LNG WRAP: Asian Prices to Rise After Russia-Ukraine Transit Ends

(Bloomberg) -- The end of Russian natural gas flows to Europe via Ukraine is likely to boost competition with Asia and prices for alternatives.

Ukraine hopes increased supply of gas from the US and other producers to Europe will make prices more comfortable, President Volodymyr Zelenskiy said in a Telegram post on Wednesday. Russia’s invasion of its neighbor in February 2022 sparked an energy crisis in Europe that led to a jump in regional benchmarks and international liquefied natural gas prices.

“This is going to further tighten the LNG market,” Scott Darling, a managing director at Haitong International Securities, said on Bloomberg TV on Thursday. “Supply, particularly for LNG, is tight, and we see more upside risk to spot LNG prices this year and next.”

Gas flows from Russia to Europe via Ukraine halted on Wednesday, bringing to an end more than five decades of the key conduit for the region. While the move was expected after months of political wrangling, Europe will still have to replace about 5% of its gas and may rely more heavily on storage, which has fallen below average levels for the time of year.

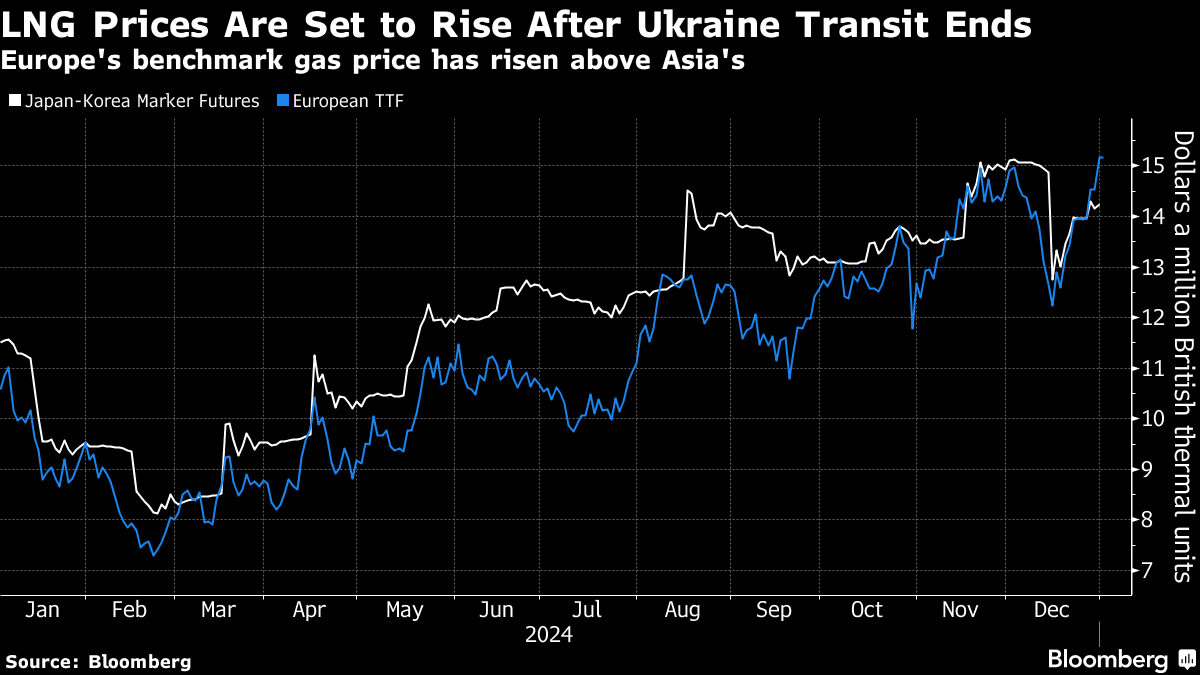

Prices rose in anticipation of the cut-off, with Europe’s gas benchmark closing 2024 up more than 50%. Those gains haven’t yet been fully reflected in the cost of the normally more-expensive LNG that nations including Japan and South Korea are heavily reliant on.

More News:

- Rupantarita Prakritik Gas Co. is seeking to purchase LNG cargoes for Jan. 30-31 and Feb. 6-7 delivery to Bangladesh

Drivers:

- LNG send-out in Europe was at ~3.2 TWh/day on Dec. 31, according to latest available data; +3.9% w/w: GIE data

- European gas storage levels were ~72% full on Dec. 31, compared with the five-year seasonal average of 77%

- The 30-day moving average of Chinese LNG imports was 236k tons on Dec. 30, up 13.5% from a week earlier, according to ship-tracking data compiled by Bloomberg

- Estimated flows to all US export terminals were ~14.5 bcf/day on Jan. 1, down 0.9% w/w: BNEF

Buy tender:

Sell tender:

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Chevron Is in Contact With Trump Administration Over Venezuela

Colombia’s Leader Asks Ecopetrol to Sell Its US Shale Operation

SoftBank, OpenAI Team Up to Develop AI for Japan Business

Exxon, Chevron Brave DeepSeek Risk to Chase AI Future as Oil Glow Fades

Chevron Starts Using ‘Gulf of America’ in Nod to Trump

Chevron Sees Permian Basin Oil Growth Reaching 10% This Year

UK Oil Ruling Sets Up Growth Versus Climate Test for Government

DeepSeek Shows How Badly Energy Industry Needs AI for Growth

EU Agrees to Extend Russia Sanctions as Hungary Backs Down