US Industrial Output Tops Forecasts as Manufacturing Stabilizes

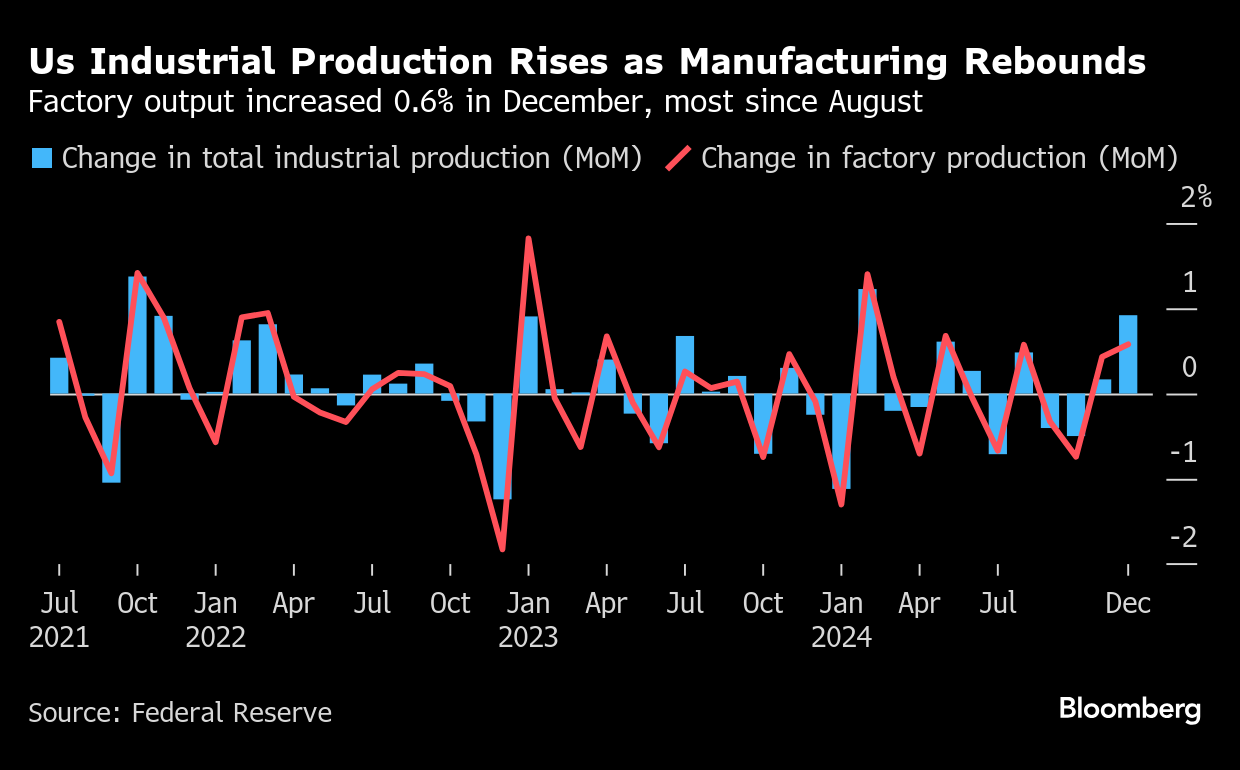

(Bloomberg) -- US industrial production rose in December by more than forecast, helped by a pickup in factory output that indicates manufacturing is stabilizing after two years of weakness.

The 0.9% increase in production at factories, mines and utilities was the largest since February and followed an upwardly revised 0.2% advance a month earlier, Federal Reserve data showed Friday. The December gain exceeded all projections in a Bloomberg survey of economists.

Manufacturing output rose 0.6%, the most since August and helped in part by the resolution of a strike at Boeing Co., after a stronger November increase than initially reported. Production of consumer goods and construction supplies also picked up.

Excluding a drop in auto output, factory production climbed 0.7%. Mining increased 1.8%, while output at utilities rose 2.1% on a rise in natural gas extraction, the Fed said.

Data out this week suggest the US economy ended 2024 on a strong note. A measure of retail sales that feeds into the government’s calculation of goods spending for gross domestic product increased in December by the most in three months.

And a separate report on Friday showed housing starts in the US climbed in December to the fastest pace since early last year. The numbers, combined with the stronger-than-expected industrial production data, prompted Goldman Sachs Group Inc. economists to boost their GDP tracking estimate for the fourth quarter by 0.1 percentage point to 2.6%.

Manufacturing Woes

Manufacturing, which accounts for three-fourths of total industrial production, struggled last year as many companies limited capital spending amid high borrowing costs and inconsistent demand. Factory output declined 0.5% for a second year, the first back-to-back decrease since 2019-2020.

The pickup in December factory output reflected a 6.3% surge in production of aerospace equipment, the largest gain since May 2020, as well as a rise in metals. Output of non-durable goods jumped 0.7% on a broad advance that included increased production of apparel, petroleum and chemicals.

The ISM’s Supply Chain Planning Forecast published last month showed purchasing and supply executives expect to see manufacturing growth in 2025. They’re optimistic about overall business prospects for the first half of this year and more excited about faster growth in the second half, according to Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee.

The Fed’s report showed capacity utilization at factories, a measure of potential output being used, climbed to a three-month high of 76.6%. The overall industrial utilization rate increased to 77.6%.

(Adds details on housing starts and retail sales)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

ADNOC successfully completes $2.84 billion marketed offering of ADNOC Gas shares

Scientists Say EU Carbon Market Should Include Removals Like CCS

Trump Will Allow for More Gas Pipe Expansion, Southern CEO Says

EU Trade Chief Says Ready to Work With US on Lower Tariffs

EU to Look at More ‘Flexible’ Filling of Gas Storage Post-2025

bp begins production from Raven Phase 2, offshore Egypt

Diamondback Nears Permian Deal to Buy Shale Producer Double Eagle

Australia’s Iron Ore Hub Reopens, Rio Mines Resume After Cyclone

Australia’s Iron Ore Export Hub to Reopen After Cyclone Weakens