China’s Richest Regions Cut Electricity Prices to Protect Industries

(Bloomberg) -- More Chinese regions are cutting electricity prices to help out their embattled industries, which is likely to worsen the squeeze on profits at power suppliers.

The richest coastal provinces have reduced their benchmark thermal power prices by about 10% from last year, according to a briefing by UBS Group AG this week. The bank expects power demand for coal, the country’s mainstay fuel, to fall by 4% in 2025.

China’s factories are contending with a weak economy at home, stemming from the country’s yearslong real estate crisis, and the threat of a trade war with the incoming Trump administration. At the same time, power supplies are plentiful, with fossil fuel and renewables output all at record levels. That’s creating room for regional governments to ease the cost burden on their local industries, albeit at the expense of energy suppliers.

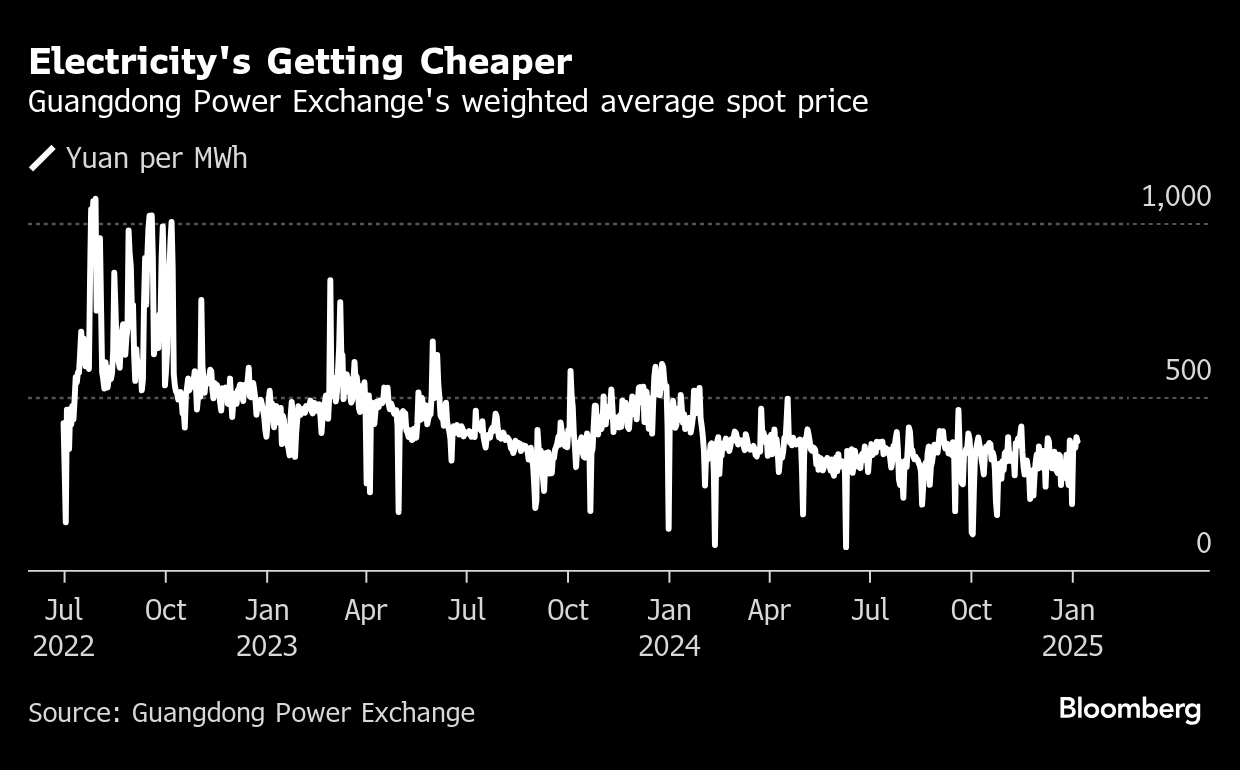

Jiangsu province, the industrial powerhouse that surrounds Shanghai, trimmed its annual power contracts by 8.9% to 412.5 yuan ($56) per megawatt hour at the end of last month. Anhui to the west has cut by 10%, according to SDIC Securities Co., while Guangdong has lopped off 16%.

Lower rates will continue to shrink coal and gas profits, UBS analyst Ken Liao said Monday in Beijing. “If the property sector fails to recover, it will cap new installations.” he said. “Thermal power prices may drop 10% on average.”

China’s industrial firms saw their profits fall in November for a fourth straight month, leaving them on track for the sharpest annual decline since records began in 2000. The crash in coal prices to near four-year lows has cut mining profits by over a fifth from the previous year. The utilities that produce electricity have fared better because of cheaper feedstock costs.

But the drop in power prices mandated by local authorities will weigh on margins across the supply chain. And the changes afoot in the industry promise more pain to come. Solar firms in particular have been hammered by China’s bid to deregulate power trading, which will replace government-fixed pricing by 2030, after spot prices fell across multiple provinces, according to news outlet hxny.com.

On the Wire

Investors in China’s $11 trillion government bond market have never been so pessimistic about the world’s second-largest economy, with some now piling into bets on a deflationary spiral mirroring Japan’s in the 1990s.

China’s Zijin Mining Group Co. aims to start producing lithium in the Democratic Republic of Congo early next year from one of the world’s largest deposits of the battery metal.

Ports in the eastern Chinese province of Shandong, home to the world’s biggest buyers of Iranian crude, have been urged by their parent company to forbid sanctioned oil tankers from docking or offloading at their terminals, according to people with the knowledge of the directive.

This Week’s Diary

(All times Beijing unless noted.)

Wednesday, Jan. 8:

- CCTD’s weekly online briefing on Chinese coal, 15:00

Thursday, Jan. 9:

- China inflation data for December, 09:30

- China to release Dec. aggregate finance & money supply by Jan. 15

Friday, Jan. 10:

- Tianqi Lithium to offer lithium carbonate at first auction on SMM’s new trading platform, 09:30

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- China’s monthly CASDE crop supply-demand report

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

China’s Shipowners Seek to Continue Talks With US on Levies

EU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

Fracker Liberty’s Profit Falls to 3-Year Low as Oil Slumps

Uniper and Woodside sign LNG supply agreements

Vista Buys Petronas’ Argentina Oil Stake in $1.5 Billion Deal

Emerson launches Global LNG Solutions Centre in Qatar

Woodside hires Mexico Pacific CEO Sarah Bairstow as Louisiana LNG head

US Junk Bond Market Defrosts After Long Period Without Deals

China’s US Decoupling Collapses Trade in Key Petroleum Product