Europe Summer Gas Premium Surges as Germany Eyes Storage Subsidy

(Bloomberg) -- European natural gas for delivery this summer has become even more expensive than prices for next winter after Germany’s market manager said it’s discussing subsidies for refilling storage sites.

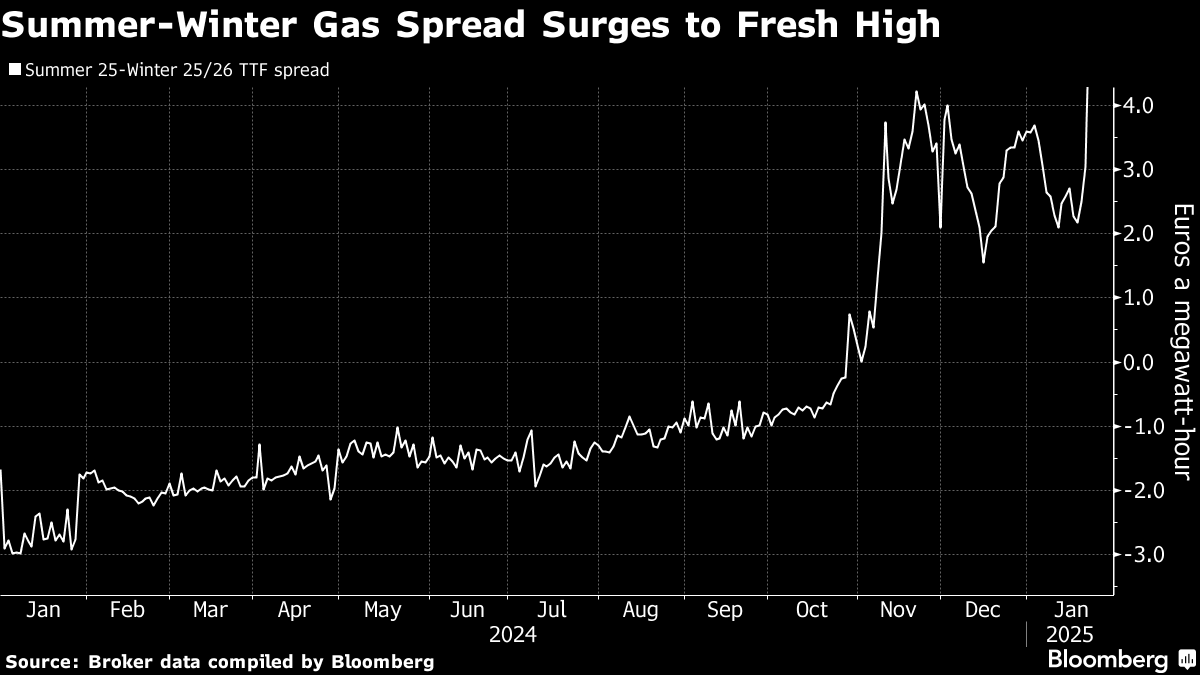

While benchmark futures retreated on Wednesday after a 4.5% jump in the previous session, the summer contract traded at the biggest premium to the following heating season since 2022.

The spread, which hit as much as €4.85 a megawatt-hour, started widening late last year due to concerns over supply tightness in 2025, and has drawn attention because it risks discouraging traders from stockpiling during warm months.

Maintaining sizable fuel inventories has become crucial for Europe’s energy security since it lost most Russian pipeline flows, as it provides a cushion against demand spikes during the heating season. Should Germany go ahead with subsidies for storage injections, it could put pressure on other gas-storing nations in Europe struggling to replenish reserves because of the widening price gap.

To incentivize storage refills, Germany’s natural-gas market manager Trading Hub Europe is discussing a possible subsidy with regulators, for which it unveiled the latest considerations on Tuesday. The premium widened further — doubling over the past two days — after the report was published, as it suggested that summer gas may be purchased despite higher prices.

“Interference in the market just works as an incentive to push the price higher in the front, making the situation even worse,” said Arne Lohmann Rasmussen, chief analyst at Global Risk Management in Copenhagen.

“The more states intervene with either subsidies for injections or penalties for non-filling, the more it will distort the price signals that would normally encourage firms to book storage,” said James Waddell, head of European gas and global LNG at Energy Aspects Ltd.

The cost of hedging against surging prices for the forthcoming stockpiling season has also gone up.

Meanwhile, traders are closely monitoring weather patterns in the US as a winter storm disrupted gas shipments from a major export plant and caused widespread transportation disruptions in the south of the country. The Freeport LNG complex has shut down, citing “intermittent” power interruptions.

Further moves from US President Donald Trump are also in focus. He said he’s likely to impose sanctions on Russia if President Vladimir Putin doesn’t come to the table to negotiate about the war in Ukraine. The US has already imposed sweeping energy sanctions on Russia, including on some of the nation’s LNG projects.

Dutch front-month futures, Europe’s gas benchmark, closed 2.6% lower at €48.72 a megawatt-hour. The summer premium over next winter contracts was €4.36 a megawatt-hour by 6 p.m. in Amsterdam.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Trump Says South Korea Talks ‘Good,’ Waiting for China Call

Shell Cuts Gas Output Guidance on Unplanned Maintenance

China Halts US LNG Imports in Longest Run Since Last Trade War

Texas Attempt to Kickstart New Gas-Fired Power Is Stumbling

Brookfield to Buy Colonial Pipeline Owner in $9 Billion Deal

US Energy Chief Plans to Use Federal Land to Build Data Centers

Eni Is Said to Discuss €13 Billion Valuation for Plenitude

Ecopetrol Eyes Buying Carlyle’s Colombia Asset to Boost Reserves

Shell finalises acquisition of Pavilion Energy