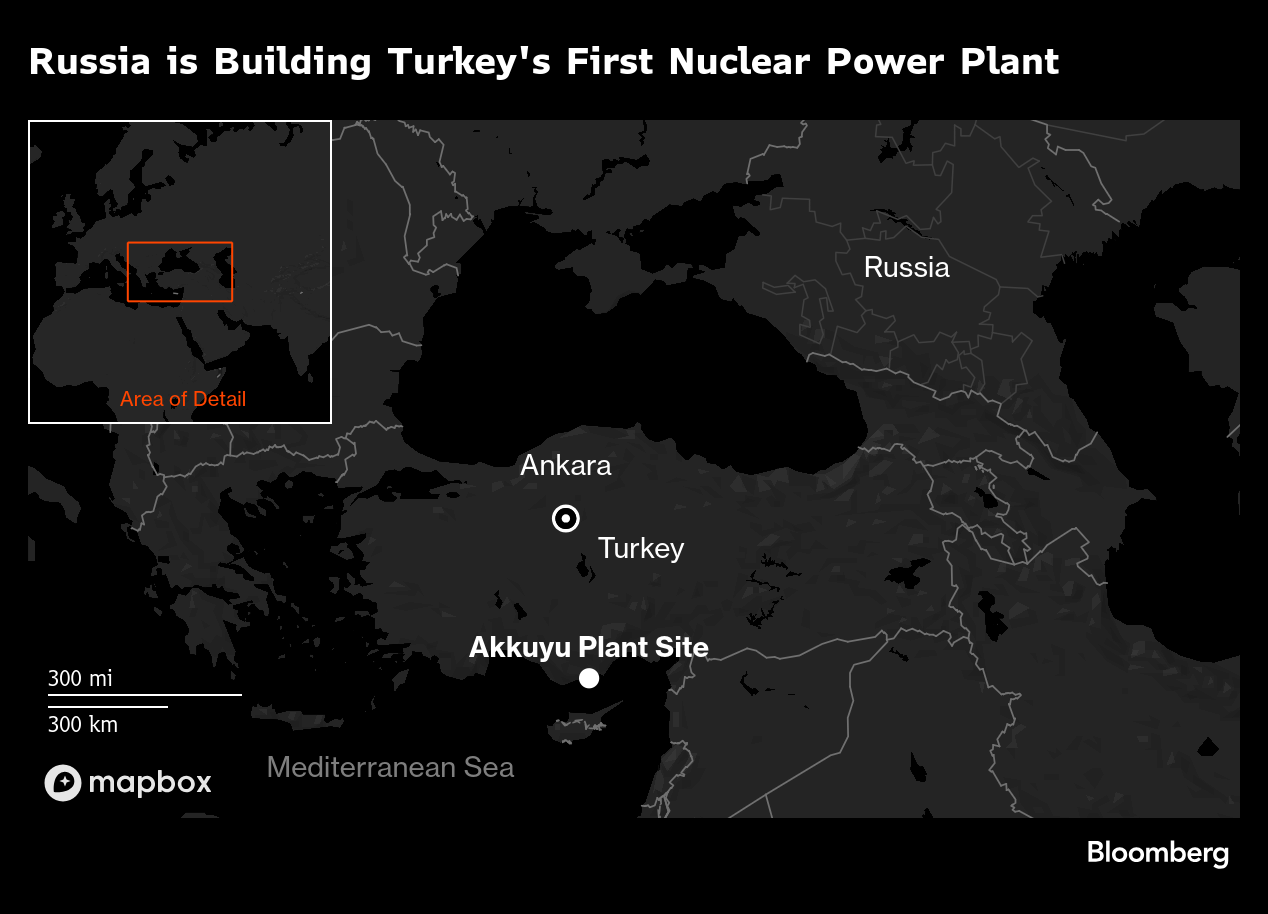

Akkuyu, Turkey’s first nuclear power plant, has already been delayed multiple times. Commissioning of the first of the 4,800MW plant’s four reactors may now be pushed back to 2026 from the currently scheduled 2025, according to Turkish officials.

Rosatom had already been forced to seek alternative parts from China for the project after an initial order with Germany’s Siemens Energy AG fell through due to US export controls.

Russia is Turkey’s top gas supplier, providing 42% of all its imports in 2023, the latest available full-year data, according to Turkey’s Energy Market Regulatory Authority.

Turkey got a sanctions exemption from the US late last year to allow it to continue importing Russian gas after Gazprom’s banking arm was sanctioned.

Once completed, Akkuyu is expected to supply 10% of Turkey’s electricity demand. Ankara wants to build two more full-scale plants as well as small modular reactors to generate a total 20,000MW of nuclear power by 2050, and has held talks with Russia, China and South Korea for the projects.

(Adds map of power plant location.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps

Uniper and Woodside sign LNG supply agreements

Vista Buys Petronas’ Argentina Oil Stake in $1.5 Billion Deal

Emerson launches Global LNG Solutions Centre in Qatar

Woodside hires Mexico Pacific CEO Sarah Bairstow as Louisiana LNG head

US Junk Bond Market Defrosts After Long Period Without Deals

China’s US Decoupling Collapses Trade in Key Petroleum Product

bp announces oil discovery in the Gulf of America